Confidential Treatment Requested by Oportun Financial Corporation

Pursuant to 17 C.F.R. Section 200.83

OPORTUN FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION AND DESCRIPTION OF BUSINESS

Oportun Financial Corporation is the parent holding company of Oportun, Inc. Each are Delaware corporations and all business operations, other

than equity financing, take place at Oportun, Inc. and its subsidiaries. Oportun, Inc. was incorporated in August 2005 as Progress Financial Corporation, and the parent holding company was incorporated in August 2011 as Progreso Financiero Holdings,

Inc. In January 2015, the names of the two companies were changed to Oportun Financial Corporation and Oportun, Inc., respectively Oportun Financial Corporation and its subsidiaries are hereinafter referred to as the “Company.” The Company

is headquartered in San Carlos, California.

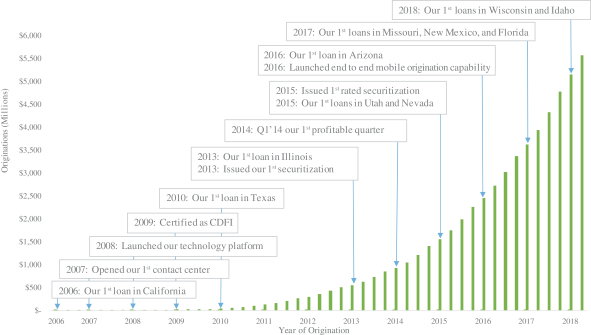

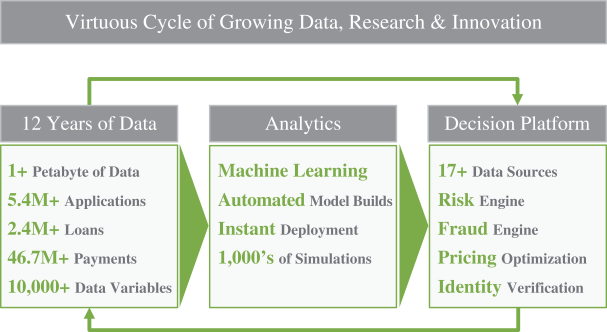

Doing business under the brand name “Oportun,” the Company is a technology-powered

and mission-driven provider of inclusive, affordable financial services to credit invisibles or mis-scored consumers. The Company provides small dollar, unsecured installment loans that are affordably priced

and that help customers establish a credit history. The Company has developed a proprietary credit management system that enables the Company to underwrite the risk of

low-to-moderate income customers with little or no credit history, leveraging data collected through the application process and data obtained from third-party data

providers, and a technology platform for application processing, loan accounting and servicing. The Company has been certified by the United States Department of the Treasury as a Community Development Financial Institution (“CDFI”) since

2009.

The following wholly-owned subsidiaries of Oportun, Inc. in the United States have active operations as of December 31, 2017:

PF Servicing, LLC, Oportun, LLC, Progreso Receivables Funding I, LLC, Progreso Receivables Funding II, LLC, Progreso Receivables Funding III, LLC, Oportun Funding I, LLC, Oportun Funding II, LLC, Progreso Receivables VFN I, LLC, Oportun Funding III,

LLC, Oportun Funding IV, LLC, Oportun Funding V, LLC, Oportun Funding VI, LLC and Oportun Funding VII, LLC. In addition the Company also has the following wholly-owned subsidiaries which were inactive as of December 31, 2017: Oportun Funding

AFS I, LLC, Oportun Funding A, LLC, Oportun Funding IX, LLC, Oportun Funding X, LLC, and Oportun Funding XI, LLC.

Additionally, Oportun,

Inc. has two wholly-owned subsidiaries in Mexico, PF Servicing, S. de R.L. de C.V and OPTNSVC Mexico, S. de R.L. de C.V. (formerly PF Controladora, S. de R.L. de C.V.). These entities were incorporated under Mexican law in December 2010 with the

purpose of establishing customer contact centers (PF Servicing) and providing administrative, support and other services (OPTNSVC Mexico) to support operations in the United States. PF Servicing, S. de R.L. de C.V. commenced operations in August

2017.

As of December 31, 2017 the Company operated in California, Texas, Illinois, Utah, Nevada, Arizona, Missouri, New Mexico, Florida,

Wisconsin and Idaho. The Company commenced operations in New Mexico in April 2017 and Florida in December 2017. Each state has consumer lending statutes that establish permitted loan pricing, fees and terms. State agencies oversee the

operations of licensees, including enforcement of applicable state statutes, compliance audits and annual reporting.

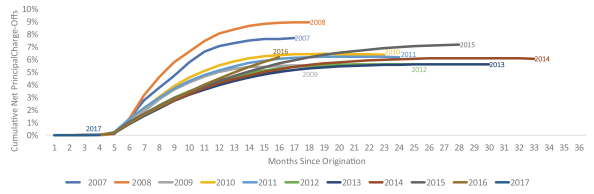

The Company uses

securitization transactions, warehouse facilities and other forms of debt financing, as well as whole loan sales, to finance the principal amount of most of the loans it makes to its customers. As described in Note 9, some of the Company’s

existing debt facilities contain debt covenants that require the Company not to delinquency and loss ratios in its loan portfolio. Breach of such covenants could cause the respective facility to enter into early amortization. Additionally, some of

the Company’s borrowing facilities pay interest expense based on variable rates and an increase in the underlying reference rate for such debt could increase the Company’s interest expense significantly. The Company monitors and is

actively engaged in managing these risks. In order to continue to expand its operations and grow its loan portfolio, the Company

F-8