Execution Version 4131-6465-6444.5 Schedule II to this exhibit has been omitted pursuant to Item 601(a)(5) of Regulation S-K. OPORTUN PLW TRUST FOURTH AMENDMENT TO THE LOAN AND SECURITY AGREEMENT This FOURTH AMENDMENT TO THE LOAN AND SECURITY AGREEMENT, dated as of September 14, 2022 (this “Amendment”), is entered into among OPORTUN PLW TRUST, as borrower (the “Borrower”), OPORTUN PLW DEPOSITOR, LLC, as the depositor (the “Depositor”), OPORTUN, INC., as seller (the “Seller”), the various financial institutions party hereto, as lenders (in such capacity, each, a “Lender” and collectively, the “Lenders”), and WILMINGTON TRUST, NATIONAL ASSOCIATION, as collateral agent (in such capacity, the “Collateral Agent”), as paying agent (in such capacity, the “Paying Agent”), as securities intermediary (in such capacity, the “Securities Intermediary”) and as depositary bank (in such capacity, the “Depositary Bank”). RECITALS WHEREAS, the Borrower, the Depositor, the Seller, the Lenders, the Collateral Agent, the Paying Agent, the Securities Intermediary and the Depositary Bank have previously entered into that certain Loan and Security Agreement, dated as of September 8, 2021 (as amended, modified or supplemented prior to the date hereof, the “Loan Agreement”); WHEREAS, concurrently herewith, (i) the Borrower, PF Servicing, LLC, as servicer, and the Collateral Agent are entering into that certain First Amendment to the Servicing Agreement, dated as of the date hereof, and (ii) the Borrower and the Lenders are entering into that certain Consent, dated as of the date hereof; and WHEREAS, in accordance with Section 10.1 of the Loan Agreement, the parties desire to amend the Loan Agreement as provided herein. NOW, THEREFORE, in consideration of the mutual agreements herein contained, and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, each party hereto agrees as follows: ARTICLE I DEFINITIONS SECTION 1.01. Defined Terms Not Defined Herein. All capitalized terms used herein that are not defined herein shall have the meanings assigned to them in, or by reference in, the Loan Agreement. 2 4131-6465-6444.5 ARTICLE II AMENDMENTS TO THE LOAN AGREEMENT SECTION 2.01. Amendments. The Loan Agreement is hereby amended to incorporate the changes reflected on the marked pages of the Loan Agreement attached hereto as Schedule I, with a conformed copy of the amended Loan Agreement attached hereto as Schedule II. ARTICLE III REPRESENTATIONS AND WARRANTIES SECTION 3.01. Representations and Warranties. Each of the Seller, the Depositor and the Borrower hereby represents and warrants to each Lender, the Collateral Agent, the Paying Agent, the Securities Intermediary, the Depositary Bank that: (a) Representations and Warranties. Both before and immediately after giving effect to this Amendment, the representations and warranties made by the Seller, the Depositor and Borrower in the Loan Agreement and each of the other Transaction Documents to which it is a party are true and correct as of the date hereof (unless stated to relate solely to an earlier date, in which case such representations or warranties were true and correct as of such earlier date). (b) Enforceability. This Amendment and the Loan Agreement, as amended hereby, constitute the legal, valid and binding obligation of the Seller, the Depositor and the Borrower enforceable against the Seller, the Depositor and the Borrower in accordance with its respective terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar law affecting creditors’ rights generally and by general principles of equity. (c) No Defaults. No Rapid Amortization Event, Event of Default, Servicer Default or Block Event has occurred and is continuing. ARTICLE IV MISCELLANEOUS SECTION 4.01. Ratification of Loan Agreement. As amended by this Amendment, the Loan Agreement is in all respects ratified and confirmed and the Loan Agreement, as amended by this Amendment, shall be read, taken and construed as one and the same instrument. SECTION 4.02. Execution in Counterparts; Electronic Execution. This Amendment may be executed in any number of counterparts, all of which taken together shall constitute one and the same instrument and any of the parties hereto may execute this Amendment by signing any such counterpart. Each of the parties hereto agrees that this transaction may be conducted by electronic means. Any signature (including, without limitation, (x) any electronic symbol or process attached to, or associated with, a contract or other record and adopted by a person with the intent to sign, authenticate or accept such contract or record and (y) any facsimile or .pdf signature) hereto or to any other certificate, agreement or document related to this transaction, and any 3 4131-6465-6444.5 contract formation or record-keeping, in each case, through electronic means, shall have the same legal validity and enforceability as a manually executed signature or use of a paper-based record- keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any similar state law based on the Uniform Electronic Transactions Act, and the parties hereto hereby waive any objection to the contrary. Each party agrees, and acknowledges that it is such party’s intent, that if such party signs this Amendment using an electronic signature, it is signing, adopting, and accepting this Amendment and that signing this Amendment using an electronic signature is the legal equivalent of having placed its handwritten signature on this Amendment on paper. Each party acknowledges that it is being provided with an electronic or paper copy of this Amendment in a usable format. SECTION 4.03. Recitals. The recitals contained in this Amendment shall be taken as the statements of the Borrower, the Depositor and the Seller, and none of the Collateral Agent, the Paying Agent, the Securities Intermediary or the Depositary Bank assumes any responsibility for their correctness. None of the Collateral Agent, the Paying Agent, the Securities Intermediary or the Depositary Bank makes any representations as to the validity or sufficiency of this Amendment. SECTION 4.04. Rights of the Collateral Agent, the Paying Agent, the Securities Intermediary and the Depositary Bank. The rights, privileges and immunities afforded to the Collateral Agent, the Paying Agent, the Securities Intermediary and the Depositary Bank under the Loan Agreement shall apply hereunder as if fully set forth herein. SECTION 4.05. GOVERNING LAW; JURISDICTION. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK, WITHOUT REFERENCE TO ITS CONFLICT OF LAW PROVISIONS (OTHER THAN SECTIONS 5-1401 AND 5-1402 OF THE NEW YORK GENERAL OBLIGATIONS LAW). EACH OF THE PARTIES TO THIS AMENDMENT HEREBY AGREES TO THE NON-EXCLUSIVE JURISDICTION OF THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK AND ANY APPELLATE COURT HAVING JURISDICTION TO REVIEW THE JUDGMENTS THEREOF. EACH OF THE PARTIES HEREBY WAIVES ANY OBJECTION BASED ON FORUM NON CONVENIENS AND ANY OBJECTION TO VENUE OF ANY ACTION INSTITUTED HEREUNDER IN ANY OF THE AFOREMENTIONED COURTS AND CONSENTS TO THE GRANTING OF SUCH LEGAL OR EQUITABLE RELIEF AS IS DEEMED APPROPRIATE BY SUCH COURT. SECTION 4.06. Effectiveness. This Amendment shall become effective as of the date hereof upon: (a) receipt by the Collateral Agent and the Paying Agent of an Officer’s Certificate of the Borrower stating that the execution of this Amendment is authorized and permitted by the Transaction Documents and all conditions precedent to the execution of this Amendment have been satisfied; 4 4131-6465-6444.5 (b) receipt by the Collateral Agent and the Paying Agent of an Opinion of Counsel stating that the execution of this Amendment is authorized and permitted under the Transaction Documents and all conditions precedent to the execution of this Amendment have been satisfied; (c) receipt by the Collateral Agent and the Paying Agent of evidence of the consent of the Borrower and the Lenders to this Amendment; (d) receipt by the Collateral Agent, Paying Agent and the Lenders of counterparts of this Amendment, duly executed by each of the parties hereto; (e) receipt by the Lenders of a non-petition letter, in form and substance satisfactory to the Lenders, duly executed by each of the parties thereto; and (f) receipt by the Collateral Agent, the Paying Agent and the Lenders of such other instruments, documents, agreements and opinions reasonably requested by the Collateral Agent, the Paying Agent or any of the Lenders prior to the date hereof. SECTION 4.07. Limitation of Liability of Owner Trustee. Notwithstanding anything herein or in any Transaction Document to the contrary, it is expressly understood and agreed by the parties hereto that (i) this Amendment is executed and delivered by Wilmington Trust, National Association, not individually or personally but solely as owner trustee (the “Owner Trustee”) of the Borrower, in the exercise of the powers and authority conferred and vested in it, (ii) each of the representations, undertakings and agreements herein made on the part of the Borrower is made and intended not as personal representations, undertakings and agreements by Wilmington Trust, National Association in its individual capacity, but made and intended for the purpose of binding only the Borrower, (iii) nothing herein contained shall be construed as creating any liability on Wilmington Trust, National Association, individually or personally, to perform any covenants, either expressed or implied, contained herein, all such liability, if any, being expressly waived by the parties hereto and by any person claiming by, through or under the parties hereto, (iv) Wilmington Trust, National Association has made no investigation as to the accuracy or completeness of any representations and warranties made by the Borrower in this Amendment and (v) under no circumstances shall Wilmington Trust, National Association be personally liable for the payment of any indebtedness or expenses of the Borrower or be liable for the breach or failure of any obligation, representation, warranty or covenant made or undertaken by the Borrower under this Amendment or any other related document. (Signature page follows)

Fourth Amendment to Loan Agreement (PLW Trust) IN WITNESS WHEREOF, the Borrower, the Depositor, the Seller, the Lenders, the Collateral Agent, the Paying Agent, the Securities Intermediary and the Depositary Bank have caused this Amendment to be duly executed by their respective officers as of the day and year first above written. OPORTUN PLW TRUST, as Borrower By: Wilmington Trust, National Association, not in its individual capacity, but solely as Owner Trustee of the Borrower By: /s/ Drew H. Davis ________________________ Name: Drew H. Davis Title: Vice President OPORTUN PLW DEPOSITOR, LLC, as Depositor By: /s/ Jonathan Coblentz Name: Jonathan Coblentz Title: Treasurer OPORTUN, INC., as Seller By: /s/ Jonathan Coblentz Name: Jonathan Coblentz Title: Chief Financial Officer Fourth Amendment to Loan Agreement (PLW Trust) WILMINGTON TRUST, NATIONAL ASSOCIATION, not in its individual capacity but solely as Collateral Agent By: /s/ Drew H. Davis ________________________ Name: Drew H. Davis Title: Vice President WILMINGTON TRUST, NATIONAL ASSOCIATION, not in its individual capacity but solely as Paying Agent By: /s/ Drew H. Davis ________________________ Name: Drew H. Davis Title: Vice President WILMINGTON TRUST, NATIONAL ASSOCIATION, not in its individual capacity but solely as Securities Intermediary By: /s/ Drew H. Davis ________________________ Name: Drew H. Davis Title: Vice President WILMINGTON TRUST, NATIONAL ASSOCIATION, not in its individual capacity but solely as Depositary Bank By: /s/ Drew H. Davis ________________________ Name: Drew H. Davis Title: Vice President Fourth Amendment to Loan Agreement (PLW Trust) GOLDMAN SACHS BANK USA, as a Committed Lender By: /s/ Jeff Hartwick Name: Jeff Hartwick Title: Authorized Person Fourth Amendment to Loan Agreement (PLW Trust) JEFFERIES FUNDING LLC, as a Committed Lender By: /s/ Michael Wade Name: Michael Wade Title: Managing Director

Fourth Amendment to Loan Agreement (PLW Trust) JPMORGAN CHASE BANK, N.A., as a Committed Lender By: /s/ Gareth Morgan Name: Gareth Morgan Title: Executive Director CHARIOT FUNDING LLC, as a Bank Sponsored Lender By: /s/ Gareth Morgan Name: Gareth Morgan Title: Executive Director Fourth Amendment to Loan Agreement (PLW Trust) MORGAN STANLEY BANK, N.A., as a Committed Lender By: /s/ Stephen Marchi Name: Stephen Marchi Title: Authorized Signatory 4131-6465-6444.5 SCHEDULE I Amendments to the Loan Agreement CONFORMED COPY As amended by the Fourth Amendment to the Loan and Security Agreement, dated as of September 14, 2022 4154-1417-9388.14154-1417-9388.6 LOAN AND SECURITY AGREEMENT among OPORTUN PLW TRUST, as Borrower, OPORTUN PLW DEPOSITOR, LLC, as Depositor, OPORTUN, INC., as Seller, THE FINANCIAL INSTITUTIONS FROM TIME TO TIME PARTY HERETO, as Lenders, and WILMINGTON TRUST, NATIONAL ASSOCIATION, as Collateral Agent, Paying Agent, Securities Intermediary and Depositary Bank dated as of September 8, 2021

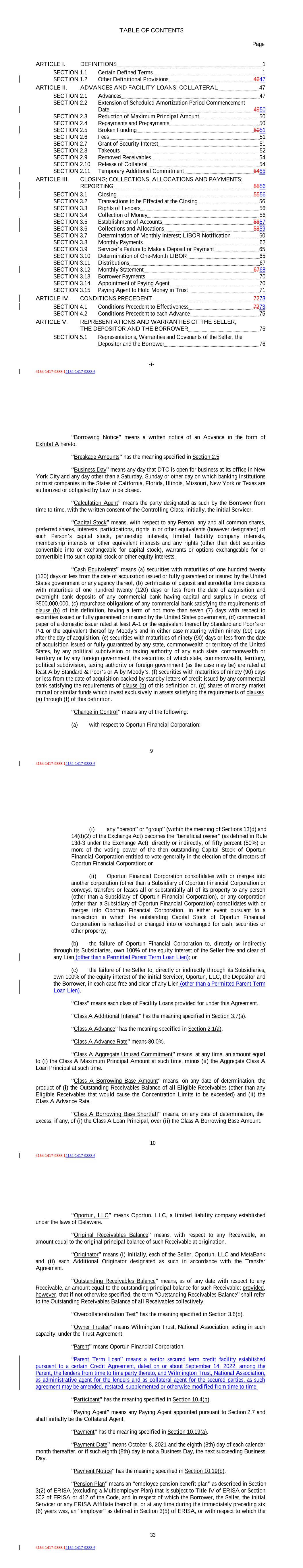

TABLE OF CONTENTS Page -i- 4154-1417-9388.14154-1417-9388.6 ARTICLE I. DEFINITIONS 1 SECTION 1.1 Certain Defined Terms 1 SECTION 1.2 Other Definitional Provisions 4647 ARTICLE II. ADVANCES AND FACILITY LOANS; COLLATERAL 47 SECTION 2.1 Advances 47 SECTION 2.2 Extension of Scheduled Amortization Period Commencement Date 4950 SECTION 2.3 Reduction of Maximum Principal Amount 50 SECTION 2.4 Repayments and Prepayments 50 SECTION 2.5 Broken Funding 5051 SECTION 2.6 Fees 51 SECTION 2.7 Grant of Security Interest 51 SECTION 2.8 Takeouts 52 SECTION 2.9 Removed Receivables 54 SECTION 2.10 Release of Collateral 54 SECTION 2.11 Temporary Additional Commitment 5455 ARTICLE III. CLOSING; COLLECTIONS, ALLOCATIONS AND PAYMENTS; REPORTING 5556 SECTION 3.1 Closing 5556 SECTION 3.2 Transactions to be Effected at the Closing 56 SECTION 3.3 Rights of Lenders 56 SECTION 3.4 Collection of Money 56 SECTION 3.5 Establishment of Accounts 5657 SECTION 3.6 Collections and Allocations 5859 SECTION 3.7 Determination of Monthly Interest; LIBOR Notification 60 SECTION 3.8 Monthly Payments 62 SECTION 3.9 Servicer’s Failure to Make a Deposit or Payment 65 SECTION 3.10 Determination of One-Month LIBOR 65 SECTION 3.11 Distributions 67 SECTION 3.12 Monthly Statement 6768 SECTION 3.13 Borrower Payments 70 SECTION 3.14 Appointment of Paying Agent 70 SECTION 3.15 Paying Agent to Hold Money in Trust 71 ARTICLE IV. CONDITIONS PRECEDENT 7273 SECTION 4.1 Conditions Precedent to Effectiveness 7273 SECTION 4.2 Conditions Precedent to each Advance 75 ARTICLE V. REPRESENTATIONS AND WARRANTIES OF THE SELLER, THE DEPOSITOR AND THE BORROWER 76 SECTION 5.1 Representations, Warranties and Covenants of the Seller, the Depositor and the Borrower 76 9 4154-1417-9388.14154-1417-9388.6 “Borrowing Notice” means a written notice of an Advance in the form of Exhibit A hereto. “Breakage Amounts” has the meaning specified in Section 2.5. “Business Day” means any day that DTC is open for business at its office in New York City and any day other than a Saturday, Sunday or other day on which banking institutions or trust companies in the States of California, Florida, Illinois, Missouri, New York or Texas are authorized or obligated by Law to be closed. “Calculation Agent” means the party designated as such by the Borrower from time to time, with the written consent of the Controlling Class; initially, the initial Servicer. “Capital Stock” means, with respect to any Person, any and all common shares, preferred shares, interests, participations, rights in or other equivalents (however designated) of such Person’s capital stock, partnership interests, limited liability company interests, membership interests or other equivalent interests and any rights (other than debt securities convertible into or exchangeable for capital stock), warrants or options exchangeable for or convertible into such capital stock or other equity interests. “Cash Equivalents” means (a) securities with maturities of one hundred twenty (120) days or less from the date of acquisition issued or fully guaranteed or insured by the United States government or any agency thereof, (b) certificates of deposit and eurodollar time deposits with maturities of one hundred twenty (120) days or less from the date of acquisition and overnight bank deposits of any commercial bank having capital and surplus in excess of $500,000,000, (c) repurchase obligations of any commercial bank satisfying the requirements of clause (b) of this definition, having a term of not more than seven (7) days with respect to securities issued or fully guaranteed or insured by the United States government, (d) commercial paper of a domestic issuer rated at least A-1 or the equivalent thereof by Standard and Poor’s or P-1 or the equivalent thereof by Moody’s and in either case maturing within ninety (90) days after the day of acquisition, (e) securities with maturities of ninety (90) days or less from the date of acquisition issued or fully guaranteed by any state, commonwealth or territory of the United States, by any political subdivision or taxing authority of any such state, commonwealth or territory or by any foreign government, the securities of which state, commonwealth, territory, political subdivision, taxing authority or foreign government (as the case may be) are rated at least A by Standard & Poor’s or A by Moody’s, (f) securities with maturities of ninety (90) days or less from the date of acquisition backed by standby letters of credit issued by any commercial bank satisfying the requirements of clause (b) of this definition or, (g) shares of money market mutual or similar funds which invest exclusively in assets satisfying the requirements of clauses (a) through (f) of this definition. “Change in Control” means any of the following: (a) with respect to Oportun Financial Corporation: 10 4154-1417-9388.14154-1417-9388.6 (i) any “person” or “group” (within the meaning of Sections 13(d) and 14(d)(2) of the Exchange Act) becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of fifty percent (50%) or more of the voting power of the then outstanding Capital Stock of Oportun Financial Corporation entitled to vote generally in the election of the directors of Oportun Financial Corporation; or (ii) Oportun Financial Corporation consolidates with or merges into another corporation (other than a Subsidiary of Oportun Financial Corporation or conveys, transfers or leases all or substantially all of its property to any person (other than a Subsidiary of Oportun Financial Corporation), or any corporation (other than a Subsidiary of Oportun Financial Corporation) consolidates with or merges into Oportun Financial Corporation, in either event pursuant to a transaction in which the outstanding Capital Stock of Oportun Financial Corporation is reclassified or changed into or exchanged for cash, securities or other property; (b) the failure of Oportun Financial Corporation to, directly or indirectly through its Subsidiaries, own 100% of the equity interest of the Seller free and clear of any Lien (other than a Permitted Parent Term Loan Lien); or (c) the failure of the Seller to, directly or indirectly through its Subsidiaries, own 100% of the equity interest of the initial Servicer, Oportun, LLC, the Depositor and the Borrower, in each case free and clear of any Lien (other than a Permitted Parent Term Loan Lien). “Class” means each class of Facility Loans provided for under this Agreement. “Class A Additional Interest” has the meaning specified in Section 3.7(a). “Class A Advance” has the meaning specified in Section 2.1(a). “Class A Advance Rate” means 80.0%. “Class A Aggregate Unused Commitment” means, at any time, an amount equal to (i) the Class A Maximum Principal Amount at such time, minus (ii) the Aggregate Class A Loan Principal at such time. “Class A Borrowing Base Amount” means, on any date of determination, the product of (i) the Outstanding Receivables Balance of all Eligible Receivables (other than any Eligible Receivables that would cause the Concentration Limits to be exceeded) and (ii) the Class A Advance Rate. “Class A Borrowing Base Shortfall” means, on any date of determination, the excess, if any, of (i) the Class A Loan Principal, over (ii) the Class A Borrowing Base Amount. 33 4154-1417-9388.14154-1417-9388.6 “Oportun, LLC” means Oportun, LLC, a limited liability company established under the laws of Delaware. “Original Receivables Balance” means, with respect to any Receivable, an amount equal to the original principal balance of such Receivable at origination. “Originator” means (i) initially, each of the Seller, Oportun, LLC and MetaBank and (ii) each Additional Originator designated as such in accordance with the Transfer Agreement. “Outstanding Receivables Balance” means, as of any date with respect to any Receivable, an amount equal to the outstanding principal balance for such Receivable; provided, however, that if not otherwise specified, the term “Outstanding Receivables Balance” shall refer to the Outstanding Receivables Balance of all Receivables collectively. “Overcollateralization Test” has the meaning specified in Section 3.6(b). “Owner Trustee” means Wilmington Trust, National Association, acting in such capacity, under the Trust Agreement. “Parent” means Oportun Financial Corporation. “Parent Term Loan” means a senior secured term credit facility established pursuant to a certain Credit Agreement, dated on or about September 14, 2022, among the Parent, the lenders from time to time party thereto, and Wilmington Trust, National Association, as administrative agent for the lenders and as collateral agent for the secured parties, as such agreement may be amended, restated, supplemented or otherwise modified from time to time. “Participant” has the meaning specified in Section 10.4(b). “Paying Agent” means any Paying Agent appointed pursuant to Section 2.7 and shall initially be the Collateral Agent. “Payment” has the meaning specified in Section 10.19(a). “Payment Date” means October 8, 2021 and the eighth (8th) day of each calendar month thereafter, or if such eighth (8th) day is not a Business Day, the next succeeding Business Day. “Payment Notice” has the meaning specified in Section 10.19(b). “Pension Plan” means an “employee pension benefit plan” as described in Section 3(2) of ERISA (excluding a Multiemployer Plan) that is subject to Title IV of ERISA or Section 302 of ERISA or 412 of the Code, and in respect of which the Borrower, the Seller, the initial Servicer or any ERISA Affiliate thereof is, or at any time during the immediately preceding six (6) years was, an “employer” as defined in Section 3(5) of ERISA, or with respect to which the

36 4154-1417-9388.14154-1417-9388.6 instrument provide a yield to maturity of greater than 120% of the yield to maturity at par of such underlying obligations. Permitted Investments may be purchased by or through the Collateral Agent or any of its Affiliates. “Permitted Parent Term Loan Lien” means, so long as each lender, administrative agent and collateral agent under the Parent Term Loan has executed a non-petition letter with the Lenders, the Borrower and the Depositor, in form and substance satisfactory to the Lenders on the date of its execution, the pledge of the equity interest of the Seller, the initial Servicer, Oportun, LLC and/or the Depositor to secure the obligations of the Parent under the Parent Term Loan; provided that any such pledge shall cease to be a Permitted Parent Term Loan Lien if, following a default under any of such obligations, such obligation is accelerated, in whole or in part. “Permitted Takeout” has the meaning specified in Section 2.8. “Permitted Takeout Release” means an agreement in substantially the form of Exhibit C and entered into in connection with a Permitted Takeout. “Person” means any corporation, limited liability company, natural person, firm, joint venture, partnership, trust, unincorporated organization, enterprise, government or any department or agency of any government. “Plan Assets” means “plan assets” within the meaning of 29 CFR §2510.3-101, as modified by Section 3(42) of ERISA. “PF Score” means the credit score for an Obligor referred to as the “PF Score” determined by the Seller in accordance with its proprietary scoring method. “Politically Exposed Person” means a natural person currently or formerly entrusted with a senior public role or function (e.g., a senior official in the executive, legislative, military, administrative, or judicial branches of government), an immediate family member of a prominent public figure, or a known close associate of a prominent public figure, or any corporation, business or other entity that has been formed by, or for the benefit of, a prominent public figure. Immediate family members include family within one-degree of separation of the prominent public figure (e.g., spouse, parent, sibling, child, step-child, or in-law). Known close associates include those widely- and publicly-known close business colleagues and personal advisors to the prominent public figure, in particular financial advisors or persons acting in a fiduciary capacity. “Pool Receivable” means each of the consumer loans that were originated by the Seller, Oportun, LLC, any of their Affiliates or any other Originator. “Prepayment” means a prepayment of the Aggregate Class A Loan Principal or the Aggregate Class B Loan Principal in accordance with Section 2.4. “Proceeding” means any suit in equity, action at law or other judicial or administrative proceeding. 98 4154-1417-9388.14154-1417-9388.6 party shall prove to have been inaccurate when made or deemed made, (x) any representation, warranty or certification made by the Depositor in the Transfer Agreement or in any certificate delivered pursuant to the Transfer Agreement shall prove to have been inaccurate when made or deemed made or (y) any representation, warranty or certification made by the Seller in the Purchase Agreement or in any other Transaction Document to which it is a party or in any certificate delivered pursuant to the Purchase Agreement or any other Transaction Document shall prove to have been inaccurate when made or deemed made and, in any such case, to the extent such representation, warranty or certification is capable of cure, such inaccuracy continues unremedied for a period of fifteen (15) Business Days after receipt of notice; (h) the Collateral Agent shall cease to have a first-priority perfected security interest in the Collateral; (i) either (x) the Borrower shall have become subject to regulation by the Commission as an “investment company” under the Investment Company Act or (y) the Class A Loans shall constitute “ownership interests” in a “covered fund,” each as defined in the Volcker Rule; (j) the Borrower shall become taxable as an association or publicly traded partnership taxable as a corporation for U.S. federal income tax purposes; (k) a lien shall be filed pursuant to Section 430 or Section 6321 of the Code and such lien has not been released within 60 days with regard to the Borrower except for any lien set forth in clause (i) of the definition of Permitted Encumbrance; (l) [Reserved]; (m) Oportun shall fail to perform any of its obligations under the Performance Guaranty; (n) any material provision of this Agreement or any other Transaction Document shall cease to be in full force and effect or any of the Borrower, the Seller, Oportun, LLC or the Servicer (or any of their respective Affiliates) shall so state in writing; (o) (w) the Borrower shall fail to pay any principal of or premium or interest on any of its Indebtedness when the same becomes due and payable (whether by scheduled maturity, required prepayment, acceleration, demand or otherwise), and such failure shall continue after the applicable grace period, if any, specified in the agreement, mortgage, indenture or instrument relating to such Indebtedness (whether or not such failure shall have been waived under the related agreement); (x) the Seller, the Servicer, Oportun, LLC, the Parent or any of their respective Subsidiaries, individually or in the aggregate, shall fail to pay any principal of or premium or interest on any of its Indebtedness that is outstanding in a principal amount of at least $2,500,000 in the aggregate when the same becomes due and payable (whether by scheduled maturity, required prepayment, acceleration, demand or otherwise), and such failure shall continue