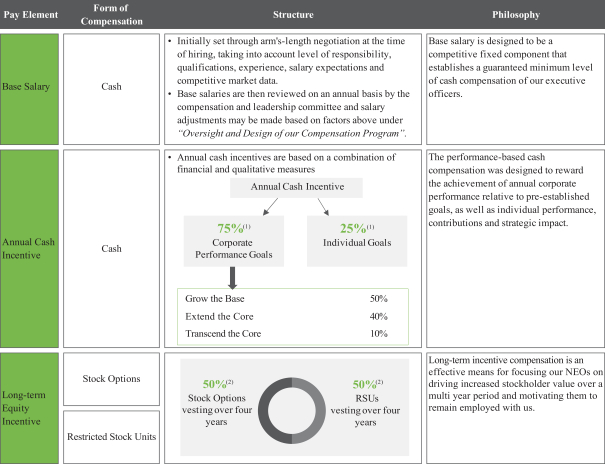

NEOs and to address special situations as they may arise from time to time. The compensation and leadership committee establishes annual targets for long-term incentive compensation to our NEOs

and other executive officers, taking into consideration the competitive market analysis performed by our compensation consultant.

Our compensation and leadership committee considers stock options to be inherently performance-based, and automatically link

executive pay to stockholder return, because the executive derives value from a stock option only if our stock price increases. As part of a balanced compensation strategy, our compensation and leadership committee also awards RSUs to help us to

attract, motivate and retain our NEOs.

In March 2021, in connection with our 2020 annual review process and performance year-to-date, we granted refresh equity grants of stock options and RSUs to NEOs. The stock option grants provide for a four-year vesting schedule, with one-fourth of the shares subject to each stock option vesting on the first anniversary of the vesting commencement date, and the remaining shares vesting in 36 successive equal monthly installments following the

first anniversary of the vesting commencement date, subject to the NEO’s continued service on each such vesting date. Each RSU grant provides for a four-year vesting schedule, with one-fourth of the RSUs

vesting on each anniversary of the vesting commencement date, subject to the NEO’s continued service on each such vesting date. In determining the amount of such grants, the compensation and leadership committee considered compensation data

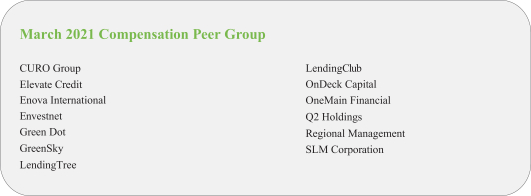

with respect to the March 2021 peer group for the grants issued in March 2021 and granted equity at a level comparable to the median annual equity grant values of the peer group on each grant date.

Historically, equity awards have been granted in connection with an executive officer’s initial employment or promotion,

and thereafter on a periodic basis (generally annually) in order to retain and reward our NEOs based on factors such as individual performance and strategic impact, retention goals and competitive pay practices. The compensation and leadership

committee generally determines the size and mix of equity awards to our NEOs in consultation with our CEO (except with respect to his own awards) and based on factors discussed above in “Oversight and Design of our Compensation

Program.” The compensation and leadership committee intends to continue to review the existing equity holdings of our NEOs, including the percentage of equity awards that are vested or will become vested as a result of our offering, as well

as other factors, when making decisions on future equity grants to our NEOs.

Employment and Change in Control Arrangements

We have entered into at-will employment offer letters with each of our NEOs that were

approved by the compensation and leadership committee and our board of directors. In addition, we provide each NEO with the opportunity to receive certain severance payments and benefits in the event of a termination of employment under certain

circumstances, including in connection with a change of control. The compensation and leadership committee generally believes that that the severance protection payments and benefits we offer are necessary to provide stability among our executive

officers, serve to focus our executive officers on our business operations, and avoid distractions in connection with a potential change in control transaction or period of uncertainty.

For additional information on the employment arrangements and potential post-employment payments to our NEOs, see

“Employment, Severance, and Change in Control Agreements” and “Potential Payments and Benefits Upon Termination or Change in Control” below.

401(k) Plan and Employee Benefits

During 2021, all full-time employees in the United States employed by Oportun, including the NEOs, were eligible to participate

in the Company’s 401(k) plan, a tax qualified retirement plan (with an employer match up to 4% of eligible contributions). Other than the 401(k) plan, we do not provide defined benefit pension plans or defined contribution retirement plans to

the NEOs or other employees.

We also offer a number of benefit programs to our full-time employees, including our NEOs,

in the United States. These benefits include medical, vision and dental insurance, health and dependent care flexible

|

|

|

|

|

|

47 |