Hello Digit, Inc. (dba Digit)

Consolidated Financial Statements

December 31, 2020 and 2019

Board of Directors

Hello Digit, Inc. (dba Digit)

San Francisco, California

INDEPENDENT AUDITORS’ REPORT

Report on the Financial Statements

We have audited the accompanying consolidated financial statements of Hello Digit, Inc. (dba Digit), which comprise the consolidated balance sheets as of December 31, 2020 and 2019, and the related consolidated statements of operations, stockholders’ equity, and cash flows for the years then ended, and the related notes to the consolidated financial statements.

Management’s Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Hello Digit, Inc. (dba Digit) as of December 31, 2020 and 2019, and the results of its operations and its cash flows for the years then ended, in accordance with accounting principles generally accepted in the United States of America.

Emphasis-of-Matter Regarding Restatement of the Financial Statements

As described in Note 11 to the consolidated financial statements, management identified errors in the presentation of customer accounts, customer deposits, sales tax liability, software development capitalization and classification of interest income. Accordingly, the 2020 consolidated financial statements have been restated to correct the accounting.

Emphasis-of-Matter Regarding Acquisition

As described in Note 10 to the consolidated financial statements, the Company was acquired by Oportun, Inc. in December 2021.

/s/ Frank, Rimerman + Co. LLP

San Francisco, California

May 10, 2021, except for the effects of subsequent events

and the restatement discussed in Notes 10 and 11, respectively,

as to which the date is February 22, 2022

| | | | | | | | | | | |

| Hello Digit, Inc. (dba Digit) | | | |

| Consolidated Balance Sheets | | | |

|

December 31, | |

December 31, |

| 2020 | | 2019 |

| (restated) | | (restated) |

| ASSETS | | | |

| Current Assets | | | |

Cash | $ 15,936,362 | | $ 23,383,824 |

Prepaid expenses and other current assets | 701,597 | | 474,715 |

Total current assets | 16,637,959 | | 23,858,539 |

| Certificates of Deposit | 1,745,981 | | 1,725,981 |

| Property and Equipment, net | 528,801 | | 557,196 |

| Capitalized Software, net | 1,717,617 | | - |

| Deposits | 213,878 | | 163,879 |

| Other Assets | 249,662 | | - |

| Restricted Cash | 20,000 | | - |

Total assets | $ 21,113,898 | | $ 26,305,595 |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current Liabilities | | | |

Accounts payable | $ 837,142 | | $ 1,703,457 |

Accrued expenses and other current liabilities | 1,342,440 | | 1,776,684 |

Deferred revenue | 1,221,252 | | 1,171,565 |

Total current liabilities | 3,400,834 | | 4,651,706 |

| Deferred Rent | 313,539 | | 244,083 |

| Deposits Held | 88,521 | | 215,360 |

| Warrant Liability | 33,836 | | - |

| Stockholders’ Equity (Note 7) | | | |

Series C convertible preferred stock, $0.0001 par value | 87 | | 87 |

Series B convertible preferred stock, $0.0001 par value | 173 | | 173 |

Series A convertible preferred stock, $0.0001 par value | 116 | | 116 |

Series Seed-2 convertible preferred stock, $0.0001 par value | 84 | | 84 |

Series Seed-1 convertible preferred stock, $0.0001 par value | 31 | | 31 |

Common stock, $0.0001 par value | 115 | | 113 |

Additional paid-in capital | 72,245,681 | | 70,531,729 |

Accumulated deficit | (54,969,119) | | (49,337,887) |

Total stockholders’ equity | 17,277,168 | | 21,194,446 |

Total liabilities and stockholders’ equity | $ 21,113,898 | | $ 26,305,595 |

See Notes to Consolidated Financial Statements

| | | | | | | | | | | | | | |

| Hello Digit, Inc. (dba Digit) | | | |

| Consolidated Statements of Operations | | | |

| 12 months ending December 31, | | 12 months ending December 31, |

| 2020 | | 2019 |

| (restated) | | (restated) |

| Revenue, net | $ 35,831,529 | | $ 22,560,400 |

| Cost of Revenue | 12,586,750 | | 9,327,018 |

Gross margin | 23,244,779 | | 13,233,382 |

| Operating Expenses | | | |

Sales and marketing | 13,466,393 | | 24,689,322 |

Research and development | 12,681,575 | | 9,256,170 |

General and administrative | 7,063,855 | | 5,443,191 |

Total operating expenses | 33,211,823 | | 39,388,683 |

| Loss from Operations | (9,967,044) | | (26,155,301) |

| Interest Income | 3,977,902 | | 5,318,347 |

| Interest Expense | (72,635) | | - |

| Other Income, net | 430,545 | | 163,594 |

| Net Loss | $ (5,631,232) | | $ (20,673,360) |

See Notes to Consolidated Financial Statements

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hello Digit, Inc. (dba Digit) | | | | | | | | | | | | | |

| Consolidated Statements of Stockholders’ Equity | | | | | | | | | | | | |

| | | | | | | Additional | | | | Total |

| Convertible Preferred Stock | | Common Stock | | Paid-In | | Accumulated | | Stockholders’ |

| Shares | | Amount | | Shares | | Amount | | Capital | | Deficit | | Equity |

| Balances at December 31, 2018 | 4,038,661 | | $ 404 | | 1,161,393 | | $ 116 | | 39,252,855 | | $ (28,664,527) | | $ 10,588,848 |

Issuance of Series C convertible preferred stock at $36.7463 |

| | | | | | | | | | | |

per share in exchange for cash, net of issuance costs | 783,397 | | 79 | | - | | - | | 28,622,758 | | - | | 28,622,837 |

Issuance of common stock upon exercise of stock options |

| | | | | | | | | | | - |

for cash | - | | - | | 89,560 | | 9 | | 111,746 | | - | | 111,755 |

Repurchase of common stock | - | | - | | (35,446) | | (4) | | (41,207) | | - | | (41,211) |

Conversion of common stock into Series C |

| | | | | | | | | | | | |

convertible preferred stock | 81,640 | | 8 | | (81,640) | | (8) | | - | | - | | - |

Vesting of early exercise options | - | | - | | - | | - | | 2,525 | | - | | 2,525 |

Stock-based compensation | - | | - | | - | | - | | 2,583,052 | | - | | 2,583,052 |

Net loss | - | | - | | - | | - | | - | | (20,673,360) | | (20,673,360) |

| Balances at December 31, 2019 | 4,903,698 | | 491 | | 1,133,867 | | 113 | | 70,531,729 | | (49,337,887) | | 21,194,446 |

Issuance of common stock upon exercise of stock options |

| | | | | | | | | | | |

for cash | - | | - | | 15,423 | | 2 | | 99,319 | | - | | 99,321 |

Stock-based compensation | - | | - | | - | | - | | 1,545,619 | | - | | 1,545,619 |

Issuance of common stock warrant | - | | - | | - | | - | | 69,014 | | - | | 69,014 |

Net loss | - | | - | | - | | - | | - | | (5,631,232) | | (5,631,232) |

| Balances at December 31, 2020 (restated) | 4,903,698 | | $ 491 | | 1,149,290 | | $ 115 | | $ 72,245,681 | | $ (54,969,119) | | $ 17,277,168 |

| | | | | | | | | | | | | |

See Notes to Consolidated Financial Statements

| | | | | | | | | | | |

| Hello Digit, Inc. (dba Digit) | | | |

| Consolidated Statements of Cash Flows | | | |

| 12 months ending December 31, | | 12 months ending December 31, |

| 2020 | | 2019 |

| (restated) | | (restated) |

| Cash Flows from Operating Activities | | | |

Net loss | $ (5,631,232) | | $ (20,673,360) |

Adjustments to reconcile net loss to net cash used in |

| | |

operating activities: |

| | |

Depreciation and amortization | 419,247 | | 89,934 |

Non-cash interest expense | 72,639 | | - |

Stock-based compensation | 1,545,619 | | 2,583,052 |

Revaluation of preferred stock warrant liability | (521) | | - |

Changes in operating assets and liabilities: |

| | |

Prepaid expenses and other current assets | (226,882) | | (327,642) |

Accounts payable | (866,315) | | 1,337,731 |

Accrued expenses and other current liabilities | (561,083) | | 1,070,559 |

Deferred revenue | 49,687 | | 544,200 |

Deferred rent | 69,456 | | 212,413 |

Net cash used in operating activities | (5,129,385) | | (15,163,113) |

| Cash Flows from Investing Activities | | | |

Movement in certificates of deposit and restricted cash | (70,001) | | (849,763) |

Purchase of property and equipment | (154,078) | | (564,691) |

Capitalized software costs | (1,954,391) | | - |

Net cash used in investing activities | (2,178,470) | | (1,414,454) |

| Cash Flows from Financing Activities | | | |

Capitalization of debt issuance costs | (218,926) | | - |

| | | |

| | | |

Proceeds from exercise of stock options | 99,319 | | 111,755 |

Proceeds from issuance of convertible preferred stock, net | - | | 28,622,837 |

Repurchase of common stock | - | | (41,211) |

Net cash (used in) provided by financing activities | (119,607) | | 28,693,381 |

| Increase (Decrease) in Cash | (7,427,462) | | 12,115,814 |

| Cash and Restricted Cash, beginning of year | 23,383,824 | | 11,268,010 |

| Cash and Restricted Cash, end of year | 15,956,362 | | 23,383,824 |

| | | | |

| Supplemental Schedule of Non-Cash Financing Activities | | | |

Issuance of common stock warrant | $ 69,014 | | |

Issuance of convertible preferred stock warrants | $ 34,357 | | |

Vesting of early exercised of stock options | $ - | | $ 2,525 |

Conversion of common stock into Series C |

| | |

convertible preferred stock | $ - | | $ 8 |

See Notes to Consolidated Financial Statements

| | | | | | | | | | | |

| Hello Digit, Inc. (dba Digit) | | | |

| Notes to Consolidated Financial Statements | | | |

1. Nature of Business and Management’s Plans Regarding Financing of Future Operations

Nature of Business

Hello Digit, Inc. (dba Digit) (the Company) was incorporated in the State of Delaware on November 27, 2012. The Company started as a savings platform that connects to customers’ checking accounts and analyzes their income and spending patterns to find amounts that can safely be set aside towards savings goals. The Company calculates these amounts by identifying upcoming bills and regular spending habits to ensure optimal amounts are flagged for savings. The platform allows customers to save without thinking about it and savings are immediately accessible.

In August 2019, the Company established a wholly-owned subsidiary, Digit Advisors, LLC (Digit Advisors). Digit Advisors is a registered investment advisor with the United States Securities and Exchange Committee (SEC) with plans to offer retirement products to its customer base, addressing longer term savings as part of its product offering.

The Company’s headquarters is in San Francisco, California.

Management’s Plans Regarding Financing of Future Operations

The Company has experienced losses since its inception and has an accumulated deficit of $54,969,119 as of December 31, 2020. Management believes the Company has sufficient resources to meet working capital needs through at least May 7, 2022. However, if the Company does not generate sufficient operating cash flows, additional debt or equity financing may be required. There is no assurance that if the Company requires additional financing, such financing will be available in the future on terms which are acceptable to the Company, or at all.

2. Significant Accounting Policies

Principles of Consolidation:

The consolidated financial statements include accounts of the Company and Digit Advisors. All

intercompany accounts have been eliminated in consolidation.

Use of Estimates:

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities, and reported amounts of revenue and expenses in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

2. Significant Accounting Policies (continued)

Revenue Recognition:

The Company recognizes revenue in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 606 Revenue from Contracts with Customers (Topic 606). The Company determines revenue recognition through the following steps:

•Identification of the contract, or contracts, with a customer

•Identification of the performance obligations in the contract

•Determination of the transaction price

•Allocation of the transaction price to the performance obligations in the contract

•Recognition of revenue when, or as, the Company satisfies a performance obligation

The Company currently has two different streams of revenue: (1) subscription revenue and (2) transaction revenue.

The Company earns revenue on a subscription basis from users of its platform. Revenue is recognized ratably over each monthly subscription. Revenue is recorded net of promotions and other discounts, which are recognized as a deduction from revenue at the time the associated revenue is earned. Deferred revenue is recognized when the service period spans into the following month. This resulted in a deferred revenue balance of $1,221,252 as of December 31, 2020 ($1,171,565 as of December 31, 2019).

The Company earns transaction revenue when customers choose to withdraw their saved funds instantly through the Real-time Payments network. Revenue is recognized at the time of transaction. Because transaction revenue is recognized at the time when the instant withdrawal transaction is completed.

2. Significant Accounting Policies (continued)

Cost of Revenue:

Cost of revenue consists primarily of the costs associated with operating and maintaining the Company’s platform. These costs include information technology costs, banking fees, consulting services, salaries and related expenses, amortization of capitalized software costs and customer service support.

Sales and Marketing:

Sales and marketing expenses consist primarily of salaries and related costs, advertising, customer acquisition costs, public relations, branding, consulting fees and the costs associated with providing free trials, which are determined based on an allocation from operations and cost of revenue as described above.

Referral bonuses to customers are included in sales and marketing expenses and were $1,224,285 in 2020 and $4,409,566 in 2019.

Cash and Restricted Cash:

Cash includes all cash balances and highly liquid investments purchased with a remaining maturity of three months or less that belong to Digit. Restricted cash includes security/collateral in the event of outstanding obligations in relation to vendor contracts.

Certificates of Deposit:

Certificates of deposit are held with major financial institutions, as collateral against risks related to the volume of electronic banking activity.

2. Significant Accounting Policies (continued)

Fair Value Measurement:

The Company uses a three-level hierarchy, which prioritizes, within the measurement of fair value, the use of market-based information over entity-specific information for fair value measurement based on the nature of inputs used in the valuation of an asset or liability as of the measurement date. Fair value focuses on an exit price and is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The inputs or methodology used for valuing financial instruments are not necessarily an indication of the risk associated with those financial instruments.

The three-level hierarchy for fair value measurement is defined as follows:

Level I: Inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level II: Inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

Level III: Inputs to the valuation methodology, which are significant to the fair value measurement, are unobservable.

An asset or liability’s categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

The Company’s certificates of deposit are recorded at fair value and classified as Level II investments under the fair value hierarchy as of December 31, 2020 and 2019.

2. Significant Accounting Policies (continued)

Fair Value Measurement (continued):

The Company issued warrants as part of debt financing in 2020 and are classified as Level III liabilities under the fair value hierarchy as of December 31,2020. The Company recorded the fair value of the warrant in the amount of $34,357 using the Black-Scholes-Merton option pricing model using the following assumptions; expected life of 7 years, risk-free interest rate of 0.47%, expected volatility of 75% and no dividends. Expected volatility is based on volatilities of public companies operating in the Company’s industry. The expected life of the warrant represents the term of the exercise period. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant.

As at December 31, 2020, the warrant liability had been revalued to $33,836.

Balance, December 31, 2019 $ -

Warrants issued 34,357

Decrease in fair value (521)

Balance, December 31, 2020 $ 33,836

Concentration of Credit Risk:

Financial instruments, which potentially subject the Company to concentration of credit risk consist primarily of cash, customer accounts and certificates of deposit, which are held with major financial institutions. The aggregate balance of these deposits were in excess of the Federal Deposit Insurance Corporation’s insurable limit as of December 31, 2020. The Company has not experienced any losses on its deposits of cash, customer accounts or certificates of deposit through December 31, 2020.

Property and Equipment:

Property and equipment is recorded at cost, less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets, typically three years. Leasehold improvements are amortized over the lesser of the asset’s estimated useful life or the remaining lease term.

Software Development Costs:

Capitalization of software development costs begins during the application development stage. Costs incurred in the application development phase, including upgrades and enhancements, if it is probable that such expenditures will result in additional functionality, are subject to capitalization and amortization over their estimated useful life. The determination of the probability the technology will result in additional functionality and the ongoing assessment of the recoverability of these costs require considerable judgment by management with respect to certain external factors, including anticipated future gross revenue, estimated economic life and changes in hardware and software technology.

2. Significant Accounting Policies (continued)

Accounting for Impairment of Long-Lived Assets:

The Company reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets held and used is measured by comparison of the carrying amount of an asset to future net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of their carrying cost or fair value less cost to sell. The Company has not recognized losses related to impairment through December 31, 2020.

Income Taxes:

The Company accounts for income taxes using the asset and liability method. Under this method, deferred income tax assets and liabilities are recorded based on the estimated future tax effects of differences between the amounts at which assets and liabilities are recorded for financial reporting purposes and the amounts recorded for income tax purposes. A valuation allowance is provided against the Company’s deferred income tax assets when their realization is not reasonably assured.

Advertising Costs:

All advertising costs are expensed as incurred and included in sales and marketing expenses in the accompanying statements of operations. Advertising expense was $9,092,331 in 2020 and $17,791,284 in 2019.

Research and Development:

The Company expenses research and development expenditures as incurred.

2. Significant Accounting Policies (continued)

Stock-Based Compensation:

Effective January 1, 2020, the Company adopted the requirements of Accounting Standards Update (ASU) 2018-07, Improvements to Nonemployee Share-Based Payment Accounting. ASU 2018-07 is an update to Topic 718 and simplifies the accounting for share-based payments to non-employees by aligning it with the accounting for share-based payments to employees, with certain exceptions. The main provision of ASU 2018-07 requires the measurement of all share-based equity classified awards will be fixed at the grant date. Management determined that the adoption of ASU 2018-07 did not result in a material change to accumulated deficit at January 1, 2020, nor did it result in material changes to the Company’s accounting policies for its stock options.

The Company generally grants stock options to its employees and non-employees for a fixed number of shares with an exercise price equal to the fair value of the shares at the date of grant. Fair value is determined by the Company’s Board of Directors. The Company accounts for stock option grants under FASB ASC Topic 718-10, Compensation – Stock Compensation. Under Topic 718-10, all stock option grants are accounted for using the fair value method and compensation is recognized as the underlying options vest. The Company assumes a 10% forfeiture rate estimated at grant.

Recent Accounting Pronouncements Not Yet Effective:

Leases:

In February 2016, the FASB issued ASC 842, Leases. This standard requires all entities that lease assets with terms of more than 12 months to capitalize the assets and related liabilities on the balance sheet. The standard is effective for the Company as of January 1, 2022 and requires the use of a modified retrospective transition approach for its adoption. The Company is currently evaluating the effect Topic 842 will have on its consolidated financial statements and related disclosures.

Management expects the assets leased under operating leases, similar to the lease disclosed in Note 4 to the consolidated financial statements, will be capitalized together with the related lease obligations on the balance sheet upon the adoption of the standard.

3. Property and Equipment

Property and equipment consists of the following as of December 31:

| | | | | | | | | | | |

| 2020 | | 2019 |

| Computer hardware | $ | 447,505 | | | $ | 302,936 | |

| Leasehold improvements | 271,757 | | | 269,974 | |

| Furniture and fixtures | 191,567 | | | 191,625 | |

| Leasehold improvements | 910,829 | | | 764,535 | |

| Less accumulated depreciation and amortization | (382,028) | | | (207,339) | |

| $ | 528,801 | | | $ | 557,196 | |

4. Commitments and Contingencies

Operating Leases:

The Company leases two office facilities in San Francisco, California under non-cancelable operating lease agreements. The first lease expired in February 2021 and the second expires in April 2027. Under the terms of the lease agreements, the Company is responsible for certain insurance and maintenance expenses. The lease agreements contain scheduled rent increases over the lease term. The related rent expense for the lease is calculated on a straight-line basis with the difference recorded as deferred rent. Rent expense was $1,703,000 in 2020 ($831,000 in 2019).

In June 2019, the office facility which expired in February 2021 was subleased to an unrelated party. Rental income under the sublease was $412,523 in 2020 ($68,206 in 2019), which was recognized as other income on the consolidated statements of operations.

Future minimum rental payments under both leases are as follows:

| | | | | | | | |

| Years ending December 31: | | |

| 2021 | | $ | 1,249,000 | |

| 2022 | | 1,223,000 | |

| 2023 | | 1,260,000 | |

| 2024 | | 1,297,000 | |

| 2025 | | 1,336,000 | |

| Thereafter | | 1,961,000 | |

| Total | | 8,326,000 | |

4. Commitments and Contingencies (continued)

Operating Leases: (continued)

Future minimum rental receipts under the sublease are as follows:

| | | | | | | | |

| Years ending December 31: | | |

| 2021 | | $ | 70,000 | |

Indemnification Agreements:

From time to time, in the normal course of business, the Company may indemnify other parties, with which it enters into contractual relationships, including directors, employees, customers, lessors and parties to other transactions with the Company. The Company may agree to hold other parties harmless against specific losses, such as those that could arise from a breach of representation, covenant or third-party infringement claims. It may not be possible to determine the maximum potential amount of liability under such indemnification agreements due to the unique facts and circumstances that are likely to be involved in each particular claim and indemnification provision. Management believes that potential liabilities related to indemnification claims, if any, would be immaterial to the consolidated financial statements.

5. Long Term Debt

On July 31, 2020, the Company entered into a credit agreement with JPMorgan Chase Bank, N.A. for a $3,000,000 term loan at a floating interest rate of prime (3.25% as at December 31, 2020) plus 1.75% with a maturity of July 31, 2023, and a $5,000,000 million revolving line of credit at a floating interest rate of prime plus 1.00% with a maturity of July 31, 2022. The Company also issued JPMorgan Chase Bank, N.A. a warrant to purchase 7,965 shares of common stock at an exercise price of $11.30 per share. The warrant expires on July 31, 2030. The Company recorded the fair value of the warrant in the amount of $69,013 using the Black-Scholes-Merton option pricing model using the following assumptions; expected life of 10 years, risk-free interest rate of 0.93%, expected volatility of 75% and no dividends. Expected volatility is based on volatilities of public companies operating in the Company’s industry. The expected life of the warrant represents the term of the exercise period. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant. $12,581 was amortized during 2020. The warrant was classified as equity and recorded as a deferred charge in the accompanying consolidated balance sheets. At December 31, 2020, the Company had not drawn down on either facility. The lender has first priority lien on the Company’s tangible and intangible assets.

5. Long Term Debt (continued)

On September 8, 2020, the Company entered into a credit agreement with Triple Point Venture Growth BDC Corp and Triple Point Private Venture Credit Inc (collectively “Triple Point Capital”) for a $10.0 million debt facility. The interest rate is dependent on the debt facility structure chosen, which is to be agreed upon at the time of draw. The facility has an availability period through June 30, 2021. The Company also issued Triple Point Capital. warrants to purchase a guaranteed minimum of 1,446 shares of Preferred Series C Stock, with an additional 5,782 shares contingent on the drawn down amount. The warrants have an exercise price of $ $36.7463 per share. The Company recorded the fair value of the warrant in the amount of $34,357 using the Black-Scholes-Merton option pricing model using the following assumptions; expected life of 7 years, risk-free interest rate of 0.47%, expected volatility of 75% and no dividends. Expected volatility is based on volatilities of public companies operating in the Company’s industry. The expected life of the warrant represents the term of the exercise period. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant. The warrant was classified as a liability due to the non-permanent warrant count and recorded as a deferred charge in the accompanying consolidated balance sheets.

The Company recorded total debt issuance costs consisting of legal fees associated with the debt financings of $218,926, excluding warrants, to be amortized over the term of the agreement. Amortization of debt issuance costs in 2020 was $60,054.

6. Income Taxes

The Company applies the provisions set forth in FASB ASC Topic 740, Income Taxes, to account for the uncertainty in accounting for income taxes.

Deferred income taxes result from the tax effect of transactions that are recognized in different periods for consolidated financial statement and income tax reporting purposes. As of December 31, 2020 and 2019, the Company’s net deferred income tax assets were approximately $12,257,000 (as restated) and $11,054,000 respectively, and have been fully offset by a valuation allowance, as their realization is not reasonably assured. These deferred income tax assets consist primarily of net operating losses and income tax credits, which may be carried forward to offset future income tax liabilities. As of December 31, 2020, the Company has federal and state net operating loss carryforwards of $49,139,000 (as restated) and $27,371,000 (as restated), respectively, ($43,887,000 and $22,849,000, respectively, as of December 31, 2019). The federal and state net operating losses will begin to expire in 2033 if not used. As of December 31, 2020, the Company has state research and development income tax credits of $107,000 ($107,000 as of December 31, 2019). The state research and development income tax credits do not expire.

6. Income Taxes (continued)

Under certain 1986 Tax Reform Act provisions, the availability of the Company’s net operating loss and tax credit carryforwards are subject to limitation if it should be determined there has been a change in the ownership of more than 50% of the value of the Company’s capital stock. Such a determination could substantially limit the eventual utilization of these net operating losses and income tax credit carryforwards.

The Company uses the “more likely than not” criterion for recognizing the tax benefit of uncertain tax positions and establishing measurement criteria for income tax benefits. The Company

has evaluated the impact of its tax positions and believes that all income tax filing positions

and deductions will be sustained upon examination and, accordingly, has not recorded any

reserves or related accruals for interest and penalties for uncertain income tax positions as of December 31, 2020. In the event the Company should need to recognize interest and penalties related to unrecognized tax liabilities, this amount will be recorded as an accrued liability and an increase to income tax expense. No interest or penalties were recorded through December 31, 2020.

The Company files income tax returns in the U.S. federal jurisdiction, the state of California and other various states. The Company is still subject to U.S. federal, state and local examinations by tax authorities since inception.

In response to the COVID-19 pandemic, the Coronavirus Aid, Relief and Economic Security Act (CARES Act) was signed into law in March 2020. The CARES Act includes modifications for net operating loss carryovers and carrybacks, limitations of business interest expense for tax, immediate refund of alternative minimum tax (AMT) credit carryovers as well as a technical correction to the Tax Cuts and Jobs Act of 2017, for qualified improvement property. As of December 31, 2020, the Company expects that these provisions will not have a material impact.

7. Capital Stock

Convertible Preferred Stock:

As of December 31, 2020, the Company is authorized to issue 4,920,496 shares of convertible preferred stock with a par value of $0.0001 per share. As of December 31, 2020, the Company had the following shares of convertible preferred stock authorized, issued and outstanding:

| | | | | | | | | | | | | | | | | | | | |

| | Shares Authorized | | Shares Issued and Outstanding | | Aggregate Liquidation Preference |

| Series C | | 881,835 | | | 865,037 | | | $ | 31,786,909 | |

| Series B | | 1,726,250 | | | 1,726,250 | | | 23,838,995 | |

| Series A | | 1,159,341 | | | 1,159,341 | | | 11,370,005 | |

| Series Seed-2 | | 841,128 | | | 841,128 | | | 2,524,982 | |

| Series Seed-1 | | 311,942 | | | 311,942 | | | 559,998 | |

| | 4,920,496 | | | 4,903,698 | | | 70,080,889 | |

The rights, preferences, privileges and restrictions for the holders of Series Seed-1 convertible preferred stock (Seed-1), Series Seed-2 convertible preferred stock (Seed-2), Series A convertible preferred stock (Series A), Series B convertible preferred stock (Series B) and Series C convertible preferred stock (Series C) (collectively, Preferred Stock) are as follows:

Dividends:

The holders of Preferred Stock are entitled to receive non-cumulative dividends at an annual rate of 8% of the original issuance price per share, as adjusted for any stock dividends, combinations, splits or the like, prior to and in preference to any declaration or payment of dividends on common stock. As of December 31, 2020, the original issuance price of each class of shares was as such:

Seed-1 $1.7952 per share

Seed-2 $3.0019 per share

Series A $9.8073 per share

Series B $13.8097 per share

Series C $36.7463 per share

Dividends are payable when and if declared by the Board of Directors. After payment of such dividends, any additional dividends or distributions will be distributed among holders of common stock and Preferred Stock on a pari passu basis. No dividends have been declared or paid through December 31, 2020.

7. Capital Stock (continued)

Convertible Preferred Stock: (continued)

Conversion:

Shares of Preferred Stock are convertible, one-for-one, into shares of common stock at any time at the option of the holder. The conversion ratio is subject to adjustment, for any stock dividends, combinations, splits or the like and for dilutive issuances of new securities. The conversion price for each class of shares:

Seed-1 $1.7952 per share

Seed-2 $3.0019 per share

Series A $9.8073 per share

Series B $13.8097 per share

Series C $36.7463 per share

Each share of Preferred Stock will automatically convert into the number of shares of common stock into which such shares are convertible at the then applicable conversion ratio upon (i) the closing of the sale of the Company’s common stock in a public offering with aggregate gross proceeds of at least $50,000,000 or (ii) the affirmative vote or consent of the holders of a majority of the outstanding shares of Preferred Stock, voting together as a single class, on an as-converted common stock basis.

Voting:

The holders of Preferred Stock are entitled to voting rights equal to the number of shares of common stock into which each share of Preferred Stock could be converted.

For so long as at least 300,000 shares of Series A remain outstanding, the holders of

Series A, voting as a separate class, are entitled to elect one member of the Board of Directors. For so long as at least 425,000 shares of Series B remain outstanding, the holders of Series B, voting as a separate class, are entitled to elect one member of the Board of Directors. The holders of common stock, voting as a separate class, are entitled to elect two members of the Board of Directors. The holders of Preferred Stock and common stock, voting together as a single class on an as-converted basis, are entitled to elect the remaining members of the Board of Directors.

7. Capital Stock (continued)

Convertible Preferred Stock: (continued)

Liquidation:

In the event of any liquidation, dissolution, or winding up of the Company, either voluntary or involuntary, the holders of each class of Preferred Stock are entitled to receive, prior to and in preference to holders of common stock, amounts per share equal to:

Seed-1 $1.7952 per share

Seed-2 $3.0019 per share

Series A $9.8073 per share

Series B $13.8097 per share

Series C $36.7463 per share

The above are subject to adjustments for stock splits, stock dividends, combinations, reclassifications, or the like, plus all declared and unpaid dividends on each share of Preferred Stock, as applicable. If, upon occurrence of such an event, the assets, and funds to be distributed among the holders of Preferred Stock are insufficient to permit the above payment to such holders, then the entire assets and funds of the Company legally available for distribution will be distributed ratably among the holders of Preferred Stock in proportion to the preferential amount each such holder is otherwise entitled to receive. Upon the completion of the distribution to the holders of Preferred Stock, all remaining proceeds, if any, will be distributed ratably among the holders of common stock.

Redemption:

Shares of Preferred Stock are not redeemable at the option of the holder.

Protective Provisions:

So long as at least 750,000 shares of Preferred Stock remaining outstanding, the vote of the holders of a majority of the outstanding shares of Preferred Stock, on an as-converted to common stock basis, is necessary for consummation of certain transactions, including but not limited to: increasing or decreasing the authorized capital stock; creating any senior or pari passu security, privileges, preferences or voting rights senior to or on parity with those granted to the Preferred Stock; altering or changing the preferred stockholder rights; redeeming or repurchasing the Company’s equity securities; changing the authorized number of members of the Board of Directors; changing the number of shares authorized under the Company’s Equity Incentive Plan; incurring indebtedness in excess of $100,000 entering into related party transactions; creating or holding stock in a subsidiary; or entering into any transaction deemed to be a liquidation or dissolution of the Company.

7. Capital Stock (continued)

Common Stock:

The Company is authorized to issue 8,232,131 shares of common stock with a par value of $0.0001 per share, of which 1,149,290 shares were issued and outstanding as of December 31, 2020.

The Company has allowed certain stock option holders to exercise unvested options to purchase shares of common stock. Shares received from such early exercises are subject to a right of repurchase

at the issuance price. The Company’s repurchase right with respect to these shares lapses over

the same period the options vest. No shares of common stock were subject to repurchase as of December 31, 2020.

Stockholder Note Receivable:

In December 2018, an employee early exercised stock options issued out of the Company's stock option plan (Note 7) and received 159,670 shares of common stock in exchange for a note receivable totaling $849,444. The note receivable accrues interest at 3.07% per annum, is collateralized by the underlying common stock and matures in December 2024. The common stock issued is subject to repurchase at the issuance price. The Company’s repurchase right with respect to these shares lapses over the same period the underlying option vests, which is through July 2022. As of December 31, 2020, the note receivable balance was $902,628 and 103,120 shares of common stock were subject to repurchase ($875,743 balance and 103,121 shares as of December 31, 2019).

The note is collateralized by the underlying common stock. The note agreement was determined to be non-recourse which the Company determined an in-substance stock option for accounting purposes (the Option). The Company determined the fair value of the Option to be $256,114 on the date of issuance using a closed-form, continuous time model for forward-start options, assuming a risk-free interest rate of 2.58%, an expected life of 6 years, expected volatility of 75% and no dividends. In 2020 and 2019, the Company recognized $42,686 of stock-based compensation relating to the Option.

Share Repurchases:

In May 2019, in connection with the Series C financing, a member of management directly transferred 81,640 shares of common stock to a Series C investor. Upon transfer, the 81,640 shares were converted to Series C. Given the Company’s financing event facilitated this direct transfer, the share sale was recognized as stock-based compensation of $1,994,163. The Company also repurchased 35,446 shares of common stock from certain tenured employees, recognizing compensation expense of $1,271,926, which is included in operating expenses in the consolidated statements of operations during 2019.

8. Equity Incentive Plan

In 2013, the Company adopted the 2013 Equity Incentive Plan (the Plan). Options granted under the Plan may be incentive stock options (ISOs) or nonqualified stock options (NSOs). ISOs may be granted only to Company employees and directors. NSOs may be granted to employees, directors, advisors and consultants. The Board of Directors has the authority to determine to whom options will be granted, the number of options, the term and the exercise price. The Company has authorized 2,530,225 shares of common stock for issuance under the Plan as of December 31, 2020.

Options are to be granted at an exercise price not less than fair value. For individuals holding more than 10% of the voting rights of all classes of stock, the exercise price of an option will not be less than 110% of fair value. Fair value is determined by the Company’s Board of Directors. The vesting period is normally monthly over a period of four years from the vesting date. The term of an option is no longer than five years for ISOs for which the grantee owns greater than 10% of the voting power of all classes of stock and no longer than ten years for all other options.

In 2020, the Company recognized $1,501,966 of stock-based compensation related to options granted to employees ($508,329 in 2019). The compensation expense is allocated on a departmental basis, based on the classification of the option holder. No income tax benefits have been recognized in the statements of operations for stock-based compensation arrangements and no stock-based compensation costs have been capitalized as property and equipment as of December 31, 2020.

The fair value of each award granted to employees in 2020 is estimated on the date of grant using the Black-Scholes option pricing model with the following weighted-average assumptions: expected life of 6.20 years, risk-free interest rate of 0.73%, expected volatility of 75% and no dividends during the expected life (5.93 years; 1.69%; 54.16% and no dividends, respectively, in 2019). Expected volatility is based on volatilities of public companies operating in the Company’s industry. The expected life of the options represents the period of time options are expected to be outstanding and is estimated considering vesting terms and employees’ historical exercise and post-vesting employment termination behavior. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant.

8. Equity Incentive Plan (continued)

As of 2020, future stock-based compensation for options granted and outstanding to employees of $5,373,434 will be recognized over a remaining weighted-average requisite service period of 1.66 years.

The Company also uses the mark to market method to value options granted to non-employees. In connection with its grant of options to non-employees, the Company has recognized $970 of

stock-based compensation in 2020 ($37,874 in 2019), over the vesting period of the individual options. As of December 31, 2020, all outstanding non-employee grants have been full recognized.

Stock option activity under the Plan is as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | | Options Outstanding |

| | Options Available | | Number of Shares | | Weighted- Average Exercise Price |

| Balances, December 31, 2018 | | 152,930 | | | 1,164,161 | | | $ | 1.784 | |

| Authorized | | 218,237 | | | — | | | — | |

| Granted | | (230,816) | | | 230,816 | | | 12.320 | |

| Exercised | | — | | | (89,560) | | | 1.248 | |

| Cancelled | | 63,932 | | | (63,932) | | | 9.253 | |

| Balances, December 31, 2019 | | 204,283 | | | 1,241,485 | | | 3.397 | |

| Authorized | | 746,642 | | | — | | | — | |

| Granted | | (855,476) | | | 855,476 | | | 11.870 | |

| Exercised | | — | | | (15,423) | | | 6.440 | |

| Cancelled | | 101,081 | | | (101,081) | | | 11.250 | |

| Balances, December 31, 2020 | | 196,530 | | | 1,980,457 | | | $ | 6.632 | |

| | | | | | |

Weighted-Average Remaining Contractual Life | | | | | | 6.20 years |

8. Equity Incentive Plan (continued)

As of December 31, 2020, there were 1,110,824 shares vested with a weighted-average exercise price of $2.206 and a weighted-average remaining contractual life of 4.63 years (946,194 shares, $1.402 and 5.25 years as of December 31, 2019). The intrinsic value of stock options exercised in 2020 was $175,935 ($951,676 in 2019).

9. Benefit Plan

The Company established a 401(k) plan under which employees may contribute a portion of their compensation to the plan, subject to the limitations under the Internal Revenue Code. The Company’s contributions to the plan are at the discretion of the Board of Directors. The Company has not made any contributions to the plan as of December 31, 2020.

10. Subsequent Events

In January 2021, the Company drew down $3,000,000 of the delayed draw term loan provided by JPMorgan Chase Bank, N.A.

In February 2021, the Company provided a new loan to an employee in the amount of $604,819 so that the employee can concurrently repay the outstanding principal and accrued interest of $849,444 as of the date issued in relation to the employee’s outstanding promissory note from 2018.

In March 2021, the Company expanded the number of shares of common stock reserved under the Equity Incentive Plan from 2,530,225 as of December 31, 2020, to 2,780,225 shares.

In July 2021, the Company amended its loan agreement with TriplePoint Capital, providing an extension of the availability period to June 30, 2022, with the agreement to issue 4,082 new Series C warrants if at least $1,000,000 and another $1,000,000 were not to be drawn down by September 30, 2021, and December 31, 2021, respectively.

In August 2021, the Company provided a loan to an employee in the amount of $476,279 to facilitate the early exercise of 5,737 vested and 35,679 unvested options. The note receivable accrues interest at 1.00% per annum, is collateralized by the underlying common stock and matures in August 2027. On December 22, 2021, the Company forgave the remaining balance of the promissory note. The associated compensation expense will be reflected in the post-combination consolidated financial statements of Oportun Financial Corporation.

In September 2021, the Company drew down $1,000,000 of debt provided by TriplePoint Capital. The promissory note has a six-month maturity of March 31, 2022, and an interest rate of 7.0%.

10. Subsequent Events (continued)

On November 16, 2021, the Company signed an agreement to be acquired by Oportun, Inc. (Nasdaq: OPRT) in exchange for consideration of approximately $98,500,000 in equity and $114,400,000 million in cash. The acquisition closed on December 22, 2021.

On December 22, 2021, the Company forgave the remaining balance of the promissory note issued in August 2021 with an officer discussed in Note 8. The associated compensation expense will be reflected in the post-combination consolidated financial statements of Oportun Financial Corporation.

Subsequent events have been evaluated through February 22, 2022, which is the date the consolidated financial statements were approved by the Company and available to be issued. No additional items requiring disclosure in the consolidated financial statements have been identified.

11. Restatement for Correction of Errors

Subsequent to issuance of the 2020 consolidated financial statements and independent auditors’ report the Company’s management determined there were certain errors related to sales taxes owed on subscription revenue, software development capitalization, the balance sheet treatment of customer accounts and deposits, and the income statement treatment of interest earned on customer funds. As a result, certain balances were restated for 2020 as below.

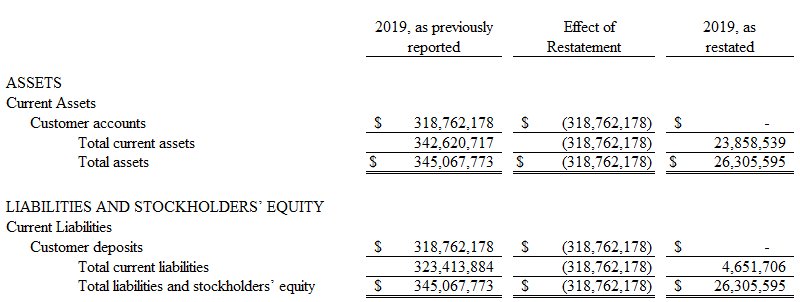

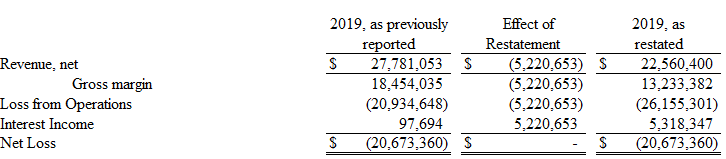

Reclasses for the balance sheet treatment of customer accounts and deposits and the income statement treatment of interest income were also made to the 2019 consolidated financial statements for comparison purposes.

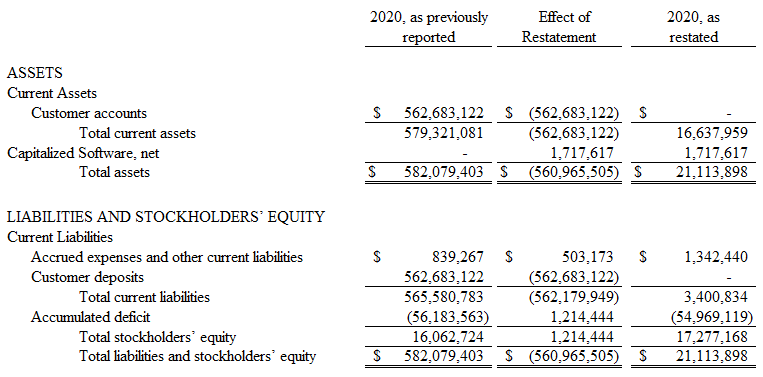

11. Restatement for Correction of Errors

Consolidated Balance Sheets

Consolidated Balance Sheets (continued)

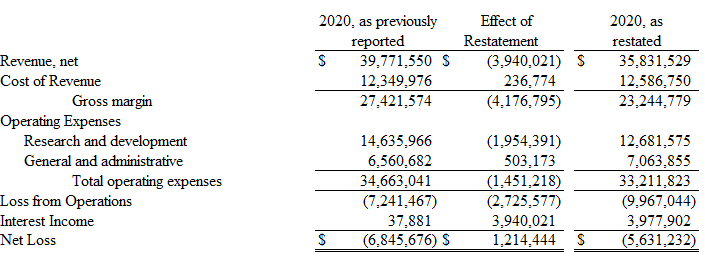

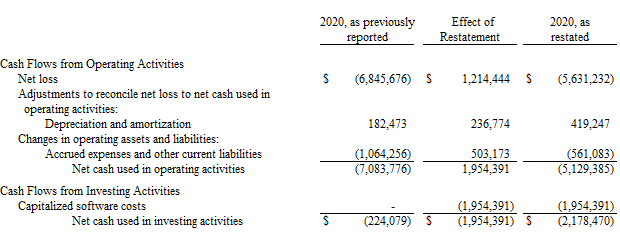

11. Restatement for Correction of Errors (continued)

Consolidated Statements of Operations

11. Restatement for Correction of Errors (continued)

Consolidated Statement of Cash Flows

There is no impact to the 2019 consolidated statement of cash flows.

Customer Accounts and Customer Deposits:

Subsequent to issuance of the 2020 consolidated financial statements management determined that customer accounts consisting of funds held with major financial institutions for the benefit of customers with deposits are not assets of the Company because customers retain legal title to the amounts deposited and enjoy the full benefits of Federal Deposit Insurance Corporation deposit insurance as if they had directly established accounts with the financial institutions. Accordingly, the Company’s consolidated balance sheets have been restated to exclude customer accounts and the associated customer deposits.

Sales Tax Liability:

Subsequent to issuance of the 2020 consolidated financial statements management determined certain revenue transactions triggered nexus rules under certain state and local sales tax guidelines. As a result, $503,173 was accrued at December 31, 2020, on the accompanying consolidated balance sheet. Cumulative amounts related to periods prior to 2020 are determined by management to be immaterial and recorded as an out of period correction included in the 2020 accrual.

11. Restatement for Correction of Errors (continued)

Software Capitalization:

Subsequent to issuance of the 2020 consolidated financial statements management determined

certain costs met the Company’s policy for capitalization. As a result, $1,954,391 was capitalized during 2020, $236,774 was amortized during 2020, resulting in a balance of $1,717,617 at

December 31, 2020 on the accompanying consolidated balance sheet. Cumulative amounts related to periods prior to 2020 are determined by management to be immaterial and recorded as an out of period correction included in the 2020 accrual.

Revenue and Interest Income:

Subsequent to issuance of the 2020 consolidated financial statements management determined that since the customer accounts and the associated customer deposits are not considered assets and liabilities of the Company, the related net interest income does not represent income from core business activities of the Company and therefore should be reclassified from revenue, net to interest income.

Income Taxes:

Resulting from the impact of the correction of the above errors Note 6 has been restated. The Company previously reported December 31, 2020 net deferred income tax assets were approximately $12,556,000 and federal and state net operating loss carryforwards of $48,635,000 and $27,082,000, respectively.