PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

DATED MAY 16, 2025

2 Circle Star Way

San Carlos, CA 94070

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held at [●] [●.m], Pacific Time, on [●], [●] [●], 2025

[●], 2025

Dear Oportun Stockholder:

I am pleased to invite you to attend the 2025 Annual Meeting of Stockholders (together with any postponement, adjournment or delay thereof, the “Annual Meeting”) of Oportun Financial Corporation (“Oportun” or the “Company”) to be held at [●] [●.m], Pacific Time, on [●], [●] [●], 2025. The Annual Meeting will be held virtually on the internet and will be available at www.cesonlineservices.com/oprt25_vm.

We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement:

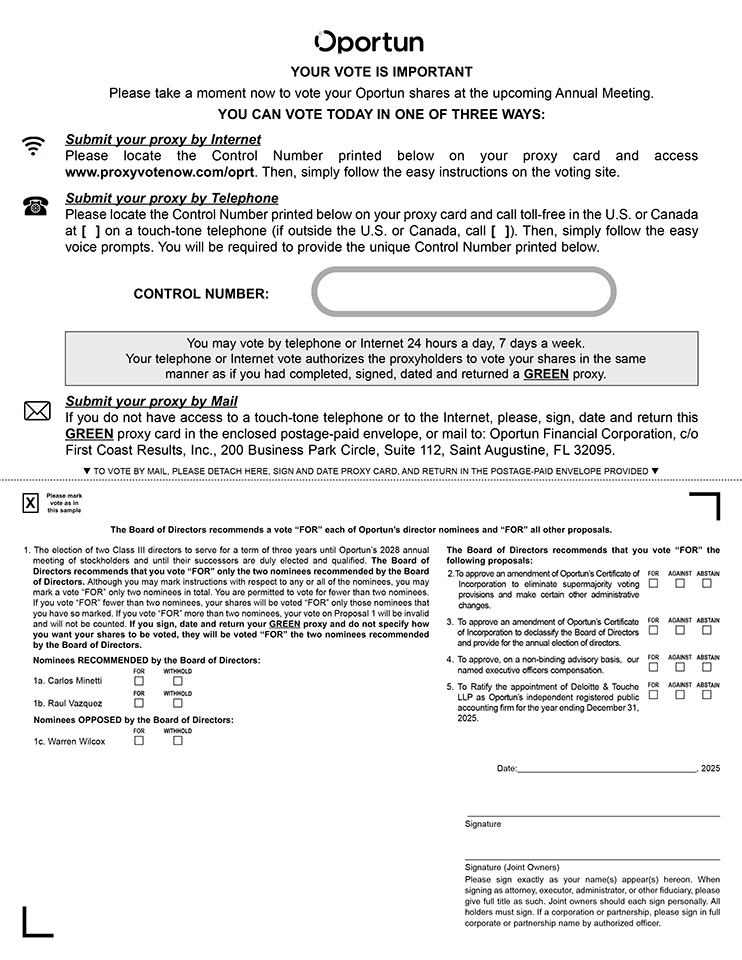

| 1) | To elect two Class III directors to serve for a term of three years until our 2028 annual meeting of stockholders and until their successors are duly elected and qualified. |

| 2) | To approve an amendment to our Certificate of Incorporation to eliminate supermajority voting provisions and make certain other administrative changes. |

| 3) | To approve an amendment to our Certificate of Incorporation to declassify our board of directors and provide for the annual election of directors. |

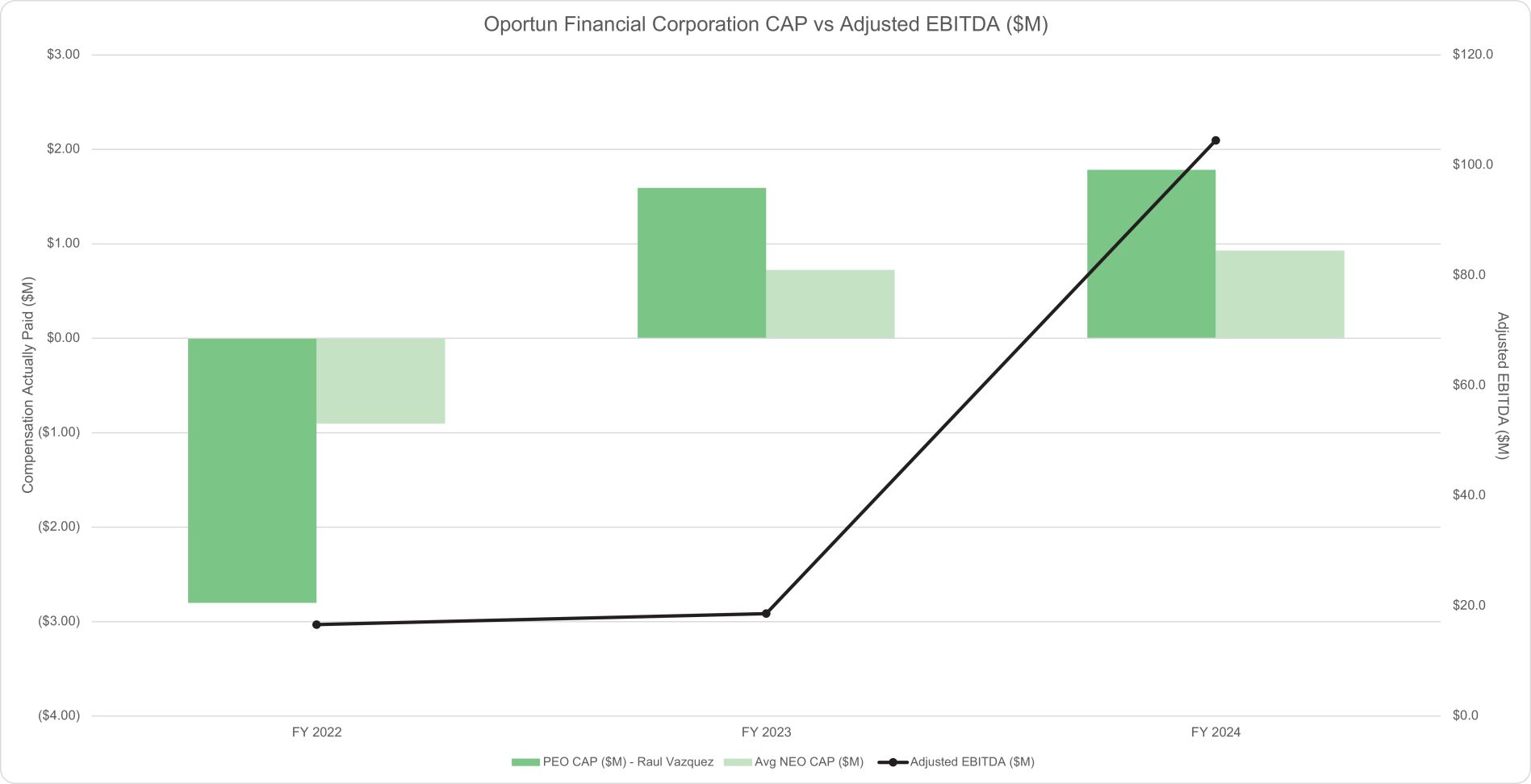

| 4) | To approve, on an advisory basis, our named executive officer compensation, as described in the proxy materials. |

| 5) | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2025. |

| 6) | To conduct any other business properly brought before the Annual Meeting. |

The Board of Directors (the “Board”) urges you to read the accompanying proxy statement and unanimously recommends a vote “FOR” each of Oportun’s director nominees and “FOR” Proposals 2, 3, 4 and 5.

The Board has fixed the close of business on May 27, 2025 as the record date for the Annual Meeting. Only stockholders of record as of the close of business on May 27, 2025 are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

The accompanying proxy statement and our annual report can be accessed by visiting: [●]. The proxy statement and the GREEN proxy card and GREEN voting instruction form are first being made available to stockholders on or about [●], 2025.

Your vote will be especially important at the Annual Meeting. As you may know, Findell Capital Partners, LP (collectively with its affiliates, “Findell Capital”), a New York-based hedge fund and activist investor, has notified the Company that it intends to nominate one candidate for election to the Board at the Annual Meeting, in opposition to one of the two nominees recommended by the Board. You may receive proxy solicitation materials from Findell Capital, including proxy statements and proxy cards. These materials are not from Oportun. The Board recommends that you disregard them. We are not responsible for the accuracy of any information provided by, or relating to, Findell Capital contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Findell Capital or any statements that Findell Capital or its representatives have made or may otherwise make. The Board strongly urges you NOT to sign or return any proxy card or voting instruction form sent to you, by or on behalf of, Findell Capital.