UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No.1

(Mark One)

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2023

or

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to ___________

Commission File Number 001-39050

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

State or Other Jurisdiction of Incorporation or Organization

|

I.R.S. Employer Identification No.

|

|

|

||

|

|

|

|

|

Address of Principal Executive Offices

|

Zip Code

|

(650 ) 810-8823

Registrant’s Telephone Number, Including Area Code

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒

No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the

definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Smaller reporting company

|

|

|

|

☒

|

Emerging growth company

|

|

|

Non-accelerated filer

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under

Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an

error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive

officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant, based on the closing price of a share of common stock on June 30, 2023

as reported by the Nasdaq Global Select Market on such date was approximately $137.7 million.

Shares of the registrant’s common stock held by each executive officer, director and holder of 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This calculation does not reflect

a determination that certain persons are affiliates of the registrant for any other purpose.

The number of shares of registrant’s common stock outstanding as of April 24, 2024 was 35,586,052 .

DOCUMENTS INCORPORATED BY REFERENCE

None.

On March 15, 2024, Oportun Financial Corporation filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (“Original Form 10-K”). The Original Form 10-K omitted portions

of Part III, Items 10 (Directors, Executive Officers and Corporate Governance), 11 (Executive Compensation), 12 (Security

Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters), 13 (Certain Relationships and Related Transactions, and Director Independence), and 14 (Principal Accountant Fees and Services) in reliance on General Instruction G(3) to Form 10-K, which provides that such information may be either incorporated by reference from the registrant’s definitive

proxy statement or included in an amendment to Form 10-K, in either case filed with the Securities and Exchange Commission (“SEC”) not later than 120 days after the end of the fiscal year.

We no longer expect that the definitive proxy statement for our 2024 annual meeting of stockholders will be filed within 120 days of December 31, 2023. Accordingly, this Amendment No. 1 to Form

10-K (“Amendment”) is being filed solely to:

| • |

amend and restate Part III, Items 10, 11, 12, 13, and 14 of the Original Form 10-K to include the information required by such Items;

|

| • |

delete the reference on the cover of the Original Form 10-K to the incorporation by reference of portions of our proxy statement into Part III of the Original Form 10-K; and

|

| • |

file new certifications of our principal executive officer and principal financial officer as exhibits to this Amendment under Item 15 of Part IV hereof, pursuant to Rule 12b-15 under the Securities

Exchange Act of 1934, as amended (“Exchange Act”). Because no financial statements are contained within this Amendment, we are not including certifications pursuant to Section 906 of The Sarbanes-Oxley Act of 2002.

|

This Amendment does not otherwise change or update any of the disclosures set forth in the Original Form 10-K and does not otherwise reflect any events occurring after the filing of the Original

Form 10-K. Accordingly, the Amendment should be read in conjunction with the Original Form 10-K and the Company’s filings made with the SEC subsequent to the filing of the Original Form 10-K. Capitalized terms used herein and not otherwise

defined are defined as set forth in the Original Form 10-K.

As used in this report, the terms “Oportun Financial Corporation,” “Company,” “Oportun,” “we,” “us,” and “our” mean Oportun Financial Corporation and its subsidiaries unless the context indicates

otherwise.

|

TABLE OF CONTENTS

|

||

| 2 | ||

|

PART III

|

||

|

Item 10.

|

4 | |

|

Item 11.

|

7 | |

|

Item 12.

|

29 | |

|

Item 13.

|

31 | |

|

Item 14.

|

33 | |

|

PART IV

|

||

|

Item 15.

|

34 | |

| 35 | ||

3

PART III

Board of Directors

The following biographical and certain other information for each of our directors or director nominees is presented as of April 24, 2024:

Roy Banks, age 57, has served as a member of our Board since September 2021. Mr. Banks currently serves as Chief Executive

Officer and a director of Nexio. Mr. Banks previously served as Chief Executive Officer and director of Weave Communications from December 2020 to September 3, 2022. Prior to joining Weave Communications, he served as a CEO Partner of

Tritium Partners from July 2019 to August 2020. Prior to that, he was the President of the LoadPay Business Unit from July 2018 to March 2019, a board member for Truckstop from May 2017 to March 2019, and a board member of TEZ Technology from May 2014 to December 2022. He also served as the CEO of Network Merchants Inc. from May 2014 to May 2018. Mr. Banks currently serves as a Venture Partner for Pelion

Venture Partners and a board member for Complete Merchant Services. Mr. Banks graduated from Utah Valley University with a B.A. in Business Management. We believe Mr. Banks’ broad experience with high-tech and financial transaction processing,

and leadership experience at technology-enabled companies enables him to make valuable contributions to our Board.

Jo Ann Barefoot, age 74, has served as a member of our Board since October 2016. Ms. Barefoot is CEO and Founder of the nonprofit organization AIR - the Alliance for Innovative Regulation, Co-founder of Hummingbird RegTech, CEO of

Barefoot Innovation Group and host of the podcast show Barefoot Innovation. Ms. Barefoot was a Senior Fellow at the John F. Kennedy School of Government’s Mossovar-Rahmani Center for Business and Government at Harvard University from July

2015 to June 2017. She serves on the Milken Institute FinTech Advisory Committee and previously served on the Consumer Advisory Board of the Consumer Financial Protection Bureau. Ms. Barefoot previously chaired the boards of directors of the

Financial Health Network and FinRegLab and is still on the latter board. She previously served as Deputy Comptroller of the Currency, on the staff of the U.S. Senate Committee on Banking, Housing and Urban Affairs, as Co-Chair of the

consulting firm Treliant Risk Advisors, as a Partner and Managing Director at KPMG Consulting and as Director of Mortgage Finance for the National Association of Realtors. Ms. Barefoot received a B.A. in English from the University of

Michigan. We believe that Ms. Barefoot’s deep understanding of consumer finance and experience in government and community service provide her with a uniquely diverse perspective that benefits our Board.

Mohit Daswani, age 49, has served as a member of our Board since February 2024. He currently serves as

the Chief Financial Officer of ThoughtSpot, Inc., an AI-enabled business analytics company. Prior to joining ThoughtSpot in January 2020, Mr. Daswani was the Head of Finance & Strategy at Square, Inc. He previously held leadership roles

in Corporate Development and Finance at PayPal, Inc. and was a private equity investor in the financial services, healthcare, and IT industries as a Principal at JMI Equity, a Principal at FTV Capital, and previously as a long-tenured private

equity professional at J.P. Morgan. Mr. Daswani is also an advisory Board Member of Centana Growth Partners since 2018. Mr. Daswani holds a Bachelor’s degree in Economics from Columbia University and an M.B.A. from the Harvard Business

School. We believe Mr. Daswani is qualified to serve as a member of our Board because of his extensive experience in the financial and technology sectors, as well as his leadership experience in the areas of investing, finance and accounting.

Ginny Lee, age 57, has served as a member of our Board since September 2021. From December 2016 to June 2021, Ms. Lee served as the President and Chief

Operating Officer of Khan Academy, a non-profit online education technology organization. Prior to Khan Academy, Ms. Lee spent more than 17 years at Intuit where she held multiple senior operational and technical roles, including Senior Vice

President and General Manager of Intuit’s Employee Management Solutions Division, as well as Chief Information Officer. She currently serves as an advisor and director for several private companies. Ms. Lee received dual baccalaureate degrees

in Business Economics and Organizational Behavior and Management from Brown University and a M.B.A. from the Stanford Graduate School of Business. We believe that Ms. Lee’s strong background of business, technology leadership roles and

experience bringing products to market enable her to make valuable contributions to our Board.

Carlos Minetti, age 61, has served as a member of our Board since February 2024. He was the Executive Vice President, President - Consumer Banking for Discover Financial Services (“Discover”), a role he held from February 2014 to September 2023. Previously, he served as Executive Vice President,

President - Consumer Banking and Operations (2010 to 2014), Executive Vice President, Cardmember Services and Consumer Banking (2007 to 2010) and Executive Vice President for Cardmember Services and Chief Risk Officer (2001 to 2007). Prior to

joining Discover, Mr. Minetti worked in card operations and risk management for American Express Company from 1987 to 2000, where he last served as Senior Vice President. Mr. Minetti currently serves as a member of the board of directors of

Trustmark Mutual Holding Company, the Better Business Bureau of Chicago and Northern Illinois, and the Ann & Robert H. Lurie Children’s Hospital of Chicago Foundation. He was a member of the board of directors of Discover Bank from 2001

to 2023. Mr. Minetti holds a Bachelor’s degree in Industrial Engineering from Texas A&M University and an M.B.A. from the Booth School of Business at The University of Chicago. We believe that Mr. Minetti’s extensive experience in the

consumer finance industry enable him to make valuable contributions to our Board.

4

Louis P. Miramontes, age 69, has served as a member of

our Board since October 2014. Mr. Miramontes is an experienced financial executive and qualified audit committee financial expert. He was a senior partner at KPMG LLP, a

public accounting firm, from 1976 to September 2014, where he served in leadership functions, including Managing Partner of the KPMG San Francisco office and Senior Partner KPMG’s Latin American Region. Mr. Miramontes was also an audit partner

directly involved with providing audit services to public and private companies, which included serving with client boards of directors and audit committees regarding

financial reporting, auditing matters, SEC compliance and Sarbanes-Oxley regulations. Mr. Miramontes currently serves on the board of directors of Lithia Motors, Inc. and a private

company, and previously served on the board of directors of Rite Aid Corporation. Mr. Miramontes received a B.S. in Business Administration from California State University, East Bay, and he is a Certified Public Accountant in the

State of California. We believe Mr. Miramontes is qualified to serve on our Board due to his professional experience and deep audit and financial reporting expertise.

Scott Parker, age 56, has served as a member of our Board since April 2024. Mr. Parker currently serves as Chief Financial Officer of NationsBenefits, LLC, since June 2022. Previously, Mr.

Parker served as Executive Vice President and Chief Financial Officer of Ryder System, Inc. (“Ryder”), from April 2021 to June 2021. Prior to Ryder, Mr. Parker served as Executive Vice President and Chief Financial Officer of OneMain Holdings, Inc. (“OneMain”), from November 2015 to March 2019. Prior to OneMain,

Mr. Parker served as Executive Vice President and Chief Financial Officer of CIT Group Inc., which was acquired by First Citizens BancShares, Inc., from 2010 to 2015. Since October 2022, Mr. Parker has served on the board of directors of

DailyPay, Inc., where he is also the Chairman of its Audit and Risk Committee since November 2023. He also served on the board of directors of Feeding South Florida, a non-profit organization, from 2019 to 2022, where he served as Treasurer and

as a member of the Finance Committee. Mr. Parker earned a B.S. in Agricultural Economics from Cornell University. We believe Mr. Parker is qualified to serve as a member of our Board because of his extensive leadership experience and background

in financial services.

Sandra A. Smith, age 53, has served as a member of our Board since September 2021. From 2018 to April 2021, Ms.

Smith served as the Chief Financial Officer of Segment.io (“Segment”), which was acquired by Twilio Inc (“Twilio”). Before joining Segment, Ms. Smith served as the Vice President, Finance at Twilio, from 2013 to 2018, and in various roles at

Akamai Technologies, Inc. from 2003 to 2013. Ms. Smith currently serves as a director at several private companies. Ms. Smith holds a B.F.A. from the University of Michigan, an M.B.A. from Boston College Carroll Graduate School of Management

and a J.D. from Boston College Law School. We believe that Ms. Smith is qualified to serve on our Board due to her broad operational experience at high-tech companies and significant leadership experience in the areas of finance, accounting,

and audit oversight.

Richard Tambor, age 62, has served as

an observer on our Board since April 2024 and will stand for election as a nominee at our next annual stockholder meeting. Mr. Tambor previously served as the Executive

Vice President and Chief Risk Officer at OneMain, from May 2014 to December 2022. Prior to OneMain, Mr. Tambor served as the Senior Vice President of Risk Management from 2011 to 2013, and as the Senior Vice President and Chief Risk Officer

of Retail Financial Services from 2009 to 2011 at JPMorgan Chase & Co. Prior to joining JPMorgan, Mr. Tambor served as the Managing Director at Novantas LLC, from 2008 to 2009. Prior to Novantas LLC, Mr. Tambor served at American Express

Travel Related Services Co., Inc. (parent organization of American Express) from 1987 to 2005, where he held several senior management positions, including President and General Manager, Senior Vice President and General Manager of Small

Business Lending, Senior Vice President and Chief Risk Officer, Vice President Customer Management of Institutional Risk Management, and Vice President of Worldwide Authorizations. Mr. Tambor previously served as a member on the board of

directors at several non-profit organizations, including Habitat for Humanity of Newark, New Jersey, the Cora Hartshorn Arboretum and Bird Sanctuary, and Count Me In for Women’s Economic Independence. Mr. Tambor received a B.A. in Economics

from The Hebrew University of Jerusalem, and an M.A. in Economics from New York University. We believe that Mr. Tambor’s extensive experience and leadership in the consumer finance industry and risk management experience enable him to make

valuable contributions to our Board.

Raul Vazquez, age 52, has served as our Chief Executive Officer and as a member of our Board since April 2012. Prior to joining Oportun, Mr. Vazquez

served in various positions since 2002 at Walmart.com and Walmart Inc., including three years as Chief Executive Officer of Walmart.com. Mr. Vazquez has served as member of the board of directors of Intuit Inc. since May 2016 and previously

served as a director of Staples, Inc. from 2013 to 2016. In addition, Mr. Vazquez has served as a member of the Consumer Advisory Board of the CFPB and the Community Advisory Council of the Federal Reserve Board, where he also served as Chair.

Mr. Vazquez received a B.S. and M.S. in Industrial Engineering from Stanford University and an M.B.A. from the Wharton Business School at the University of Pennsylvania. We believe Mr. Vazquez’ experience in our industry, his role as our Chief

Executive Officer, and his extensive insight to the Company enable him to make valuable contributions to our Board.

R. Neil Williams, age 71, has served as a member of our Board since November 2017. Mr. Williams has served as Executive Vice President and Chief

Financial Officer at Intuit Inc. from January 2008 to February 2018. Prior to joining Intuit, from April 2001 to September 2007, Mr. Williams served as Executive Vice President of Visa U.S.A., Inc. and from November 2004 to September 2007, he

served as Chief Financial Officer. During the same period, Mr. Williams held the dual role of Chief Financial Officer for Inovant LLC, Visa’s global IT organization. He has been an independent director of RingCentral, Inc. since March 2012 and

previously served on the board of directors of Amyris, Inc. from May 2013 to March 2020. His previous banking experience includes senior financial positions at commercial banks in the Southern and Midwestern regions of the United States. Mr.

Williams, a certified public accountant, received his bachelor’s degree in business administration from the University of Southern Mississippi. We believe that Mr. Williams’s professional experience in the areas of finance, accounting, and

audit oversight enables him to make valuable contributions to our Board.

Executive Officers

The following biographical information for our executive officers is presented as of April 24, 2024:

For the biography of Mr. Vazquez, see “Board of Directors” above.

5

Jonathan Coblentz, age 53, has served as our Chief Financial Officer since July 2009 and our Chief Administrative

Officer since September 2015. Prior to joining Oportun, Mr. Coblentz served as Chief Financial Officer and Treasurer of MRU Holdings, Inc., a publicly-traded student loan finance company, from April 2007 to February 2009. Prior to joining MRU

Holdings, Mr. Coblentz was a Vice President at Fortress Investment Group, LLC, a global investment management company. Prior to his time at Fortress, Mr. Coblentz spent over seven years at Goldman, Sachs & Co. Mr. Coblentz began his career

at Credit Suisse First Boston. Mr. Coblentz received a B.S., summa cum laude, in Applied Mathematics with a concentration in Economics from Yale University.

Patrick Kirscht, age 56, has served as our Chief Credit Officer since October 2015, and previously served as our Vice President, Risk Management and

Chief Risk Officer from October 2008 to October 2015 and our Senior Director, Risk Management from January 2008 to October 2008. Prior to joining Oportun, Mr. Kirscht was Senior Vice President of Risk Management for HSBC Card Services, Inc.,

the consumer credit card segment of HSBC Holdings, from 2007 to 2008. Mr. Kirscht joined HSBC Card Services in 2005 as part of HSBC’s acquisition of Metris Companies Inc., a start-up mono-line credit card company. Mr. Kirscht joined Metris

Companies in 1995, where he served as Vice President of Planning and Analysis until he moved to Risk Management in 2004. Mr. Kirscht received a B.S. in Economics with a minor in Statistics, a B.S. in Business, and an M.B.A. from the University

of Minnesota.

Kathleen Layton, age 44, has served as our Chief Legal Officer and Corporate Secretary since July 2023. She

previously served as our Senior Vice President, Deputy General Counsel and Corporate Secretary from March 2020 to July 2023, as our Vice President, Assistant General Counsel from December 2017 to March 2020, and as our Senior Director, Senior

Corporate Counsel from September 2015 to December 2017. Prior to joining Oportun, Ms. Layton was a Senior Corporate Counsel at ServiceNow and an attorney at Simpson Thacher & Bartlett LLP and McDermott Will & Emery LLP. Ms. Layton

received a B.A. from the University of Wisconsin-Madison, and a J.D. from the University of Wisconsin Law School.

Board Committees

Our Board has established an audit and risk committee, a compensation and leadership committee, a credit risk and finance committee and a

nominating, governance and social responsibility committee. Our Board may establish other committees to facilitate the oversight of our business. The composition and functions of each committee are described below. Each of the committees

operates pursuant to a written charter, available on our investor relations website (http://investor.oportun.com/corporate-governance/governance-documents).

Members serve on these committees until their resignation or until otherwise determined by our Board.

|

Audit and

Risk Committee

|

Compensation and Leadership Committee

|

Credit Risk and Finance Committee

|

Nominating, Governance and Social Responsibility Committee

|

||||

|

Roy Banks(1)

|

C

|

M

|

|||||

|

Jo Ann Barefoot(2)

|

M

|

M

|

|||||

|

Mohit Daswani(3)

|

M, E

|

M

|

|||||

|

Ginny Lee

|

M

|

C

|

|||||

|

Carlos Minetti(4)

|

M

|

M

|

|||||

|

Louis P. Miramontes(5)

|

M, E

|

M

|

|||||

|

Scott Parker(6)

|

M, E

|

M

|

|||||

|

Sandra A. Smith(7)

|

C, E

|

M

|

|||||

|

R. Neil Williams(8) L

|

M, E

|

C

|

| C - Committee Chair |

M - Committee Member |

L - Lead Independent Director |

E - Audit Committee Financial Expert |

| (1) |

Effective June 6, 2023, Mr. Banks was appointed as the chair of the compensation and

leadership committee. Effective February 7, 2024, Mr. Banks was no

longer a member of the credit risk and finance committee and was appointed as a member of the nominating, governance and social responsibility

committee.

|

| (2) |

Effective February 7, 2024, Ms. Barefoot was appointed as a member of the nominating, governance and social responsibility

committee and was no longer a member of the audit and risk committee.

|

| (3) |

Effective February 7, 2024, Mr. Daswani was appointed as a member of the audit and risk committee and the compensation and leadership committee.

|

| (4) |

Effective February 7, 2024, Mr. Minetti was appointed as a member of the credit risk and finance committee and the nominating, governance and social responsibility

committee.

|

| (5) |

Effective February 7, 2024, Mr. Miramontes was appointed as a member of the compensation and

leadership committee and was no longer a member of the nominating, governance and social responsibility committee.

|

| (6) |

Effective April 19, 2024, Mr. Parker was appointed as a member of the audit and risk committee and the compensation and leadership committee.

|

| (7) |

Effective November 4, 2023, Ms. Smith was appointed as the chair of the audit and risk committee. On the same date, Ms. Smith stepped

down as the chair of the credit risk and finance committee, and continued as a committee member.

|

| (8) |

Effective November 4, 2023, Mr. Williams was appointed as the Lead Independent Director. On the same date, Mr. Williams was appointed as the chair of the credit risk and finance committee and he stepped down as the chair of the audit and risk committee and continued as a committee member.

|

6

Audit and Risk Committee

|

Sandra A. Smith (Chair)*+

Mohit Daswani+

Louis Miramontes+

Scott Parker+

R. Neil Williams+

|

Primary responsibilities:

|

||

| • |

Oversee the integrity of Oportun’s financial statements and Oportun’s accounting and financial reporting process (both internal and external) and financial statement audits;

|

||

| • |

Oversee the qualifications and independence of the independent auditor;

|

||

| • |

Oversee the performance of Oportun’s internal audit function and independent auditors;

|

||

| • |

Oversee finance matters;

|

||

| • |

Review and approve related-person transactions;

|

||

| • |

Oversee enterprise risk management; privacy and data security; and the auditing, accounting, and financial reporting process generally; and

|

||

| • |

Oversee Oportun’s systems of internal controls, including the internal audit function.

|

||

|

*Since November 2023

+Financial Expert

|

Our Board has determined that each member of the Audit and Risk Committee satisfies the relevant SEC and Nasdaq independence requirements.

Our Board has determined that Mr. Daswani, Mr. Miramontes, Mr. Parker, Ms. Smith, and Mr. Williams each qualifies as an “audit committee financial expert” as that term is

defined under the SEC, and possesses financial sophistication, as defined under the Nasdaq listing standards.

|

||

Compensation and Leadership Committee

|

Roy Banks (Chair)*

Mohit Daswani

Ginny Lee

Louis Miramontes

Scott Parker

Compensation and Leadership Committee Report page 25

*Since June 2023

|

Primary responsibilities:

|

||

| • |

Oversee human resources, compensation and employee benefits programs, policies, and plans;

|

||

| • |

Review and advise on management succession planning and executive organizational development;

|

||

| • |

Review and approve the compensatory arrangements with our executive officers and other senior management;

|

||

| • |

Approve the compensation program for Board members;

|

||

| • |

Assist the Board in its oversight of management’s strategies, policies, and practices relating to Oportun’s people and teams; and

|

||

| • |

Oversee Oportun’s policies and strategies relating to culture and human capital management, including diversity, equity, inclusion and belonging (DEIB).

|

||

|

For a description of the compensation and leadership committee’s processes and procedures, including the roles of its

independent compensation consultant and the CEO in support of the committee’s decision-making process, see the section entitled “Executive Compensation” beginning on page 7.

|

|||

Credit Risk and Finance Committee

|

R. Neil Williams (Chair)*

Jo Ann Barefoot

Carlos Minetti

Sandra A. Smith

*Since November 2023

|

Primary responsibilities:

|

||

| • |

Review the quality of our credit portfolio and the trends affecting that portfolio through the review of selected measures of credit quality and trends;

|

||

| • |

Oversee credit and pricing risk and monitors policy administration and compliance;

|

||

| • |

Monitor projected compliance with the covenants and restrictions arising under our financial obligations and commitments;

|

||

| • |

Assess funding acquisitions, borrowing and lending strategy; and

|

||

| • |

Review potential financial transactions and commitments, including equity and debt financings, capital expenditures, and financing arrangements.

|

||

Nominating, Governance and Social Responsibility Committee

|

Ginny Lee (Chair)*

Roy Banks

Jo Ann Barefoot

Carlos Minetti

*Since November 2022

|

Primary Responsibilities:

|

||

| • |

Identify and recommend qualified candidates for election to the Board;

|

||

| • |

Oversee the composition, structure and size of the Board and its committees;

|

||

| • |

Oversee corporate governance policies and practices, including Oportun’s Code of Business Conduct;

|

||

| • |

Oversee Oportun’s strategies, policies, and practices relating to environmental, social and governance (ESG) matters, responsible lending practices, government relations, charitable

contributions and community development, human rights and other social and public policy matters; and

|

||

| • |

Oversee the annual Board performance self-evaluation process.

|

||

Code of Business Conduct and Corporate Governance Guidelines

Our Board has adopted a Code of Business Conduct and Corporate Governance Guidelines that apply to all of our employees, officers and directors, including those officers responsible for

financial reporting. The Code of Business Conduct and Corporate Governance Guidelines are available on our investor relations website (http://investor.oportun.com/corporate-governance/governance-documents).

We intend to disclose any amendments to the Code of Business Conduct, or any waivers of its requirements, on our website to the extent required by the applicable rules and stock exchange requirements.

Compensation and Leadership Committee Interlocks and Insider Participation

None of the members of our compensation and leadership committee has ever been an officer or employee of the Company. None of our executive

officers serve, or have served during the last fiscal year, as a member of the Board, compensation and leadership committee or other Board committee performing equivalent functions of any entity that has one or more executive officers serving

as one of our directors or on our compensation and leadership committee.

Named Executive Officers

The Company is a “smaller reporting company” under Item 10 of Regulation S-K promulgated under the Securities and Exchange Act of 1934, and

the following compensation disclosure is intended to comply with the requirements applicable to smaller reporting companies. Although the rules allow the Company to provide less detail about its executive compensation program, the

compensation and leadership committee is committed to providing the information helpful to stockholders in understanding the Company’s executive compensation program.

Accordingly, this section includes supplemental narratives that describe the executive compensation program for our named executive officers (“NEOs”) during fiscal year 2023, who consisted of:

|

Raul Vazquez

|

Kathleen Layton

|

Patrick Kirscht

|

||

|

Chief Executive Officer (“CEO”)

|

Chief Legal Officer and Corporate Secretary (“CLO”)

|

Chief Credit Officer (“CCO”)

|

||

|

Age: 52

|

Age: 44

|

Age: 56

|

||

|

Tenure: 12 years

|

Tenure: 8 years

|

Tenure: 16 years

|

2023 Financial Highlights and Challenges

2023 continued to present significant challenges for our business, including elevated inflation and high interest rates requiring further tightening actions. Our management team remained

disciplined in managing and reducing operating expenses and diversifying our funding sources.

Despite a challenging macroeconomic environment and a tightened credit posture, we were able to deliver double-digit top-line growth, demonstrating the resilience of our business. We also made

progress on our strategic priorities, including improving credit outcomes, and fortifying our business economics by focusing on our core lending and savings products while streamlining our operations. We remain focused on maximizing stockholder

value by driving towards long-term growth and profitability, while delivering on our mission to provide access to responsible and affordable credit and adequate savings for our members.

Key 2023 highlights include:

| • |

Total revenue growth of 11% year-over-year to a record $1.1 billion.

|

| • |

Adjusted Operating Efficiency of 43%, a 15 percentage point improvement year-over-year.

|

7

| • |

Record cash flows from operating activities of $393 million, a 58% year-over-year increase.

|

| • |

Secured $700 million in whole loan sale program agreements with institutional investors.

|

| • |

Completed a $200 million private structured financing transaction.

|

| • |

Launched our Oportun Mobile App, to foster long-term, highly engaged relationships with our members.

|

For a reconciliation of non-GAAP Adjusted Operating Efficiency to GAAP

Operating Efficiency, refer to the Reconciliation on Non-GAAP Financial Measures section of this amendment. The compensation and leadership committee believes that the NEO’s compensation was appropriately linked to company performance in 2023 and aligned the interests of our NEOs with the interests of our stockholders. The 2023 annual cash incentive program was linked to

targets tied to the company’s total revenue and adjusted EBITDA, both of which were adversely affected by the challenging macroeconomic conditions. As a result, the program funded at 22.8% of the target for corporate performance, underscoring

the company’s commitment to aligning compensation with overall corporate performance, as discussed in more detail below in “Elements of Executive Compensation

and 2023 Compensation Decisions — Annual Incentive Plan.”

Oversight and Design of our Compensation Program

Compensation Philosophy and Objectives

We operate in a highly competitive and rapidly evolving market, and we expect competition among companies in our market to continue to increase. Our ability to compete and succeed in this

environment is directly correlated to our ability to recruit, incentivize, and retain talented individuals.

We are guided by certain overarching values:

|

Primary Goals of our Executive Compensation Programs

|

|

|

Consistent with our values, the primary goals of our executive compensation program are as follows:

|

|

|

•

|

Attract, motivate and retain highly qualified and experienced executives who can execute our business plans in a fast-changing, competitive landscape.

|

|

•

|

Recognize and reward our executive officers fairly for achieving or exceeding rigorous corporate and individual objectives.

|

|

•

|

Align the long-term interests of our executive officers with those of our members and stockholders.

|

|

Key 2023 Program Changes

|

|

|

•

|

Adopted a new, enhanced long-term incentive program for our executive officers, which is intended to further align the interests of our executive officers

with those of our stockholders, by granting both performance based restricted stock units (“PSUs”)

and time-based restricted stock units (“RSUs”) to deliver annual long-term incentive compensation opportunities to our executives.

|

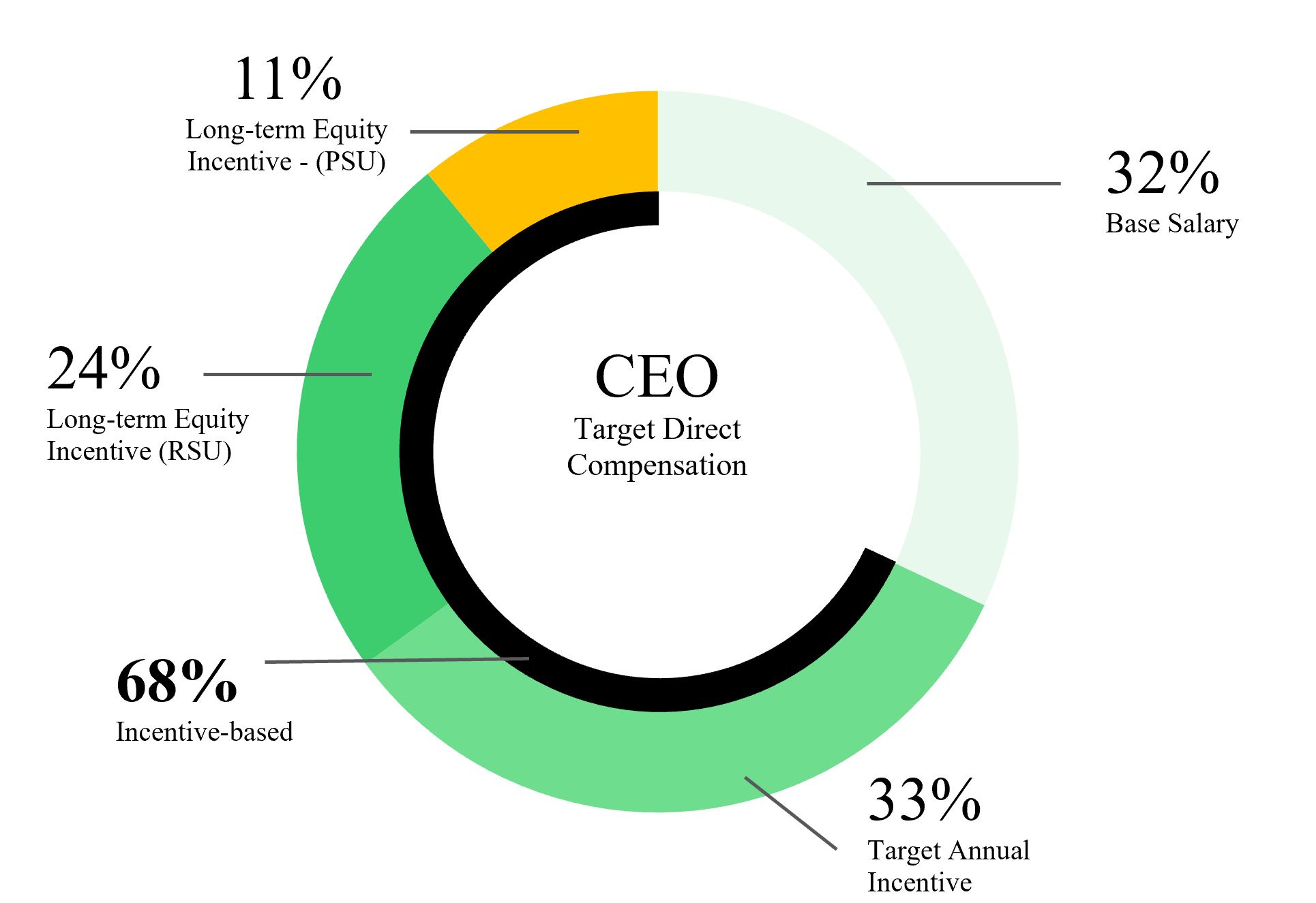

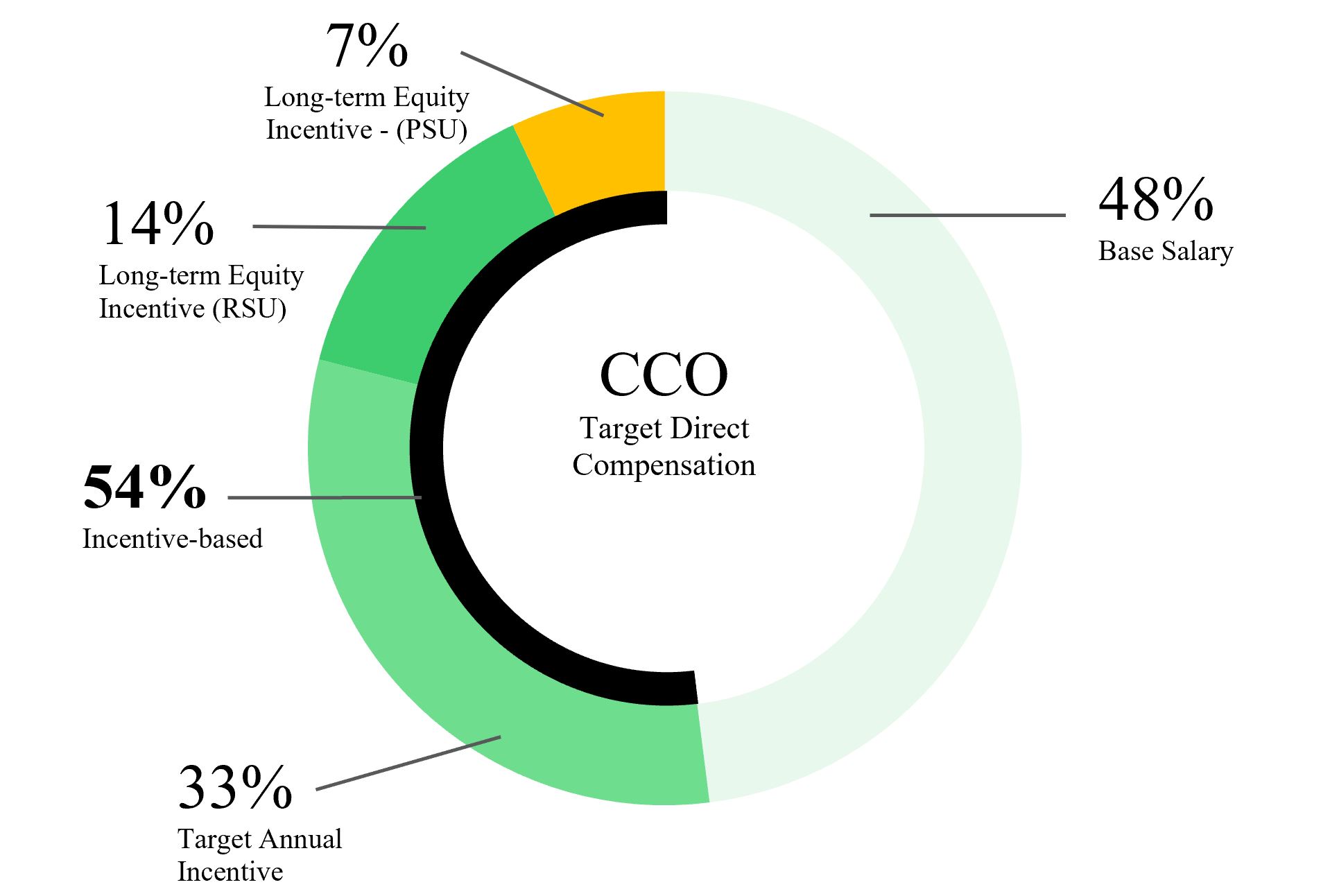

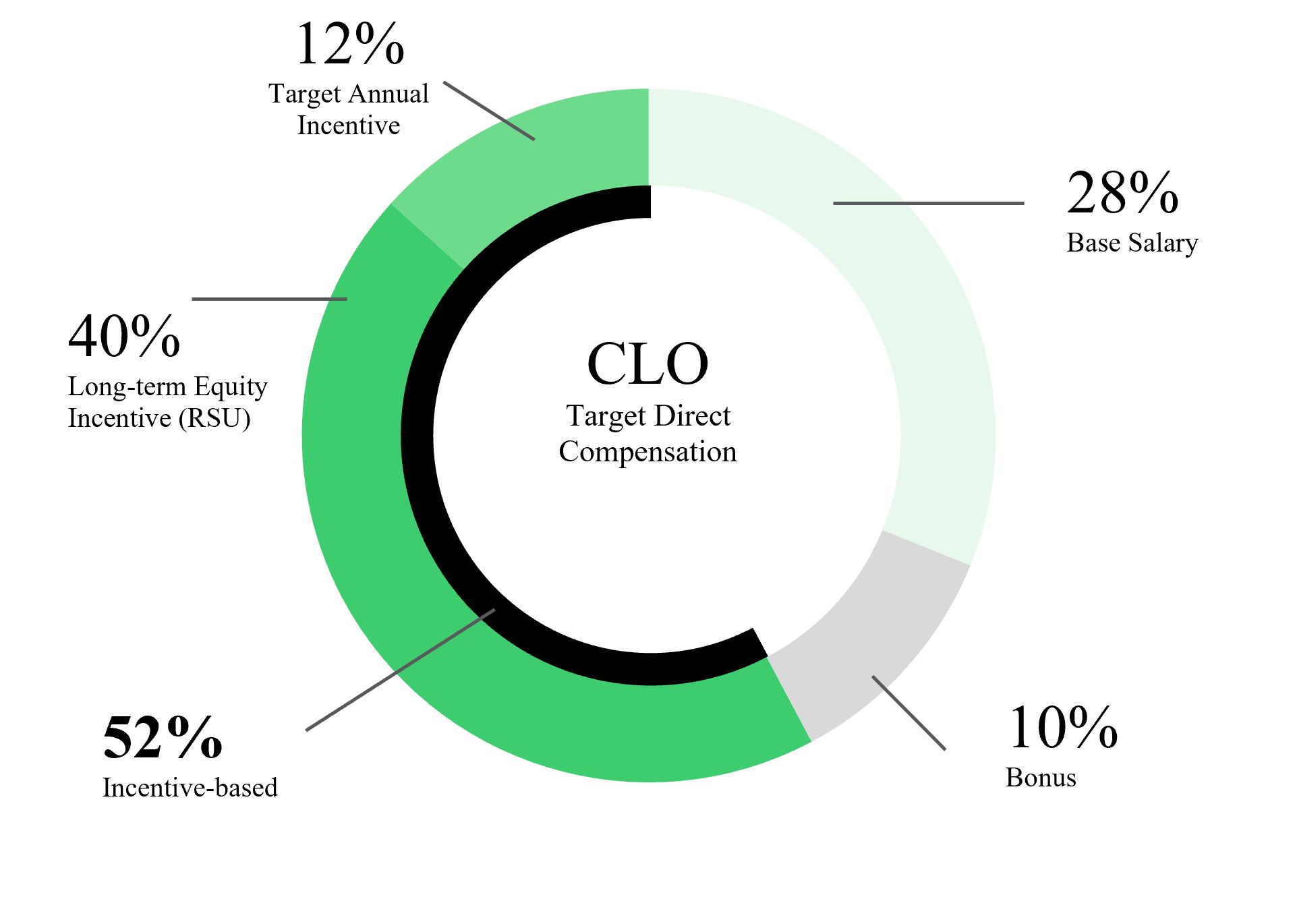

Fiscal 2023 Pay Mix

The key components of total compensation opportunity for each executive officer set by the compensation and leadership committee annually are

short-term cash compensation (annual base salary and annual incentive award) and long-term equity incentive compensation (PSUs and RSUs), which we refer to collectively as the executive officer’s target total direct compensation. The target

pay mix for fiscal 2023 for each NEO is shown below.

8

The CEO’s 2023 target total direct compensation decision

focuses on variable and “at-risk” compensation that is closely aligned with Company performance. As shown in the chart below, the percentage of our CEO, Mr. Vazquez’

2023 target total direct compensation that is incentive-based is 68%. For our CCO, Mr. Kirscht, the 2023 target total direct compensation that is incentive-based is 54%. For our CLO, Ms. Layton, the components of her 2023 target total

direct compensation vary slightly from the other NEOs, due to her promotion in the second half of 2023. The portion of Ms. Layton’s 2023 target total direct compensation that is incentive-based is 52%.

|

|

9

Elements of our 2023 Compensation Program

|

Element of

Pay

|

|

Form of

Compensation

|

|

|

Structure

|

|

Philosophy

|

|

Base Salary

|

Cash

|

•

|

Initially set through arm’s-length negotiation at the time of hiring, taking into account level of responsibility, qualifications,

experience, salary expectations and competitive market data.

|

Base salary is designed to be a competitive fixed component that establishes a guaranteed minimum level of cash compensation to recognize

and reward day-to-day contributions of our executive officers.

|

|||

|

•

|

Base salaries are then reviewed on an annual basis by the compensation and leadership committee and salary adjustments may be made based on

factors described below under "Roles of the Compensation and Leadership Committee, Management and the Compensation Consultant."

|

||||||

|

|

|

|

|

|

|||

|

Annual

Cash

Incentive

|

Cash

|

•

|

Annual cash incentive is based on a combination of financial and qualitative measures

|

The performance-based cash compensation was designed to reward the achievement of annual corporate performance relative to pre-established

goals, as well as individual performance, contributions and strategic impact.

|

|||

|

|||||||

|

Long-term

Equity

Incentive

|

Performance

Based Restricted

Stock Units (PSU)

|

|

Long-term incentive compensation is an effective means for focusing our NEOs on driving increased stockholder value over a multi-year period

and motivating them to remain employed with us.

|

||||

|

Restricted Stock

Units (RSU)

|

|||||||

| (1) |

For the CEO, 80% on corporate performance and 20% on attainment of individual goals.

|

| (2) |

For all NEOs other than Ms. Layton, the annual equity mix consisted of approximately 50% PSUs and 50% RSUs. For Ms. Layton, long-term equity incentive

was provided 100% in RSUs due to her not serving in an executive role for the full year of 2023. Beginning with 2024, it is anticipated that Ms. Layton will

receive the same long-term equity incentive mix as the other NEOs.

|

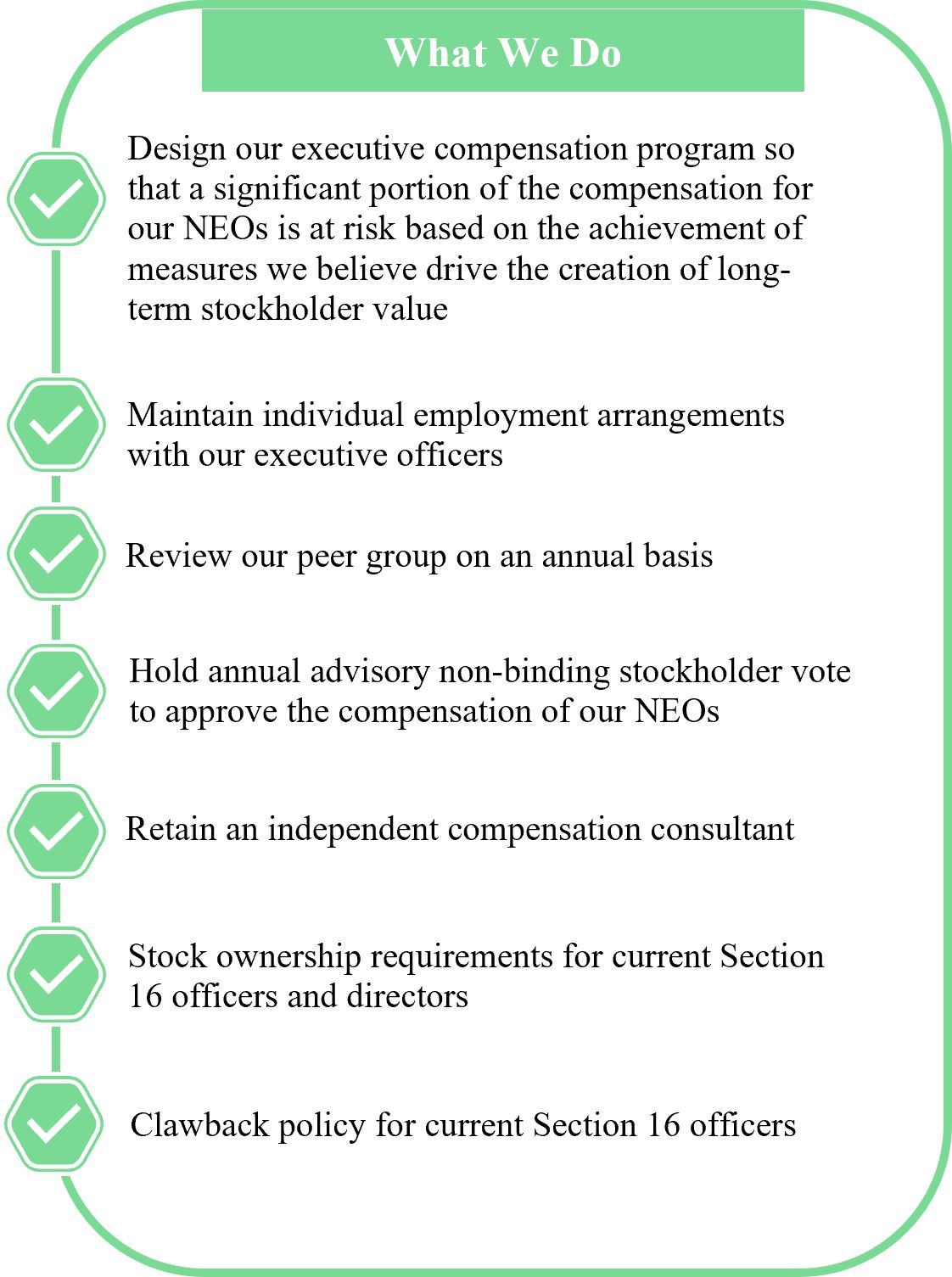

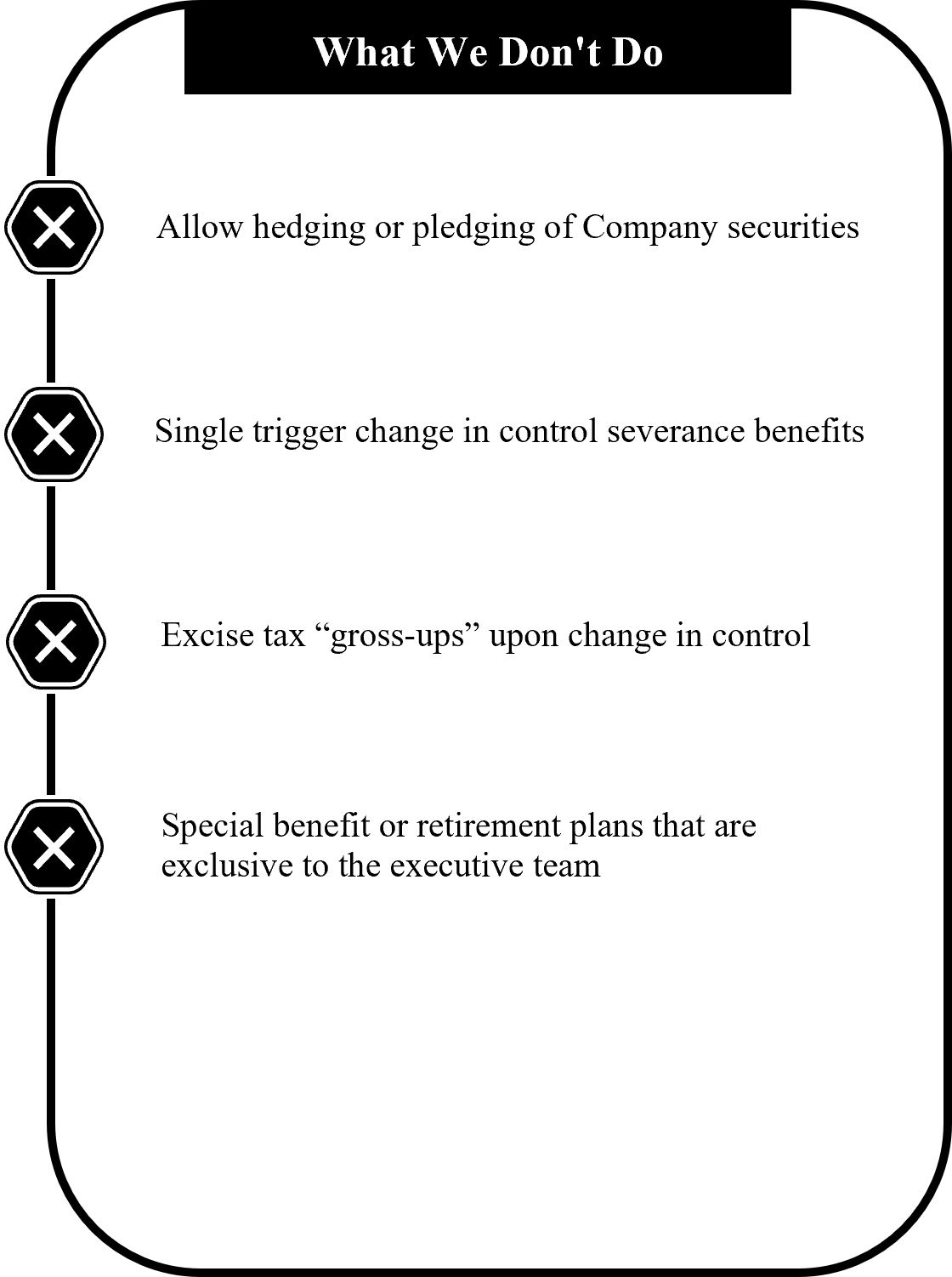

Compensation Governance Policies and Practices

The Company’s executive compensation program is overseen by the compensation and leadership committee with the advice and support of the

Company’s independent compensation consultant as well as input from the Company’s management team. The following summarizes certain executive compensation practices we have implemented to drive performance and create accountability and

alignment with our stockholders, as well as the practices we have not implemented because we do not believe they would serve the Company and our stockholders’ long-term interests.

10

|

|

11

Roles of the Compensation and Leadership Committee, Management and the Compensation Consultant

|

Role of the Compensation and Leadership Committee

|

The compensation and leadership committee is responsible for overseeing our compensation programs and policies, including our equity incentive plans. Our compensation and leadership committee operates

under a written charter adopted and approved by our Board, under which our Board retains concurrent authority with our compensation and leadership committee to approve compensation-related matters.

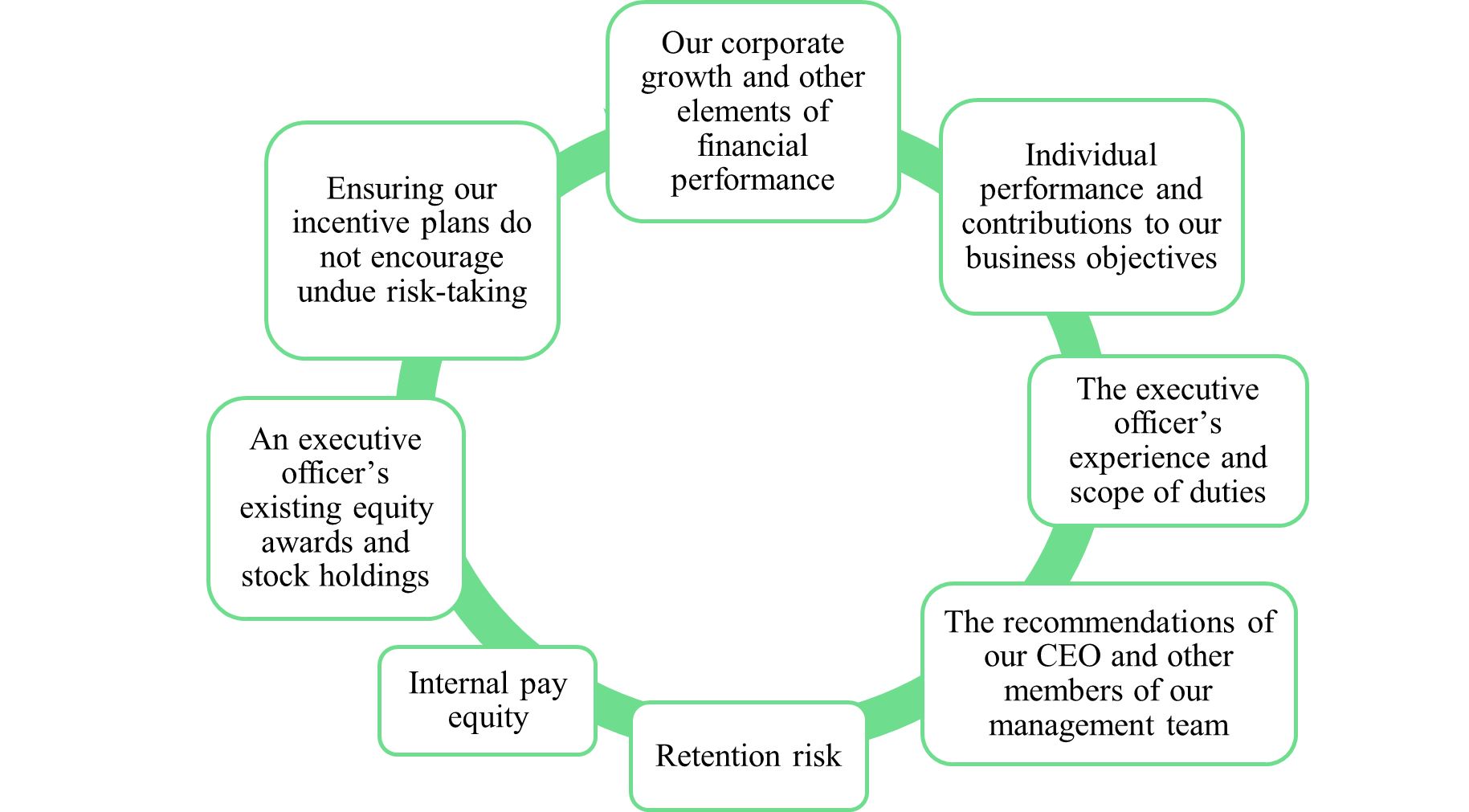

Each year, the compensation and leadership committee reviews and approves compensation decisions as they relate to our NEOs and other senior executive officers, including our CEO. The compensation and

leadership committee initially establishes a framework by engaging in a baseline review of our current compensation programs, together with its independent compensation consultant and management, to ensure that they remain consistent

with our business requirements and growth objectives. In this review, the independent compensation consultant is also asked to provide a perspective on changing market practices as to compensation programs, with a particular focus on

our identified peer group and other companies with whom we compete directly for talent, as discussed below under “Role of Compensation Consultants” and “Use of Competitive Market Data”. Following this review, the compensation and

leadership committee considers the recommendations of our CEO, as discussed below under “Role of Management.” The compensation and leadership committee also manages the annual review process of our CEO, in cooperation with our lead

director, in which all members of our Board are asked to participate and provide perspective, resulting in a compensation and leadership committee recommendation to the full board regarding individual compensation adjustments for our

CEO. As part of this review of the compensation of our NEOs and other senior executive officers, the compensation and leadership committee considers several factors, including:

Our compensation and leadership committee rely on their judgment and extensive experience serving on the boards of publicly traded companies to establish an annual target total direct compensation

opportunity for each NEO that they believe will best achieve the goals of our executive compensation program and our short-term and long-term business objectives. The compensation and leadership committee retains flexibility to review

our compensation structure periodically as needed to focus on different business objectives.

|

12

|

Role of Management

|

Our CEO works closely with the compensation and leadership committee in determining the compensation of our NEOs (other than his own) and other executive officers. Each year, our CEO

reviews the annual performance of our NEOs and other executive officers and makes recommendations to the compensation and leadership committee (except as it relates to his own performance and compensation) regarding individual

compensation adjustments, promotions, bonus pool funding, level of achievement of corporate goals and annual incentive plan payouts. Our CEO also identifies and recommends corporate and individual performance objectives for our annual

incentive plan for approval by the compensation and leadership committee based on our business plan and strategic objectives for the relevant fiscal year, and makes recommendations on the size, frequency and terms of equity incentive

awards and new hire compensation packages. These recommendations from our CEO are often developed in consultation with members of his senior management team, including our CFO and Chief People Officer.

In certain situations, our compensation and leadership committee may elect to delegate a portion of its authority to our CEO or a subcommittee, other than any authority relating to our

executive officers. Our compensation and leadership committee has delegated to our CEO the authority to make employment offers to candidates at and below the senior vice president level without seeking the approval of the compensation

and leadership committee, subject to certain parameters. In addition, our compensation and leadership committee has delegated to a subcommittee, currently made up of our CEO and CFO, the authority to approve certain equity grants to

employees at and below the senior vice president level, subject to certain parameters approved by the compensation and leadership committee.

At the request of the compensation and leadership committee, our CEO typically attends a portion of each compensation and leadership committee meeting, including meetings at which the

compensation and leadership committee’s compensation consultant is present. From time to time, various members of management and other employees, as well as outside legal counsel and consultants retained by management, attend

compensation and leadership committee meetings to make presentations and provide financial and other background information and advice relevant to compensation and leadership committee deliberations. Our CEO and other NEOs do not

typically participate in, or are present during, any deliberations or determinations of our compensation and leadership committee regarding their compensation or individual performance objectives.

|

|

Role of Compensation Consultants

|

The compensation and leadership committee has the authority under its charter to retain the services of one or more external advisors, including compensation consultants, legal counsel,

accounting, and other advisors, to assist it in performance of its duties and responsibilities. The compensation and leadership committee makes all determinations regarding the engagement, fees, and services of these external advisors,

and any such external advisor reports directly to the compensation and leadership committee.

During 2023, the compensation and leadership committee retained Willis Towers Watson as its independent compensation consultant to provide support and advisory services as it relates to

our compensation program. Willis Towers Watson performs no other services for us other than its work for the compensation and leadership committee. Willis Towers Watson complied with the definition of independence under the Dodd-Frank

Act and other applicable SEC and stock exchange regulations.

|

Use of Competitive Market Data

We strive to attract and retain the most highly qualified executive officers in an extremely competitive market. Accordingly, our compensation and leadership committee believes that it is

important when making its compensation decisions to be informed as to the competitive market for executive talent, including the current practices of comparable public companies. Consequently, our compensation and leadership committee annually

reviews market data for each executive officer’s position, as described below.

In addition to using survey data for similar sized companies, the compensation and leadership committee approved a peer group of comparable

publicly-traded companies, developed with the assistance of Willis Towers Watson, to aid it in assessing the overall competitiveness of our executive compensation program and the key components of compensation under the program. The peer group

was selected from publicly-traded companies with (i) similar industry focus (i.e., consumer finance, software and services) (ii) comparable company scope and size, or (iii)

that have similar product offerings. Our compensation and leadership committee considered compensation data from the below-listed companies.

|

Atlanticus

|

Green Dot

|

MoneyLion

|

Regional Management

|

World Acceptance

|

|

CURO Group

|

LendingClub

|

OppFi

|

SoFi Technologies

|

|

|

Enova International

|

LendingTree

|

PROG Holdings

|

Upstart Holdings

|

13

Elements of Executive Compensation and 2023 Compensation Decisions

The key components of the target total direct compensation for each executive officer set by the compensation and leadership committee annually are annual base salary, short-term cash incentive

compensation and long-term equity incentive compensation (PSUs and RSUs). The compensation and leadership committee generally positions total cash compensation and equity compensation in a way that the committee believes substantially links

executive compensation to corporate performance and strikes a balance between our short-term and long-term strategic goals. A significant portion of our NEOs’ target total direct compensation opportunity is comprised of “at-risk” compensation

in the form of performance-based annual incentive opportunities and equity awards in order to align the NEOs’ incentives with the interests of our stockholders and our corporate goals. The compensation and leadership committee believes that the

target total direct compensation of our NEOs should be competitive within the markets in which we compete, while considering factors such as individual performance, company performance and any unique circumstances of the NEO’s position based on

that individual’s responsibilities and market factors. We believe that this target will enable us to attract, motivate and retain the executive talent necessary to develop and execute our business strategy. The compensation and leadership

committee reviews the compensation of our NEOs against our peer group, survey data sources, and other companies which we compete with for talent to provide a general assessment of the overall competitiveness of our executive compensation

program. We also provide our NEOs with certain severance and change in control benefits, as well as other benefits generally available to all our employees, including retirement benefits under our 401(k) plan and participation in our employee

benefit plans.

Base Salaries

Base salary is a fixed component of pay intended to recognize and reward the day-to-day contributions of our executive officers. Base salaries are initially set at the time of hiring, taking

into account level of responsibility, qualifications, experience, salary expectations and market data. Base salaries are then reviewed on an annual basis by the compensation and leadership committee. The table below reflects changes in our

NEOs’ salaries from the prior year.

|

Executives

|

2022 Annual Base Salary ($)

|

2023 Annual Base Salary ($)(1)

|

Change (%)

|

|||||||||

|

Raul Vazquez

|

700,000

|

595,000

|

(2)

|

(15.00

|

)

|

|||||||

|

Kathleen Layton

|

341,318

|

375,000

|

(3)

|

9.87

|

||||||||

|

Patrick Kirscht

|

473,509

|

473,509

|

—

|

|||||||||

| (1) |

The base salary amount for each of our NEOs is approved by the compensation and leadership committee.

|

| (2) |

In connection with certain operating expense reduction efforts by the Company, Mr. Vazquez voluntarily requested a reduction of his annual base salary of 15%, effective November 11, 2023, which was reduced from $700,000 to $595,000

on an annualized basis.

|

| (3) |

Ms. Layton’s salary was increased on July 15, 2023 in connection with her promotion to Chief Legal Officer.

|

Annual Incentive Plan

Each of our NEOs was eligible to participate in our annual incentive plan for 2023. This performance-based cash compensation was designed to reward the achievement of annual corporate

performance relative to pre-established goals, as well as individual performance, contributions and strategic impact.

The compensation and leadership committee established target annual incentive awards for each executive officer, denominated as a percentage of base salary, which were set at the same

percentages of base salary for 2023 as in 2022.

|

2023 Target Annual Incentive Award Opportunity

|

||||||||

|

Target Award ($)

|

Percentage of Base Salary (%)

|

|||||||

|

Raul Vazquez

|

700,000

|

(1)

|

100

|

|||||

|

Kathleen Layton

|

113,625

|

(2)

|

65

|

(3)

|

||||

|

Patrick Kirscht

|

307,780

|

65

|

||||||

| (1) |

In connection with Mr. Vazquez’ voluntary reduction in salary, the compensation and leadership committee agreed that with respect to the annual bonus calculation for 2023, Mr. Vazquez’ target award would be determined using the

annual base salary in effect immediately before the reduction.

|

| (2) |

Ms. Layton was only eligible for this bonus opportunity for approximately five months of the year, which is the prorated portion of time in which she served in an executive capacity. This Target Award represents the time in which Ms.

Layton served as Chief Legal Officer.

|

| (3) |

Ms. Layton was only eligible for this bonus opportunity for approximately five months of the year, which is the prorated portion of time in which she served in an executive capacity. This represents the bonus opportunity for Ms.

Layton assuming no proration.

|

For 2023, the compensation and leadership committee approved the corporate performance goals and their respective weightings set forth

below. Our compensation and leadership committee believes these are the appropriate drivers for our business as they provide a balance between growth and strengthening our financial position while operating in a challenging environment. Periodically throughout the year, the compensation and leadership committee may revise corporate performance goals and weightings for annual incentive awards based

on our business priorities and annual operating plan. Our Adjusted EBITDA and total revenue performance metrics allow the compensation and leadership committee to

accurately assess the Company’s productivity and efficiency, while evaluating comparative results period-over-period. Please refer to the Reconciliation on Non-GAAP Financial

Measures section of this amendment for the Company’s definition of Adjusted EBITDA.

14

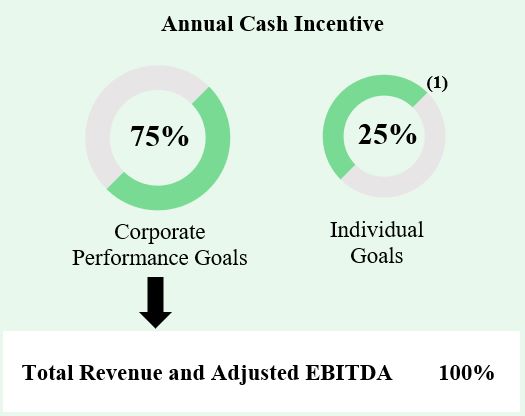

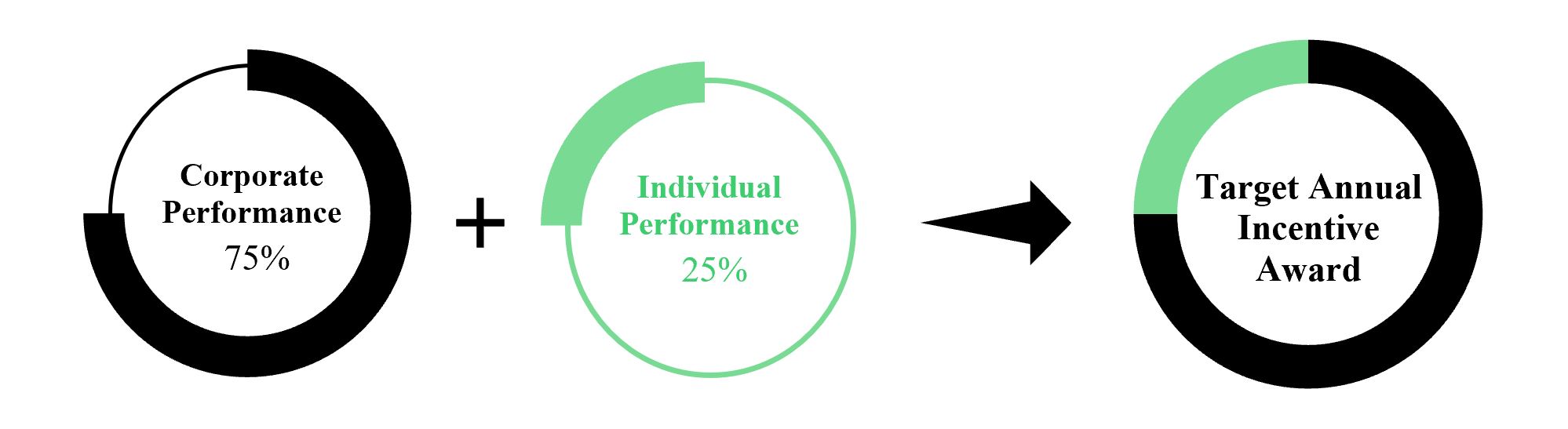

In 2023, the annual incentive awards were weighted 75% on corporate performance and 25% on attainment of individual goals for all of our

NEOs, except for our CEO. The annual incentive award for the CEO was weighted 80% on corporate performance and 20% on attainment of individual goals. Individual goal achievement for each NEO’s performance was determined by the compensation

and leadership committee.

| (1) |

For the CEO, the weightings were 80% on corporate performance and 20% on attainment of individual goals.

|

Our 2023 performance included several achievements but ultimately fell short of our expectations. The following provides additional information regarding the corporate goals under our Annual

Incentive Plan.

|

Metric (Weighting)

|

|

|

Target

($) |

Actual

($) |

Percent attainment

(%) |

Total Revenue and Adjusted EBITDA

|

|

Total Revenue (consolidated) (25%)

|

1,109M

|

1,057M

|

91.2%

|

|

|

|||||

|

|

Adjusted EBITDA (75%)

|

77.9M

|

1.7M

|

0.0%

|

|

|

|

|||||

|

Total Corporate Attainment

|

|

|

|

|

23%

|

For a reconciliation of non-GAAP Adjusted EBITDA to GAAP EBITDA, refer to

the Reconciliation on Non-GAAP Financial Measures section of this amendment. For more information about our business, please see “Business” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in our Original Form 10-K.

Individual annual incentive award goals and achievement for our NEOs vary depending on our strategic corporate initiatives and each executive

officer’s responsibilities. While not exhaustive, below are certain key factors that the compensation and leadership committee, in consultation with our CEO, considered when determining the individual component of each 2023 annual incentive

award. While the compensation and leadership committee recognized that the challenging macroeconomic environment resulting from inflationary pressures and higher interest rates negatively impacted the business and stock performance, it

determined that in 2023 our NEOs were able to continue to shift priorities to focus on tightening our underwriting, reducing expenses, optimizing operational efficiency and guiding Oportun on a trajectory for sustainable, profitable growth and

long-term value creation for stockholders. The compensation and leadership committee recognized the individual accomplishments of the NEOs, including:

| • |

Regularly enhancing our underwriting models and servicing efforts to continue to improve credit outcomes amidst an uncertain and dynamic macroeconomic environment;

|

| • |

Adaptability and responsiveness of the legal and compliance organization amidst a complex regulatory landscape;

|

| • |

Providing strategic guidance that contributed to the achievement of key business initiatives;

|

| • |

Increasing operating efficiency due to several cost structure optimization initiatives; and

|

| • |

Executing and delivering a number of funding arrangements in a challenging capital markets environment.

|

15

As a result of the compensation and leadership committee’s performance review, including the decline in our Net Income and Total Stockholder Return, the following annual incentive awards were

paid to each of our NEOs for 2023, representing a decrease in the incentive award paid in comparison to 2022:

|

Target Bonus

($)

|

Bonus Payout

(% of Target)

|

Bonus Amount

($)

|

YoY

Change

(%)

|

|||||||||||||

|

Raul Vazquez

|

700,000

|

(1)

|

32.2

|

225,680

|

(43.0

|

) |

||||||||||

|

Kathleen Layton

|

113,625

|

(2)

|

42.1

|

47,795

|

(2)

|

N/A

|

(3)

|

|||||||||

|

Patrick Kirscht

|

307,780

|

39.6

|

121,881

|

(51.9

|

) | |||||||||||

| (1) |

In connection with Mr. Vazquez’ voluntary reduction in salary, the compensation and leadership committee agreed that with respect to annual bonus calculation for 2023, Mr. Vazquez’ target award would be determined using the annual

base salary in effect immediately before the reduction.

|

| (2) |

Ms. Layton’s target annual incentive award was prorated for the portion of time in which she served in an executive capacity. Assuming no proration, the

Target Bonus for Ms. Layton would have been $243,750 and the Bonus Amount would have been $102,619. Prior to her promotion to Chief Legal Officer, Ms. Layton

received $95,175 in bonus payments for 2023.

|

| (3) |

Ms. Layton was not serving in an executive capacity in 2022 and did not receive an annual incentive award.

|

Long-Term Incentive Compensation

Our compensation and leadership committee believes long-term incentive compensation is an effective means for focusing our NEOs on driving increased stockholder value over a multi-year period

and motivating them to remain employed with us. In 2023, our compensation and leadership committee, in consultation with Willis Towers Watson, conducted a review of the design of our long-term incentive program. Based on this review, the

compensation and leadership committee determined to adopt a new, enhanced long-term incentive program for our executive officers. The design of the 2023 program is intended to directly align the interests of our executive officers with those of

our stockholders, to give our executive officers a strong incentive to maximize stockholder returns on a long-term basis, and to aid in our recruitment and retention of key executive talent necessary to ensure our continued success.

In 2023, our long-term incentive program provided for the delivery of long-term incentive awards through a combination of the following two award vehicles:

|

LTI Vehicle

|

Performance Period

|

Weighting

|

|

Performance-based

Restricted Stock Units (PSUs)

|

A three-year performance period covering calendar years 2023 through 2025; three-year cliff vesting

|

Approximately 50% of total target award

|

|

Restricted Stock Units (RSUs)

|

N/A – Shares vest in three equal annual installments from the vesting commencement date of March 10, 2023, subject to continued employment

|

Approximately 50% of total target award

|

The PSU award is the new element of our long-term incentive program, and it is the performance-contingent award which replaces the stock options in our prior long-term incentive program. The

PSU award rewards executives for absolute total shareholder return as measured by the Company’s stock price appreciation and any declared dividends. We use absolute total shareholder return as the sole performance metric for the award because

the compensation and leadership committee believes it is the ultimate measure of the Company’s achievement for its stockholders over the long term. The PSUs have both upside potential and downside risk based on positive or negative absolute

total shareholder return performance. Vesting of the 2023-2025 PSU award cycle occurs at the end of the three-year performance period, which is December 31, 2025, and vested PSUs are subject to the continued employment of each executive through

March 10, 2026. Vesting is dependent upon meeting a three-year threshold level of absolute total shareholder return, and participants are eligible to earn up to 125% of their target award. Any PSUs that vest in excess of the 100% target number

of units (the “Upside Units”), may be paid out via a cash payment with respect to some or all of the Upside Units, in an amount equal to the fair market value of the underlying shares as of the vesting date.

16

The following table reflects potential performance and payout percentages. Performance between these points will be linearly interpolated.

|

TSR Global

|

Percent That Become Eligible Units

|

Corresponding Average Closing Stock Prices

|

|

If Company TSR

is achieved at . . .

|

. . . Then the percentage of the Target Number of Performance-Based Restricted Stock Units that become Eligible Units is:

|

The applicable average closing prices of our common stock for each of the twenty (20) trailing consecutive trading days ending with, and inclusive of, the measurement date would need to

reach:

|

|

125% or greater

|

125%

|

$13.61

|

|

100%

|

100%

|

$12.10

|

|

75%

|

75%

|

$10.59

|

|

50%

|

50%

|

$9.08

|

|

25%

|

25%

|

$7.56

|

|

Less than 25%

|

0%

|

< $7.56

|

Stock-based compensation cost for the PSUs is measured based on the estimated fair value of the PSUs granted using a Monte Carlo simulation. The fair value is then amortized ratably over the

requisite service period of the awards. The fair value for PSUs achieved over 100% of target are recognized as a liability and will be revalued as needed throughout the service period.

A summary of our PSU activity under the 2019 Plan for the year ended December 31, 2023 is as follows:

|

PSU Outstanding

|

Weighted Average Grant-

Date Fair Value

($)

|

|

|

Balance – January 1, 2023

|

—

|

—

|

|

Granted

|

327,668

|

1.33

|

|

Vested

|

—

|

—

|

|

Forfeited

|

—

|

—

|

|

Balance – December 31, 2023

|

327,668

|

1.33

|

For fiscal year 2023, we recognized approximately $13.2 thousand in compensation cost related to nonvested PSU awards granted to employees in our condensed consolidated statements of

operations. As of December 31, 2023, we had approximately $422.6 thousand in unrecognized compensation cost related to nonvested PSU awards granted to employees, which will be recognized over a weighted average vesting period of approximately

2.19 years.

Employment and Change in Control Arrangements

We have entered into at-will employment offer letters with each of our NEOs that were approved by the compensation and leadership committee and our Board. In addition, we provide each NEO with

the opportunity to receive certain severance payments and benefits in the event of a termination of employment under certain circumstances, including in connection with a change of control. The compensation and leadership committee generally

believes that the severance protection payments and benefits we offer are necessary to provide stability among our executive officers, serve to focus our executive officers on our business operations, and avoid distractions in connection with a

potential change in control transaction or period of uncertainty.

For additional information on the employment arrangements and potential post-employment payments to our NEOs, see “Employment, Severance, and Change in Control

Agreements” and “Potential Payments and Benefits Upon Termination or Change in Control” below.

17

401(k) Plan and Employee Benefits

During 2023, all full-time employees in the United States employed by Oportun, including the NEOs, were eligible to participate in the Company’s 401(k) plan, a tax qualified retirement plan

(with an employer match up to 4% of eligible contributions). Other than the 401(k) plan, we do not provide defined benefit pension plans or defined contribution retirement plans to the NEOs or other employees.

We also offer a number of benefit programs to our full-time employees, including our NEOs, in the United States. These benefits include medical, vision and dental insurance, health and

dependent care flexible spending accounts, wellness programs, charitable donation matching, short-term and long-term disability insurance, accidental death and dismemberment insurance, basic life insurance coverage, and business travel

insurance. Full-time and part-time employees in the United States are eligible to receive paid parental leave.

Stock Ownership Guidelines

In April 2022, the compensation and leadership committee adopted stock ownership guidelines for our executive officers and non-employee directors to further align their interests with our

stockholders. Under these guidelines, each participant is required to own shares of our common stock with value of at least the following:

|

Position

|

Ownership Requirement

|

|

CEO

|

6x annual base salary

|

|

Other Section 16 officers

|

3x annual base salary

|

|

Non-employee directors

|

5x annual cash retainer

|

Covered executives are expected to meet the required ownership level within five years of the later of the initial adoption of the policy or hire or promotion into a covered executive role.

Non-employee directors are expected to meet the required ownership level within five years of the appointment date. Further, executives and non-employee directors must hold at least 50% of any net after-tax shares realized from equity award

vesting or exercise until the guideline has been met. Shares held outright and unvested RSUs that are subject to only a time-vesting condition count towards the ownership threshold but shares underlying options and unearned performance-vesting

shares do not.

Compensation Clawback

In April 2022, the compensation and leadership committee approved a discretionary executive clawback policy which applies to our Section 16 officers. Our discretionary clawback policy provides that if (i) the Company is required to restate its financial statements filed pursuant to the Exchange Act

as a result of a material error in the financial statement, (ii) such restatement is due to the gross negligence or intentional misconduct of a clawback officer (as determined by the compensation and leadership committee), (iii) the amount

of any cash-based incentive paid to or payable to such clawback officer that was determined based on the achievement of financial or operating results would have been less if such financial statements had been correct at the time of

determination, and (iv) no more than three years have elapsed from the filing date of such financial statements upon which such incentive compensation was determined, then the Company shall recoup from such clawback officer an amount equal

to such excess cash incentive compensation through such means as the compensation and leadership committee determines in accordance with the policy.

In addition to the above-described discretionary clawback policy, in November 2023, the compensation and leadership committee adopted a separate mandatory incentive-based

executive clawback policy which applies to our current and former executive officers, on or after October 2, 2023. Our mandatory clawback policy provides for the recoupment of certain executive compensation, including but not limited to short-

and long-term incentive-based compensation, in the event of an accounting restatement resulting from material noncompliance with financial reporting requirements under U.S. federal securities laws, consistent with SEC regulations effective in

2023.

Hedging and Pledging Policies

We have established an insider trading policy, which, among other things, prohibits all employees and non-employee directors from engaging in short sales or transactions in publicly-traded

options (such as puts and calls) and other derivative securities relating to our common stock, hedging or similar transaction designed to decrease the risks associated with holding our securities, pledging any of our securities as collateral

for a loan, and holding any of our securities in a margin account.

Compensation Risk Assessment

The compensation and leadership committee has reviewed our compensation programs to assess whether they encourage our employees to take excessive or inappropriate risks. After reviewing and

assessing our compensation philosophy, policies and practices, including the mix of fixed and variable, short-term and long-term incentives and overall pay, incentive plan structures, and the checks and balances built into, and oversight of,

each plan and practice, the compensation and leadership committee has determined that any risks arising from our compensation programs are not reasonably likely to have a material adverse effect on the Company.

18

Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code generally places a $1 million limit on the amount of compensation a publicly-held company can deduct for U.S. federal tax purposes in any tax year on

compensation paid to “covered employees.” The compensation and leadership committee retains discretion to award compensation amounts which are not tax-deductible if it determines that such compensation is consistent with our business needs.

Taxation of Parachute Payments and Deferred Compensation

We do not provide, and have no obligation to provide, any executive officer, including any NEO, with a “gross-up” or other reimbursement payment for any tax liability that he or she might owe

as a result of the application of Section 280G, 4999, or 409A of the Code. Sections 280G and 4999 of the Code provide that executive officers and directors who hold significant equity interests and certain other service providers may be subject

to an excise tax if they receive payments or benefits in connection with a change of control that exceed certain limits prescribed by the Code, and that the employer may be unable to take a deduction on the amounts subject to this additional

tax.

Summary Compensation Table

The following table provides information regarding the compensation awarded to, earned by or paid to our NEOs for the years ended December 31, 2023, 2022, and 2021:

|

|

Year

|

Salary(1)

($)

|

Bonus

($)

|

Stock Awards(3)

($)

|

Option Awards(3)

($)

|

Non-Equity Incentive Plan Compensation (4)

($)

|

All Other Compensation (5)

($)

|

Total

($)

|

|||||||||||||||||||||

|

Raul Vazquez(6)(7)

|

2023

|

687,885

|

—

|

746,007

|

—

|

225,680

|

34,963

|

1,694,535

|

|||||||||||||||||||||

|

Chief Executive Officer

|

2022

|

683,836

|

—

|

2,650,738

|

875,005

|

525,000

|

31,345

|

4,765,924

|

|||||||||||||||||||||

|

|

2021 |

591,917

|

—

|

875,019

|

875,010

|

745,440

|

31,999

|

3,119,385

|

|||||||||||||||||||||

|

Kathleen Layton(8)

|

2023

|

356,216

|

95,175

|

(2)

|

371,545

|

—

|

47,795

|

15,362

|

886,093

|

||||||||||||||||||||

|

Chief Legal Officer and Corporate Secretary