Exhibit 10.17-7 Execution

Copy

OPORTUN RF, LLC

SIXTH AMENDMENT TO INDENTURE

This SIXTH AMENDMENT TO INDENTURE, dated as of December 20, 2023 (this “Amendment”), is entered into among OPORTUN RF, LLC, a special purpose Delaware limited liability company, as issuer (the “Issuer”), and WILMINGTON TRUST, NATIONAL ASSOCIATION, a national banking association with trust powers, as indenture trustee (in such capacity, the “Indenture Trustee”), as securities intermediary (in such capacity, the “Securities Intermediary”) and as depositary bank (in such capacity, the “Depositary Bank”).

RECITALS

WHEREAS, the Issuer, the Indenture Trustee, the Securities Intermediary and the Depositary Bank have previously entered into that certain Indenture, dated as of December 20, 2021 (as amended, modified or supplemented prior to the date hereof, the “Indenture”);

WHEREAS, in accordance with Section 13.2 of the Base Indenture, the Issuer desires to amend the Indenture as provided herein; and

WHEREAS, as evidenced by their signature hereto, the Required Noteholders have consented to the amendments provided for herein;

NOW, THEREFORE, in consideration of the mutual agreements herein contained, and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, each party hereto agrees as follows:

ARTICLE I DEFINITIONS

SECTION 1.01. Defined Terms Not Defined Herein. All capitalized terms used

herein that are not defined herein shall have the meanings assigned to them in, or by reference in, the Indenture.

ARTICLE II AMENDMENTS TO THE INDENTURE

SECTION 2.01. Amendments. The Indenture is hereby amended to incorporate the

changes reflected on the marked pages of the Indenture attached hereto as Schedule I, with a conformed copy of the amended Indenture attached hereto as Schedule II.

ARTICLE III REPRESENTATIONS AND WARRANTIES

SECTION 3.01. Representations and Warranties. The Issuer hereby represents and

warrants to the Indenture Trustee, the Securities Intermediary, the Depositary Bank and each of the other Secured Parties that:

(a)Representations and Warranties. Both before and immediately after giving effect to this Amendment, the representations and warranties made by the Issuer in the Indenture and each of the other Transaction Documents to which it is a party are true and correct as of the date hereof (unless stated to relate solely to an earlier date, in which case such representations or warranties were true and correct as of such earlier date).

(b)Enforceability. This Amendment and the Indenture, as amended hereby, constitute the legal, valid and binding obligation of the Issuer enforceable against the Issuer in accordance with its respective terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar law affecting creditors’ rights generally and by general principles of equity.

(c)No Defaults. No Rapid Amortization Event, Event of Default, Servicer Default or Default has occurred and is continuing.

ARTICLE IV MISCELLANEOUS

SECTION 4.01. Ratification of Indenture. As amended by this Amendment, the

Indenture is in all respects ratified and confirmed and the Indenture, as amended by this Amendment, shall be read, taken and construed as one and the same instrument.

SECTION 4.02. Counterparts. This Amendment may be executed in any number of counterparts, and by different parties in separate counterparts, each of which so executed shall be deemed to be an original, but all of such counterparts shall together constitute but one and the same instrument. Each of the parties hereto agrees that the transaction consisting of this Amendment may be conducted by electronic means. Each party agrees, and acknowledges that it is such party’s intent, that if such party signs this Amendment using an electronic signature, it is signing, adopting, and accepting this Amendment and that signing this Amendment using an electronic signature is the legal equivalent of having placed its handwritten signature on this Amendment on paper. Each party acknowledges that it is being provided with an electronic or paper copy of this Amendment in a usable format.

SECTION 4.03. Recitals. The recitals contained in this Amendment shall be taken as the statements of the Issuer, and none of the Indenture Trustee, the Securities Intermediary or the Depositary Bank assumes any responsibility for their correctness. None of the Indenture Trustee, the Securities Intermediary or the Depositary Bank makes any representations as to the validity or sufficiency of this Amendment.

SECTION 4.04. Rights of the Indenture Trustee, the Securities Intermediary and the Depositary Bank. The rights, privileges and immunities afforded to the Indenture Trustee, the Securities Intermediary and the Depositary Bank under the Indenture shall apply hereunder as if fully set forth herein.

SECTION 4.05. GOVERNING LAW; JURISDICTION. THIS AMENDMENT SHALL BE CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK, WITHOUT REFERENCE TO ITS CONFLICT OF LAW PROVISIONS, AND THE OBLIGATIONS, RIGHTS AND REMEDIES OF THE PARTIES HEREUNDER SHALL BE DETERMINED IN ACCORDANCE WITH SUCH LAWS. EACH OF THE PARTIES HERETO AND EACH SECURED PARTY HEREBY AGREES TO THE NON-EXCLUSIVE JURISDICTION OF THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK AND ANY APPELLATE COURT HAVING JURISDICTION TO REVIEW THE JUDGMENTS THEREOF. EACH OF THE PARTIES HERETO AND EACH SECURED PARTY HEREBY WAIVES ANY OBJECTION BASED ON FORUM NON

CONVENIENS AND ANY OBJECTION TO VENUE OF ANY ACTION INSTITUTED HEREUNDER IN ANY OF THE AFOREMENTIONED COURTS AND CONSENTS TO THE GRANTING OF SUCH LEGAL OR EQUITABLE RELIEF AS IS DEEMED APPROPRIATE BY SUCH COURT.

SECTION 4.06. Effectiveness. This Amendment shall become effective as of the date hereof upon:

(a)receipt by the Indenture Trustee of an Issuer Order directing it to execute and deliver this Amendment;

(b)receipt by the Indenture Trustee of an Officer’s Certificate of the Issuer stating that the execution of this Amendment is authorized and permitted by the Indenture and all conditions precedent to the execution of this Amendment have been satisfied;

(c)receipt by the Indenture Trustee of an Opinion of Counsel stating that the execution of this Amendment is authorized and permitted under the Indenture and all conditions precedent to the execution of this Amendment have been satisfied;

(d)receipt by the Indenture Trustee of evidence of the consent of the Required Noteholders to this Amendment;

(e)receipt by the Indenture Trustee of counterparts of this Amendment, duly executed by each of the parties hereto; and

(f)receipt by the Indenture Trustee of such other instruments, documents, agreements and opinions reasonably requested by the Indenture Trustee prior to the date hereof.

(Signature page follows)

IN WITNESS WHEREOF, the Issuer, the Indenture Trustee, the Securities Intermediary and the Depositary Bank have caused this Amendment to be duly executed by their respective officers as of the day and year first above written.

OPORTUN RF, LLC,

as Issuer

By: /s/ Jonathan Coblentz Name: Jonathan Coblentz Title: Treasurer

WILMINGTON TRUST, NATIONAL ASSOCIATION,

not in its individual capacity but solely as Indenture Trustee

By: /s/ Drew H. Davis Name: Drew H. Davis Title:

WILMINGTON TRUST, NATIONAL ASSOCIATION,

not in its individual capacity but solely as Securities Intermediary

By: /s/ Drew H. Davis Name: Drew H. Davis Title:

WILMINGTON TRUST, NATIONAL ASSOCIATION,

not in its individual capacity but solely as Depositary Bank

By: /s/ Drew H. Davis Name: Drew H. Davis Title:

Consented to and acknowledged by the Required Noteholders:

JEFFERIES FUNDING LLC,

as Holder of 100% of the outstanding Notes

By: /s/ Michael Wade Name: Michael Wade Title: Managing Director

SCHEDULE I

Amendments to Indenture

CONFORMED COPY As

amended by the Sixth Amendment to Indenture, dated as of December 20, 2023

OPORTUN RF, LLC,

as Issuer

and

WILMINGTON TRUST, NATIONAL ASSOCIATION,

as Indenture Trustee, as Securities Intermediary and as Depositary Bank

INDENTURE

Dated as of December 20, 2021

Asset Backed Notes, Class A Asset Backed Certificates

TABLE OF CONTENTS

Page

ARTICLE 1. DEFINITIONS AND INCORPORATION BY REFERENCE 2

Section 1.1. Definitions 2

Section 1.2. [Reserved] 26

Section 1.3. Cross-References 26

Section 1.4. Accounting and Financial Determinations; No Duplication 26 Section 1.5. Rules of Construction 2726

Section 1.6. Other Definitional Provisions. 27

ARTICLE 2. THE SECURITIES 2827

Section 2.1. Designation and Terms of Securities 2827

Section 2.2. [Reserved] 28

Section 2.3. [Reserved]. 28

Section 2.4. Execution and Authentication. 28

Section 2.5. Authenticating Agent. 28 Section 2.6. Registration of Transfer and Exchange of Securities. 29 Section 2.7. Appointment of Paying Agent 3332 Section 2.8. Paying Agent to Hold Money in Trust. 33 Section 2.9. Private Placement Legend 34

Section 2.10. Mutilated, Destroyed, Lost or Stolen Securities. 36 Section 2.11. Temporary Notes. 37 Section 2.12. Persons Deemed Owners 37 Section 2.13. Cancellation 3837

Section 2.14. Release of Trust Estate 38

Section 2.15. Payment of Principal, Interest and Other Amounts. 3938 Section 2.16. Book-Entry Notes 39

Section 2.17. Notices to Clearing Agency 44 Section 2.18. Definitive Notes 44

Section 2.19. Global Note 45

Section 2.20. Tax Treatment 45

Section 2.21. Duties of the Indenture Trustee and the Transfer Agent and

Registrar 4645

ARTICLE 3. ISSUANCE OF SECURITIES; CERTAIN FEES AND EXPENSES 46

Section 3.1. Issuance 46

Section 3.2. Certain Fees and Expenses 47

ARTICLE 4. NOTEHOLDER LISTS AND REPORTS 47

Section 4.1. Issuer To Furnish To Indenture Trustee Names and Addresses of Noteholders and Certificateholders 47

Section 4.2. Preservation of Information; Communications to Noteholders and Certificateholders 48

Section 4.3. Reports by Issuer 48 Section 4.4. [Reserved] 49

Section 4.5. Reports and Records for the Indenture Trustee and Instructions 49

ARTICLE 5. ALLOCATION AND APPLICATION OF UNDERLYING PAYMENTS 49

Section 5.1. Rights of Noteholders and Certificateholders 49

Section 5.2. Collection of Money 5049

Section 5.3. Establishment of Accounts. 50

Section 5.4. Payments and Allocations. 52

Section 5.5. [Reserved] 5352

Section 5.6. [Reserved] 5352

Section 5.7. General Provisions Regarding Accounts 5352

Section 5.8. [Reserved] 53

Section 5.9. [Reserved] 53

Section 5.10. [Reserved]. 53

Section 5.11. [Reserved] 53

Section 5.12. Determination of Monthly Interest. 53

Section 5.13. Benchmark Replacement 54

Section 5.14. [Reserved]. 55

Section 5.15. Monthly Payments 55

Section 5.16. Failure to Make a Deposit or Payment. 56

ARTICLE 6. DISTRIBUTIONS AND REPORTS 56

Section 6.1. Distributions. 5756

Section 6.2. Monthly Report. 57

ARTICLE 7. REPRESENTATIONS AND WARRANTIES OF THE ISSUER 58

Section 7.1. Representations and Warranties of the Issuer 58

Section 7.2. Reaffirmation of Representations and Warranties by the Issuer. 6261 ARTICLE 8. COVENANTS 62

Section 8.1. Money for Payments To Be Held in Trust 62 Section 8.2. Affirmative Covenants of Issuer 62 Section 8.3. Negative Covenants 66

Section 8.4. Further Instruments and Acts 6968

Section 8.6. Perfection Representations 6968

ARTICLE 9. RAPID AMORTIZATION EVENTS AND REMEDIES 69

Section 9.1. Rapid Amortization Events. 69

ARTICLE 10. REMEDIES 70

Section 10.1. Events of Default 70

Section 10.2. Rights of the Indenture Trustee Upon Events of Default. 71

Section 10.3. Collection of Indebtedness and Suits for Enforcement by Indenture

Trustee. 72

Section 10.4. Remedies 74

Section 10.5. Priority of Remedies Exercised Against the Underlying Securities 75

Section 10.6. Waiver of Past Events 75

Section 10.7. Limitation on Suits 75Section 10.8. Unconditional Rights of Holders to Receive Payment; Withholding

Taxes 76

Section 10.9. Restoration of Rights and Remedies 77

Section 10.10. The Indenture Trustee May File Proofs of Claim 77

Section 10.11. Priorities 77

Section 10.12. Undertaking for Costs 78

Section 10.13. Rights and Remedies Cumulative 78

Section 10.14. Delay or Omission Not Waiver 78

Section 10.15. Control by Noteholders 78

Section 10.16. Waiver of Stay or Extension Laws 79

Section 10.17. Action on Securities 79

Section 10.18. Performance and Enforcement of Certain Obligations. 8079

Section 10.19. Reassignment of Surplus 80

ARTICLE 11. THE INDENTURE TRUSTEE 80

Section 11.1. Duties of the Indenture Trustee. 80

Section 11.2. Rights of the Indenture Trustee 83

Section 11.3. Indenture Trustee Not Liable for Recitals in Securities 87

Section 11.4. Individual Rights of the Indenture Trustee; Multiple Capacities 87

Section 11.5. Notice of Defaults 88

Section 11.6. Compensation. 88

Section 11.7. Replacement of the Indenture Trustee 88

Section 11.8. Successor Indenture Trustee by Merger, etc. 9089

Section 11.9. Eligibility: Disqualification 90

Section 11.10. Appointment of Co-Indenture Trustee or Separate Indenture

Trustee. 9190

Section 11.11. [Reserved] 9291

Section 11.12. Taxes 92

Section 11.13. [Reserved] 92

Section 11.14. Suits for Enforcement 92

Section 11.15. Reports by Indenture Trustee to Holders 92

Section 11.16. Representations and Warranties of Indenture Trustee 92

Section 11.17. The Issuer Indemnification of the Indenture Trustee 9392

Section 11.18. Indenture Trustee’s Application for Instructions from the Issuer 93

Section 11.19. [Reserved] 93

Section 11.20. Maintenance of Office or Agency 93

Section 11.21. Concerning the Rights of the Indenture Trustee 9493

Section 11.22. Direction to the Indenture Trustee 9493

ARTICLE 12. DISCHARGE OF INDENTURE 9493

Section 12.1. Satisfaction and Discharge of Indenture 9493

Section 12.2. Application of Issuer Money 94

Section 12.3. Repayment of Moneys Held by Paying Agent 9594

Section 12.4. [Reserved] 9594

Section 12.5. Final Payment 9594

Section 12.6. Termination Rights of Issuer 9695

Section 12.7. Repayment to the Issuer 96

ARTICLE 13. AMENDMENTS 96

Section 13.1. Supplemental Indentures without Consent of the Noteholders 96 Section 13.2. Supplemental Indentures with Consent of Noteholders 97

Section 13.3. Execution of Supplemental Indentures 99

Section 13.4. Effect of Supplemental Indenture 99

Section 13.5. [Reserved] 99

Section 13.6. [Reserved] 99

Section 13.7. [Reserved] 99

Section 13.8. Revocation and Effect of Consents 99

Section 13.9. Notation on or Exchange of Securities Following Amendment. 10099

Section 13.10. The Indenture Trustee to Sign Amendments, etc. 100

ARTICLE 14. REDEMPTION AND REFINANCING OF NOTES 100

Section 14.1. Redemption and Refinancing 100

Section 14.2. Form of Redemption Notice 101

Section 14.3. Notes Payable on Redemption Date 101

ARTICLE 15. MISCELLANEOUS 102101

Section 15.1. Compliance Certificates and Opinions, etc 102101

Section 15.2. Form of Documents Delivered to Indenture Trustee 103

Section 15.3. Acts of Noteholders and Certificateholders 104

Section 15.4. Notices 105104

Section 15.5. Notices to Noteholders and Certificateholders; Waiver 105

Section 15.6. Alternate Payment and Notice Provisions 106105

Section 15.7. [Reserved] 106

Section 15.8. Effect of Headings and Table of Contents 106

Section 15.9. Successors and Assigns 106

Section 15.10. Separability of Provisions 106

Section 15.11. Benefits of Indenture 106

Section 15.12. Legal Holidays 106

Section 15.13. GOVERNING LAW; JURISDICTION 107106

Section 15.14. Counterparts; Electronic Execution 107

Section 15.15. Recording of Indenture 107

Section 15.16. Issuer Obligation 107

Section 15.17. No Bankruptcy Petition Against the Issuer 108107

Section 15.18. No Joint Venture 108

Section 15.19. Rule 144A Information 108

Section 15.20. No Waiver; Cumulative Remedies 108

Section 15.21. Third-Party Beneficiaries 108

Section 15.22. Merger and Integration 109108

Section 15.23. Rules by the Indenture Trustee 109108

Section 15.24. Duplicate Originals 109108

“2019-A Indenture” means the Base Indenture as supplemented by the Series 2019-A Supplement, each dated as of August 1, 2019, between the 2019-A Issuer, and Wilmington Trust, National Association, as trustee, securities intermediary and depositary bank, as amended, restated, modified or supplemented from time to time.

“2019-A Issuer” means Oportun Funding XIII, LLC, a Delaware special purpose limited liability company.

“2019-A Transaction Documents” means the “Transaction Documents” as defined in the 2019-A Indenture.

“2021-A Certificates” means the residual certificates issued by the 2021-A Issuer under the 2021-A Indenture and assigned CUSIP Number 68377B 107.

“2021-A Indenture” means the Base Indenture as supplemented by the Series 2021-A Supplement, each dated as of March 8, 2021, between the 2021-A Issuer, and Wilmington Trust, National Association, as trustee, securities intermediary and depositary bank, as amended, restated, modified or supplemented from time to time.

“2021-A Issuer” means Oportun Funding XIV, LLC, a Delaware special purpose limited liability company.

“2021-A Transaction Documents” means the “Transaction Documents” as defined in the 2021-A Indenture.

“2021-B Certificates” means the trust certificates issued by the 2021-B Issuer pursuant to the 2021-B Trust Agreement, representing the beneficial interest in the 2021-B Issuer and assigned CUSIP Number 68377G AE6.

“2021-B Indenture” means the Indenture, dated as of May 10, 2021, between the 2021-B Issuer, and Wilmington Trust, National Association, as indenture trustee, securities intermediary and depositary bank, as amended, restated, modified or supplemented from time to time.

“2021-B Issuer” means Oportun Issuance Trust 2021-B, a Delaware statutory trust. “2021-B Transaction Documents” means the “Transaction Documents” as defined in the

2021-B Indenture.

“2021-B Trust Agreement” means the Amended and Restated Trust Agreement relating to the 2021-B Issuer, dated as of May 10, 2021, among Oportun Depositor, LLC, as depositor, Wilmington Savings Fund Society, FSB, as owner trustee, and PF Servicing, LLC, as administrator, as amended, restated, modified or supplemented from time to time.

“2021-C Certificates” means the trust certificates issued by the 2021-C Issuer pursuant to the 2021-C Trust Agreement, representing the beneficial interest in the 2021-C Issuer and assigned CUSIP Number 68377W 101.

“2022-2 Indenture” means the Indenture, dated as of July 22, 2022 between the 2022-2 Issuer, and Wilmington Trust, National Association, as indenture trustee, securities intermediary and depositary bank, as amended, restated, modified or supplemented from time to time.

“2022-2 Issuer” means Oportun Issuance Trust 2022-2, a Delaware Statutory Trust. “2022-2 Purchase Agreement” means the Security Purchase Agreement (2022-2), dated

as of the 2022-2 Purchase Date, among the Seller and the Issuer, relating to the purchase by the

Issuer of the 2022-2 Certificates, as such agreement may be amended, supplemented or otherwise modified and in effect from time to time.

“2022-2 Purchase Date” means July 28, 2022.

“2022-2 Transaction Documents” means the “Transaction Documents” as defined in the 2022-2 Indenture Release Date” means December 20, 2023.

“2022-2 Trust Agreement” means the Amended and Restated Trust Agreement relating to the 2022-2 Issuer, dated as of July 22, 2022, among Oportun Depositor, LLC, as depositor, Wilmington Savings Fund Society, FSB, as owner trustee, and PF Servicing, LLC, as administrator, as amended, restated, modified or supplemented from time to time.

“Additional Notes” means any Notes issued after the Closing Date in accordance with Section 3.1.

“Additional Principal Payment Percentage” means, (I) for any Payment Date up to and including the July 2023 Payment Date, 0%, and (II) for any Payment Date on or after the August 2023 Payment Date, (a) if the Three-Month Average Underlying Loss Percentage for such Payment Date is less than or equal to 13.0%, 0.0%, (b) if the Three-Month Average Underlying Loss Percentage for such Payment Date is greater than 13.0% but less than or equal to 14.0%, 50.0%,

(c) if the Three-Month Average Underlying Loss Percentage for such Payment Date is greater than 14.0% but less than or equal to 15.0%, 75.0%, and (d) if the Three-Month Average Underlying Loss Percentage for such Payment Date is greater than 15.0%, 100.0%.

“Adjusted Leverage Ratio” means, on any date of determination, the ratio of (i) Adjusted Liabilities to (ii) Tangible Net Worth.

“Adjusted Leverage Ratio Covenant” means that the Parent will have a maximum Adjusted Leverage Ratio of 3.5:1.

“Adjusted Liabilities” means, on any date of determination, the excess of total Liabilities over the amount of any asset-backed securities that would appear as liabilities on the balance sheet of the Parent and its Subsidiaries determined on a consolidated basis in accordance with GAAP.

“Administration Fee” means the fee payable to the Administrator pursuant to the Administrative Services Agreement.

“Administrative Services Agreement” means the Administrative Services and Premises Agreement, dated as of the Closing Date, between the Issuer and the Administrator, as amended, supplemented or otherwise modified from time to time.

“Administrator” means Oportun, as administrator of the Issuer pursuant to the Administrative Services Agreement.

“Administrator Default” has the meaning specified in the Administrative Services Agreement.

“Adverse Claim” means a Lien on any Person’s assets or properties in favor of any other Person (including any UCC financing statement or any similar instrument filed against such Person’s assets or properties), other than a Permitted Encumbrance.

“Affiliate” means, with respect to any Person, any other Person directly or indirectly controlling, controlled by, or under direct or indirect common control with, such Person. A Person shall be deemed to control another Person if the controlling Person possesses, directly or indirectly, the power to direct or cause the direction of the management or policies of the controlled Person, whether through ownership of voting stock, by contract or otherwise.

“Agent” means any Transfer Agent and Registrar or Paying Agent.

“Alternative Rate” means, for any day, the sum of a per annum rate equal to the sum of (i) the rate set forth in the weekly statistical release designated as H.15(519), or any successor publication, published by the Federal Reserve Board (including any such successor, “H.15(519)”) for such day opposite the caption “Federal Funds (Effective)” and (ii) 0.50%. If on any relevant day such rate is not yet published in H. 15(519), the rate for such day will be the rate set forth in the daily statistical release designated as the Composite 3:30 p.m. Quotations for U.S. Government Securities, or any successor publication, published by the Federal Reserve Bank of New York (including any such successor, the “Composite 3:30 p.m. Quotations”) for such day under the caption “Federal Funds Effective Rate.” If on any relevant day the appropriate rate is not yet published in either H.15(519) or the Composite 3:30 p.m. Quotations, the rate for such day will be the arithmetic mean as determined by the Calculation Agent of the rates for the last transaction in overnight Federal funds arranged before 9:00 a.m. (New York time) on that day by each of three leading brokers of Federal funds transactions in New York City selected by the Calculation Agent.

“Amortization Schedule” means the schedule of Payment Dates and corresponding Scheduled Note Principal Amounts attached hereto as Schedule 1, as amended as of the 2022-2 Purchase Date and as otherwise amended from time to time with the prior written consent of the Noteholders.

“Applicable Margin” shall have the meaning set forth in the Fee Letter. “Applicants” has the meaning specified in Section 4.2(b).

“Available Funds” means, with respect to any Monthly Period and the Payment Date related thereto, the sum of the following, without duplication: (a) any Underlying Payments

or trust company shall have a credit rating from a Rating Agency in the highest investment category granted thereby;

(3)commercial paper having, at the time of the investment or contractual commitment to invest therein, a rating from Fitch of “F2” or the equivalent thereof from Moody’s or Standard & Poor’s; or

(4)only to the extent permitted by Rule 3a-7 under the Investment Company Act, investments in money market funds having a rating from Fitch of “AA” or, to the extent not rated by Fitch, rated in the highest rating category by Moody’s, Standard & Poor’s or another Rating Agency.

Permitted Investments may be purchased by or through the Indenture Trustee or any of its Affiliates.

“Person” means any corporation, limited liability company, natural person, firm, joint venture, partnership, trust, unincorporated organization, enterprise, government or any department or agency of any government.

“Proceeding” means any suit in equity, action at law or other judicial or administrative proceeding.

“Purchase Agreement” means each of the Initial Purchase Agreement, and the 2022-A Purchase Agreement and the 2022-2 Purchase Agreement.

“QIB” has the meaning specified in Section 2.16(a)(i).

“Qualified Institution” means a depository institution or trust company:

(1)whose commercial paper, short-term unsecured debt obligations or other short-term deposits have a rating commonly regarded as “investment grade” by at least one Rating Agency, if the deposits are to be held in the account for 30 days or less, or

(2)whose long-term unsecured debt obligations have a rating commonly regarded as “investment grade” by at least one Rating Agency, if the deposits are to be held in the account more than 30 days.

“Rapid Amortization Event” has the meaning specified in Section 9.1.

“Rating Agency” means any nationally recognized statistical rating organization. “Record Date” means, with respect to any Payment Date, the last Business Day of the

preceding Monthly Period.

“Records” means all documents, books, records and other information in physical or electronic format (including, without limitation, computer programs, tapes, disks, punch cards, data processing software and related property and rights) maintained with respect to the Underlying Securities.

“Trust Estate” has the meaning specified in the Granting Clause of this Indenture.

“Trust Officer” means any officer within the Corporate Trust Office (or any successor group of the Indenture Trustee), including any Vice President, any Director, any Managing Director, any Assistant Vice President or any other officer of the Indenture Trustee customarily performing functions similar to those performed by any individual who at the time shall be an above-designated officer and is directly responsible for the day-to-day administration of the transactions contemplated herein.

“Trustee Fees and Expenses” means, for any Payment Date, the amount of accrued and unpaid fees, indemnity amounts and reasonable out-of-pocket expenses, not in excess of $150,000 per calendar year for the Indenture Trustee (including in its capacity as Agent), the Securities Intermediary and the Depositary Bank (or, if an Event of Default or other Rapid Amortization Event has occurred and is continuing, without limit).

“U.S. Government Securities Business Day” means any day except for (a) a Saturday, (b) a Sunday or (c) a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in United States government securities.

“UCC” means, with respect to any jurisdiction, the Uniform Commercial Code as the same may, from time to time, be enacted and in effect in such jurisdiction.

“Unadjusted Benchmark Replacement” means the applicable Benchmark Replacement excluding the related Benchmark Replacement Adjustment.

“Underlying Indenture” means the 20192021-A Indenture, the 2021-A Indenture, the 2021-B Indenture, the 2021-C Indenture, or the 2022-A Indenture or the 2022-2 Indenture, as applicable.

“Underlying Issuer” means the 20192021-A Issuer, the 2021-A Issuer, the 2021-B Issuer, the 2021-C Issuer, or the 2022-A Issuer or the 2022-2 Issuer, as applicable.

“Underlying Monthly Loss Percentage” means, for any Underlying Issuer, the “Monthly Loss Percentage” as defined in the applicable Underlying Indenture.

“Underlying Payment Date” means with respect to any Underlying Security, means the eighth (8th) day of each calendar month, or if such eighth (8th) day is not a Business Day, the next succeeding Business Day.

“Underlying Payments” means, with respect to any Underlying Securities, any payments or distributions made in respect of such Underlying Securities in accordance with the applicable Underlying Transaction Documents.

“Underlying Securities” means, collectively, the 2019-A Certificates, the 2021-A Certificates, the 2021-B Certificates, the 2021-C Certificates, and the 2022-A Certificates and the 2022-2 Certificates.

“Underlying Transaction Documents” means the 20192021-A Transaction Documents, the 2021-A Transaction Documents, the 2021-B Transaction Documents, the 2021-C Transaction Documents, and the 2022-A Transaction Documents and the 2022-2 Transaction Documents, as applicable.

“U.S.” or “United States” means the United States of America and its territories. “written” or “in writing” means any form of written communication, including, without

limitation, by means of e-mail, telex or telecopier device.

Section 1.2. [Reserved].

Section 1.3. Cross-References. Unless otherwise specified, references in this Indenture and in each other Transaction Document to any Article or Section are references to such Article or Section of this Indenture or such other Transaction Document, as the case may be, and, unless otherwise specified, references in any Article, Section or definition to any clause are references to such clause of such Article, Section or definition.

Section 1.4. Accounting and Financial Determinations; No Duplication. Where the character or amount of any asset or liability or item of income or expense is required to be determined, or any accounting computation is required to be made, for the purpose of this Indenture, such determination or calculation shall be made, to the extent applicable and except as otherwise specified in this Indenture, in accordance with GAAP. When used herein, the term “financial statement” shall include the notes and schedules thereto. All accounting determinations and computations hereunder or under any other Transaction Documents shall be made without duplication.

Section 1.5. Rules of Construction. In this Indenture, unless the context otherwise

requires:

(a)“or” is not exclusive;

(b)the singular includes the plural and vice versa;

(c)reference to any Person includes such Person’s successors and assigns but, if applicable, only if such successors and assigns are permitted by this Indenture, and reference to any Person in a particular capacity only refers to such Person in such capacity;

(d)reference to any gender includes the other gender;

(e)reference to any Requirement of Law means such Requirement of Law as amended, modified, codified or reenacted, in whole or in part, and in effect from time to time;

(f)“including” (and with correlative meaning “include”) means including without limiting the generality of any description preceding such term; and

in any manner whatsoever, and all Securities so delivered shall be promptly cancelled by the Indenture Trustee. No Securities shall be authenticated in lieu of or in exchange for any Securities cancelled as provided in this Section, except as expressly permitted by this Indenture. All cancelled Securities may be held or disposed of by the Indenture Trustee in accordance with its standard retention or disposal policy as in effect at the time unless the Issuer shall direct by an Issuer Order that they be destroyed or returned to it; provided that such Issuer Order is timely and the Securities have not been previously disposed of by the Indenture Trustee. The Registrar and Paying Agent shall forward to the Indenture Trustee any Securities surrendered to them for registration of transfer, exchange or payment.

Section 2.14. Release of Trust Estate.

(1)The Indenture Trustee shall (a) in connection any redemption of the Securities, release the Trust Estate from the Lien created by this Indenture upon receipt of an Officer’s Certificate of the Issuer certifying that (i) the Redemption Price and all other amounts due and owing on the Redemption Date have been deposited into a Trust Account that is within the sole control of the Indenture Trustee, (ii) the distribution on the Certificates if and as required by Section 14.1(c) has been made in full, and (iii) such release is authorized and permitted under the Transaction Documents and (b) on or after the Indenture Termination Date, release any remaining portion of the Trust Estate from the Lien created by this Indenture, including any funds then on deposit in any Trust Account upon receipt of an Issuer Order accompanied by an Officer’s Certificate of the Issuer meeting the applicable requirements of Section 15.1.

(2)On the 2022-2 Purchase Date, concurrently with the inclusion of the 2022- 2 Certificates in the Trust Estate and the transfer by the Issuer of the 2022-A Class D Notes, the Lien created by this Indenture in respect of the 2022-A Class D Notes, together with all monies due or to become due thereunder and all proceeds of every kind and nature whatsoever in respect of the foregoing, shall be automatically released and the Indenture Trustee shall be deemed to have released such Lien, without the execution or filing of any instrument or paper or the performance of any further act, and the 2022-A Class D Notes shall no longer be included in the Trust Estate.

(3)On the 2022-2 Release Date, the Lien created by this Indenture in respect of the 2022-2 Certificates, together with all monies due or to become due thereunder and all proceeds of every kind and nature whatsoever in respect of the foregoing, shall be automatically released and the Indenture Trustee shall be deemed to have released such Lien, without the execution or filing of any instrument or paper or the performance of any further act, and the 2022- 2 Certificates shall no longer be included in the Trust Estate.

Section 2.15. Payment of Principal, Interest and Other Amounts.

(a)The principal of each of the Notes shall be payable at the times and in the amounts set forth in Section 5.15 and in accordance with Section 8.1.

(b)Each of the Notes shall accrue interest as provided in Section 5.12 and such interest shall be payable at the times and in the amounts set forth in Section 5.15 and in accordance with Section 8.1. The payments of amounts payable with respect to the Certificates

Section 8.4. Further Instruments and Acts. The Issuer will execute and deliver such further instruments, furnish such other information and do such further acts as may be reasonably necessary or proper to carry out more effectively the purpose of this Indenture.

Section 8.5. [Reserved].

Section 8.6. Perfection Representations. The parties hereto agree that the Perfection Representations shall be a part of this Indenture for all purposes.

ARTICLE 9.

RAPID AMORTIZATION EVENTS AND REMEDIES

Section 9.1. Rapid Amortization Events. A “Rapid Amortization Event,” wherever used herein, means any one of the following events:

(a)default in the payment of any interest on the Notes on any Payment Date, and such default shall continue (and shall not have been waived by the Required Noteholders) for a period of three (3) Business Days after receipt of notice thereof from the Indenture Trustee or the Required Noteholders;

(b)default in the payment of the principal of or any installment of the principal of the Notes when the same becomes due and payable, and such default shall continue (and shall not have been waived by the Required Noteholders) for a period of three (3) Business Days after receipt of notice thereof from the Indenture Trustee or the Required Noteholders;

(c)commencing with the three (3) consecutive Payment Dates ending with the March 2023 Payment Date, the Three-Month Average Underlying Loss Percentage shall have been greater than 13.0% on three (3) consecutive Payment Dates;

(d)a “Rapid Amortization Event” (as defined in the applicable Underlying Indenture) shall have occurred with respect to any Underlying Issuer (other than the 2021-A Issuer);

(e)the failure of the Issuer to maintain any Financial Covenant;

(f)the failure of the Issuer to provide, or cause to be provided, the Monthly Report when due, which failure shall continue unremedied for a period of three (3) days after receipt of notice thereof from the Indenture Trustee or the Required Noteholders;

(g)a failure on the part of the Seller duly to observe or perform any other covenants or agreements of the Seller set forth in any Purchase Agreement or the other Transaction Documents, which failure has a material adverse effect on the interests of the Noteholders (as reasonably determined by the Required Noteholders) and which continues unremedied for a period of thirty (30) days after the date on which notice of such failure, requiring the same to be remedied, shall have been given by registered or certified mail to the

Schedule 1

Schedule 2

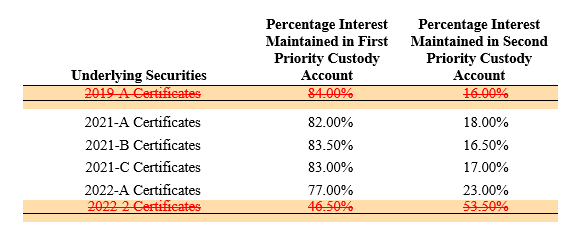

CUSTODY ACCOUNT ALLOCATIONS

(as of December 20, 2023)

SCHEDULE II

Conformed Copy of Amended Indenture

CONFORMED COPY

As amended by the Sixth Amendment to Indenture, dated as of December 20, 2023

OPORTUN RF, LLC,

as Issuer

and

WILMINGTON TRUST, NATIONAL ASSOCIATION,

as Indenture Trustee, as Securities Intermediary and as Depositary Bank

INDENTURE

Dated as of December 20, 2021

Asset Backed Notes, Class A Asset Backed Certificates

TABLE OF CONTENTS

Page

TABLE OF CONTENTS

(continued)

Page

Exhibits and Schedules:

Exhibit A: Form of Release and Reconveyance of Trust Estate Exhibit B: [Reserved]

Exhibit C: Form of Class A Restricted Global Note Exhibit D: Form of Monthly Report

Exhibit E: Form of Certificate

Schedule 1 Amortization Schedule Schedule 2 Custody Account Allocations

Schedule 3 Perfection Representations, Warranties and Covenants Schedule 4 List of Proceedings

-vi-

INDENTURE, dated as of December 20, 2021, between OPORTUN RF, LLC, a Delaware limited liability company, as issuer (the “Issuer”) and WILMINGTON TRUST, NATIONAL ASSOCIATION, a national banking association with trust powers, as Indenture Trustee, as Securities Intermediary and as Depositary Bank.

W I T N E S S E T H:

W I T N E S S E T H:WHEREAS, the Issuer has duly executed and delivered this Indenture to provide for the issuance of Securities, issuable as provided in this Indenture; and

WHEREAS, all things necessary to make this Indenture a legal, valid and binding agreement of the Issuer, enforceable in accordance with its terms, have been done, and the Issuer proposes to do all the things necessary to make the Securities, when executed by the Issuer and authenticated and delivered by the Indenture Trustee hereunder and duly issued by the Issuer, the legal, valid and binding obligations of the Issuer as hereinafter provided.

NOW, THEREFORE, for and in consideration of the premises and the receipt of the Securities by the Holders, it is mutually covenanted and agreed, for the equal and proportionate benefit of all Holders, as follows:

GRANTING CLAUSE

The Issuer hereby grants to the Indenture Trustee at the Closing Date, for the benefit of the Indenture Trustee, the Noteholders, the Certificateholders and any other Person to which any Secured Obligations are payable (the “Secured Parties”), to secure the Secured Obligations, a continuing Lien on and security interest in all of the Issuer’s right, title and interest in, to and under the following property whether now owned or hereafter acquired, now existing or hereafter created and wherever located: (a) all Underlying Securities, and any and all monies due or to become due thereunder; (b) the Payment Account, each other Securities Account, and any other account maintained by the Indenture Trustee pursuant hereto (each such account, a “Trust Account”), all monies from time to time deposited therein and all money, instruments, investment property and other property from time to time credited thereto or on deposit therein; (c) all certificates and instruments, if any, representing or evidencing any or all of the Trust Accounts or the funds on deposit therein from time to time; (d) all investments made at any time and from time to time with moneys in the Trust Accounts; (e) the Purchase Agreements; (f) all

accounts, chattel paper, commercial tort claims, deposit accounts, documents, general intangibles, goods, instruments, investment property, letter-of-credit rights, letters of credit, money, and oil, gas and other minerals,

(g) all additional property that may from time to time hereafter be subjected to the grant and pledge made by the Issuer or by anyone on its behalf; (h) all present and future claims, demands, causes and choses in action and all payments on or under the foregoing; and (i) all proceeds of every kind and nature whatsoever in respect of any or all of the foregoing, including all proceeds of all of the foregoing and the conversion thereof, voluntary or involuntary, into cash or other liquid property, all cash proceeds, accounts, accounts receivable, notes, drafts, acceptances, chattel paper, checks, deposit accounts, insurance proceeds, investment property, rights to payment of any and every kind and other forms of obligations and receivables, instruments and other property which at any

time constitute all or part of or are included in the proceeds of any of the foregoing (collectively, the “Trust Estate”).

The foregoing Grant is made in trust to secure the payment of principal of and interest on, and any other amounts owing in respect of, the Secured Obligations, equally and ratably without prejudice, priority or distinction except as set forth herein, and to secure compliance with the provisions of this Indenture, all as provided in this Indenture.

The Issuer hereby assigns to the Indenture Trustee all of the Issuer’s power to authorize an amendment to the financing statement filed with the Delaware Secretary of State relating to the security interest granted to the Issuer by the Seller pursuant to each Purchase Agreement; provided, however, that the Indenture Trustee shall be entitled to all the protections of Article 11, including Sections 11.1(g) and 11.2(k), in connection therewith, and the obligations of the Issuer under Sections 8.2(i) and 8.3(j) shall remain unaffected.

The Indenture Trustee, for the benefit of the Secured Parties, hereby acknowledges such Grant, accepts the trusts under this Indenture in accordance with the provisions of this Indenture and the Lien on the Trust Estate conveyed by the Issuer pursuant to the Grant, declares that it shall maintain such right, title and interest, upon the trust set forth, for the benefit of all Secured Parties, subject to Sections 11.1 and 11.2, and agrees to perform its duties required in this Indenture in accordance with the terms of this Indenture.

DESIGNATION

(a)There are hereby created notes and subordinate residual certificates to be issued pursuant to this Indenture and such notes and subordinate residual certificates shall be substantially in the form of Exhibit C and E, respectively, hereto, executed by or on behalf of the Issuer and authenticated by the Indenture Trustee and designated generally Asset Backed Notes, Class A, which notes shall include any Additional Notes (the “Class A Notes” or the “Notes”), and Asset Backed Certificates (the “Certificates” and, together with the Notes, the “Securities”)). The Class A Notes shall be issued in minimum denominations of $100,000 and integral multiples of $1,000 in excess thereof, and the Certificates shall be issued in minimum percentage interests of 5% with no minimum incremental percentage interests in excess thereof.

(b)The Certificates shall be subordinate to the Class A Notes to the extent described herein.

ARTICLE 1.

DEFINITIONS AND INCORPORATION BY REFERENCE

Section 1.1. Definitions. Certain capitalized terms used herein (including the preamble and the recitals hereto) shall have the following meanings:

“2019-A Certificates” means the residual certificates issued by the 2019-A Issuer under the 2019-A Indenture and assigned CUSIP Number 68377F 108.

“2019-A Indenture” means the Base Indenture as supplemented by the Series 2019-A Supplement, each dated as of August 1, 2019, between the 2019-A Issuer, and Wilmington Trust, National Association, as trustee, securities intermediary and depositary bank, as amended, restated, modified or supplemented from time to time.

“2019-A Issuer” means Oportun Funding XIII, LLC, a Delaware special purpose limited liability company.

“2021-A Certificates” means the residual certificates issued by the 2021-A Issuer under the 2021-A Indenture and assigned CUSIP Number 68377B 107.

“2021-A Indenture” means the Base Indenture as supplemented by the Series 2021-A Supplement, each dated as of March 8, 2021, between the 2021-A Issuer, and Wilmington Trust, National Association, as trustee, securities intermediary and depositary bank, as amended, restated, modified or supplemented from time to time.

“2021-A Issuer” means Oportun Funding XIV, LLC, a Delaware special purpose limited liability company.

“2021-A Transaction Documents” means the “Transaction Documents” as defined in the 2021-A Indenture.

“2021-B Certificates” means the trust certificates issued by the 2021-B Issuer pursuant to the 2021-B Trust Agreement, representing the beneficial interest in the 2021-B Issuer and assigned CUSIP Number 68377G AE6.

“2021-B Indenture” means the Indenture, dated as of May 10, 2021, between the 2021-B Issuer, and Wilmington Trust, National Association, as indenture trustee, securities intermediary and depositary bank, as amended, restated, modified or supplemented from time to time.

“2021-B Issuer” means Oportun Issuance Trust 2021-B, a Delaware statutory trust.

“2021-B Transaction Documents” means the “Transaction Documents” as defined in the 2021-B Indenture.

“2021-B Trust Agreement” means the Amended and Restated Trust Agreement relating to the 2021-B Issuer, dated as of May 10, 2021, among Oportun Depositor, LLC, as depositor, Wilmington Savings Fund Society, FSB, as owner trustee, and PF Servicing, LLC, as administrator, as amended, restated, modified or supplemented from time to time.

“2021-C Certificates” means the trust certificates issued by the 2021-C Issuer pursuant to the 2021-C Trust Agreement, representing the beneficial interest in the 2021-C Issuer and assigned CUSIP Number 68377W 101.

“2021-C Indenture” means the Indenture, dated as of October 28, 2021, between the 2021- C Issuer, and Wilmington Trust, National Association, as indenture trustee, securities intermediary and depositary bank, as amended, restated, modified or supplemented from time to time.

“2021-C Issuer” means Oportun Issuance Trust 2021-C, a Delaware statutory trust.

“2021-C Transaction Documents” means the “Transaction Documents” as defined in the 2021-C Indenture.

“2021-C Trust Agreement” means the Amended and Restated Trust Agreement relating to the 2021-C Issuer, dated as of October 28, 2021, among Oportun Depositor, LLC, as depositor, Wilmington Savings Fund Society, FSB, as owner trustee, and PF Servicing, LLC, as administrator, as amended, restated, modified or supplemented from time to time.

“2022-A Certificates” means the trust certificates issued by the 2022-A Issuer pursuant to the 2022-A Trust Agreement, representing the beneficial interest in the 2022-A Issuer and assigned CUSIP Number 68378N AE0.

“2022-A Class D Notes” means the Class D notes issued by the 2022-A Issuer pursuant to the 2022-A Indenture and assigned CUSIP Number 68378N AD2.

“2022-A Indenture” means the Indenture, dated as of May 23, 2022, between the 2022-A Issuer, and Wilmington Trust, National Association, as indenture trustee, securities intermediary and depositary bank, as amended, restated, modified or supplemented from time to time.

“2022-A Issuer” means Oportun Issuance Trust 2022-A, a Delaware statutory trust. “2022-A Purchase Agreement” means the Security Purchase Agreement (2022-A), dated

as of the 2022-A Purchase Date, among the Seller and the Issuer, relating to the purchase by the Issuer of the 2022-A Class D Notes and the 2022-A Certificates, as such agreement may be amended, supplemented or otherwise modified and in effect from time to time.

“2022-A Purchase Date” means May 24, 2022.

“2022-A Transaction Documents” means the “Transaction Documents” as defined in the 2022-A Indenture.

“2022-A Trust Agreement” means the Amended and Restated Trust Agreement relating to the 2022-A Issuer, dated as of May 23, 2022, among Oportun Depositor, LLC, as depositor, Wilmington Savings Fund Society, FSB, as owner trustee, and PF Servicing, LLC, as administrator, as amended, restated, modified or supplemented from time to time.

“2022-2 Certificates” means the trust certificates issued by the 2022-2 Issuer pursuant to the 2022-2 Trust Agreement, representing the beneficial interest in the 2022-2 Issuer and assigned CUSIP Number 68377H 104.

“2022-2 Issuer” means Oportun Issuance Trust 2022-2, a Delaware Statutory Trust. “2022-2 Purchase Date” means July 28, 2022.

“2022-2 Release Date” means December 20, 2023.

“2022-2 Trust Agreement” means the Amended and Restated Trust Agreement relating to the 2022-2 Issuer, dated as of July 22, 2022, among Oportun Depositor, LLC, as depositor, Wilmington Savings Fund Society, FSB, as owner trustee, and PF Servicing, LLC, as administrator, as amended, restated, modified or supplemented from time to time.

“Additional Notes” means any Notes issued after the Closing Date in accordance with Section 3.1.

“Additional Principal Payment Percentage” means, (I) for any Payment Date up to and including the July 2023 Payment Date, 0%, and (II) for any Payment Date on or after the August 2023 Payment Date, (a) if the Three-Month Average Underlying Loss Percentage for such Payment Date is less than or equal to 13.0%, 0.0%, (b) if the Three-Month Average Underlying Loss Percentage for such Payment Date is greater than 13.0% but less than or equal to 14.0%, 50.0%, (c) if the Three-Month Average Underlying Loss Percentage for such Payment Date is greater than 14.0% but less than or equal to 15.0%, 75.0%, and (d) if the Three-Month Average Underlying Loss Percentage for such Payment Date is greater than 15.0%, 100.0%.

“Adjusted Leverage Ratio” means, on any date of determination, the ratio of (i) Adjusted Liabilities to (ii) Tangible Net Worth.

“Adjusted Leverage Ratio Covenant” means that the Parent will have a maximum Adjusted Leverage Ratio of 3.5:1.

“Adjusted Liabilities” means, on any date of determination, the excess of total Liabilities over the amount of any asset-backed securities that would appear as liabilities on the balance sheet of the Parent and its Subsidiaries determined on a consolidated basis in accordance with GAAP.

“Administration Fee” means the fee payable to the Administrator pursuant to the Administrative Services Agreement.

“Administrative Services Agreement” means the Administrative Services and Premises Agreement, dated as of the Closing Date, between the Issuer and the Administrator, as amended, supplemented or otherwise modified from time to time.

“Administrator” means Oportun, as administrator of the Issuer pursuant to the Administrative Services Agreement.

“Administrator Default” has the meaning specified in the Administrative Services Agreement.

“Adverse Claim” means a Lien on any Person’s assets or properties in favor of any other Person (including any UCC financing statement or any similar instrument filed against such Person’s assets or properties), other than a Permitted Encumbrance.

“Affiliate” means, with respect to any Person, any other Person directly or indirectly controlling, controlled by, or under direct or indirect common control with, such Person. A Person shall be deemed to control another Person if the controlling Person possesses, directly or indirectly,

the power to direct or cause the direction of the management or policies of the controlled Person, whether through ownership of voting stock, by contract or otherwise.

“Agent” means any Transfer Agent and Registrar or Paying Agent.

“Alternative Rate” means, for any day, the sum of a per annum rate equal to the sum of (i) the rate set forth in the weekly statistical release designated as H.15(519), or any successor publication, published by the Federal Reserve Board (including any such successor, “H.15(519)”) for such day opposite the caption “Federal Funds (Effective)” and (ii) 0.50%. If on any relevant day such rate is not yet published in H. 15(519), the rate for such day will be the rate set forth in the daily statistical release designated as the Composite 3:30 p.m. Quotations for U.S. Government Securities, or any successor publication, published by the Federal Reserve Bank of New York (including any such successor, the “Composite 3:30 p.m. Quotations”) for such day

under the caption “Federal Funds Effective Rate.” If on any relevant day the appropriate rate is not yet published in either H.15(519) or the Composite 3:30 p.m. Quotations, the rate for such day will be the arithmetic mean as determined by the Calculation Agent of the rates for the last transaction in overnight Federal funds arranged before 9:00 a.m. (New York time) on that day by each of three leading brokers of Federal funds transactions in New York City selected by the Calculation Agent.

“Amortization Schedule” means the schedule of Payment Dates and corresponding Scheduled Note Principal Amounts attached hereto as Schedule 1, as amended from time to time with the prior written consent of the Noteholders.

“Applicable Margin” shall have the meaning set forth in the Fee Letter. “Applicants” has the meaning specified in Section 4.2(b).

“Available Funds” means, with respect to any Monthly Period and the Payment Date related thereto, the sum of the following, without duplication: (a) any Underlying Payments received in respect of the Underlying Securities on the Underlying Payment Date immediately following such Monthly Period and deposited into the Payment Account on such Underlying Payment Date; and (b) any Investment Earnings received with respect to the Trust Estate.

“Available Tenor” means, as of any date of determination and with respect to the then- current Benchmark, as applicable, any tenor for such Benchmark (or component thereof) or payment period for interest calculated with reference to such Benchmark (or component thereof), as applicable, that is or may be used for determining the length of an Interest Period for any term rate or otherwise, for determining any frequency of making payments of interest calculated pursuant to this Indenture as of such date.

“Bankruptcy Code” means the United States Bankruptcy Code, Title 11, United States, as amended.

“Benchmark” means, effective as of May 24, 2022, Term SOFR; provided that if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement to the extent that such Benchmark Replacement has replaced such prior benchmark rate pursuant to clause (a) of Section 5.13.

“Benchmark Replacement” means, for any Available Tenor, the first alternative set forth in the order below that can be determined by the Required Noteholders, in consultation with the Issuer, for the applicable Benchmark Replacement Date:

(1)the sum of: (a) Daily Simple SOFR and (b) the related Benchmark Replacement Adjustment; or

(2)the sum of: (a) the alternate benchmark rate that has been selected by the Required Noteholders and the Issuer as the replacement for the then-current Benchmark for the applicable Corresponding Tenor giving due consideration to (i) any selection or recommendation of a replacement benchmark rate or the mechanism for determining such a rate by the Relevant Governmental Body or (ii) any evolving or then-prevailing market convention for determining a benchmark rate as a replacement for the then-current Benchmark for dollar-denominated syndicated credit facilities at such time and (b) the related Benchmark Replacement Adjustment.

If the Benchmark Replacement as determined pursuant to clause (1) or (2) above would be less than the Floor, the Benchmark Replacement will be deemed to be the Floor for the purposes of this Indenture and the other Transaction Documents.

The Required Noteholders shall use commercially reasonable efforts to satisfy any applicable IRS guidance, including Proposed Treasury Regulation 1.1001-6 and any future guidance, to the effect that a Benchmark Replacement will not result in a deemed exchange for

U.S. federal income Tax purposes of any Class A Note hereunder.

“Benchmark Replacement Adjustment” means, with respect to any replacement of the then-current Benchmark with an Unadjusted Benchmark Replacement for any applicable Interest Period and Available Tenor for any setting of such Unadjusted Benchmark Replacement:

(1)for purposes of clause (1) of the definition of “Benchmark Replacement,” the first alternative set forth in the order below that can be determined by the Required Noteholders:

(a)the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) as of the Reference Time such Benchmark Replacement is first set for such Interest Period that has been selected or recommended by the Relevant Governmental Body for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for the applicable Corresponding Tenor; and

(b)the spread adjustment (which may be a positive or negative value or zero) as of the Reference Time such Benchmark Replacement is first set for such Interest Period that would apply to the fallback rate for a derivative transaction referencing the ISDA Definitions to be effective upon an index cessation event with respect to such Benchmark for the applicable Corresponding Tenor; and

(2)for purposes of clause (2) of the definition of “Benchmark Replacement,” the spread adjustment, or method for calculating or determining such spread adjustment,

(which may be a positive or negative value or zero) that has been selected by the Required Noteholders and the Issuer for the applicable Corresponding Tenor giving due consideration to (i) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body on the applicable Benchmark Replacement Date and/or (ii) any evolving or then- prevailing market convention for determining a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for dollar-denominated syndicated credit facilities at such time;

provided that, in the case of clause (1) above, such adjustment is displayed on a screen or other information service that publishes such Benchmark Replacement Adjustment from time to time as selected by the Required Noteholders in their reasonable discretion.

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark:

(1)in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of such Benchmark (or the

published component used in the calculation thereof) permanently or indefinitely ceases to provide all Available Tenors of such Benchmark (or such component thereof); or

(2)in the case of clause (3) of the definition of “Benchmark Transition Event,” the first date on which such Benchmark (or the published component used in the calculation thereof) has been determined and announced by the regulatory supervisor for the administrator of such Benchmark (or component thereof) to be no longer representative; provided that such non-representativeness will be determined by reference to the most recent statement or publication referenced in such clause (3) and even if any Available Tenor of such Benchmark (or component thereof) continues to be provided on such date.

For the avoidance of doubt, (i) if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination and (ii) the “Benchmark Replacement Date” will be deemed to have occurred in the case of clause (1) or (2) with respect to any Benchmark upon the occurrence of the applicable event or events set forth therein with respect to all then-current Available Tenors of such Benchmark (or the published component used in the calculation thereof).

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark:

(1)a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such administrator has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof), permanently or

indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof);

(2)a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof), the Federal Reserve Board, the NYFRB, an insolvency official with jurisdiction over the administrator for such Benchmark (or such component), a resolution authority with jurisdiction over the administrator for such Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark (or such component), which states that the administrator of such Benchmark (or such component) has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); or

(3)a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that all Available Tenors of such Benchmark (or such component thereof) are no longer, or as of a specified future date will no longer be, representative.

For the avoidance of doubt, a “Benchmark Transition Event” will be deemed to have occurred with respect to any Benchmark if a public statement or publication of information set

forth above has occurred with respect to each then-current Available Tenor of such Benchmark (or the published component used in the calculation thereof).

“Benchmark Unavailability Period” means the period (if any) (x) beginning at the time that a Benchmark Replacement Date pursuant to clauses (1) or (2) of that definition has occurred if, at such time, no Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Transaction Document in accordance with Section 5.13 and (y) ending at the time that a Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Transaction Document in accordance with Section 5.13.

“Benefit Plan Investor” mean an “employee benefit plan” as defined in Section 3(3) of ERISA, which is subject to Title I of ERISA, a “plan” as described in Section 4975 of the Code, which is subject to Section 4975 of the Code, or an entity deemed to hold plan assets of any of the foregoing.

“Book-Entry Notes” means Notes in which beneficial interests are owned and transferred through book entries by a Clearing Agency as described in Section 2.16; provided that after the occurrence of a condition whereupon book-entry registration and transfer are no longer permitted and Definitive Notes are issued to the Note Owners, such Definitive Notes shall replace Book- Entry Notes.

“Business Day” means any day that DTC is open for business at its office in New York City and any day other than a Saturday, Sunday or other day on which banking institutions or trust companies in the States of California, Florida, Illinois, Missouri, New York or Texas are authorized or obligated by Law to be closed.

“Calculation Agent” means the party designated as such by the Issuer from time to time, with the written consent of the Required Noteholders; initially, the Administrator. The compensation payable to the Administrator for the services performed by the Calculation Agent hereunder shall be included in the Administration Fee.

“Capitalized Lease” of a Person means any lease of property by such Person as lessee which would be capitalized on a balance sheet of such Person prepared in accordance with GAAP.

“Cash Equivalents” means (a) securities with maturities of one hundred twenty (120) days or less from the date of acquisition issued or fully guaranteed or insured by the United States government or any agency thereof, (b) certificates of deposit and eurodollar time deposits with maturities of one hundred twenty (120) days or less from the date of acquisition and overnight bank deposits of any commercial bank having capital and surplus in excess of $500,000,000, (c) repurchase obligations of any commercial bank satisfying the requirements of clause (b) of this definition, having a term of not more than seven (7) days with respect to securities issued or fully guaranteed or insured by the United States government, (d) commercial paper of a domestic issuer rated at least A-1 or the equivalent thereof by Standard and Poor’s or P-1 or the equivalent thereof by Moody’s and in either case maturing within ninety (90) days after the day of acquisition, (e) securities with maturities of ninety (90) days or less from the date of acquisition issued or fully guaranteed by any state, commonwealth or territory of the United States, by any political subdivision or taxing authority of any such state, commonwealth or territory or by any foreign government, the securities of which state, commonwealth, territory, political subdivision, taxing authority or foreign government (as the case may be) are rated at least A by Standard & Poor’s or A by Moody’s, (f) securities with maturities of ninety (90) days or less from the date of acquisition backed by standby letters of credit issued by any commercial bank satisfying the requirements of clause (b) of this definition or, (g) shares of money market mutual or similar funds which invest exclusively in assets satisfying the requirements of clauses (a) through (f) of this definition.

“Certificateholder” means a Holder of a Certificate.

“Certificates” has the meaning specified in paragraph (a) of the Designation. “Class A Additional Interest” has the meaning specified in Section 5.12(a). “Class A Deficiency Amount” has the meaning specified in Section 5.12(a). “Class A Monthly Interest” has the meaning specified in Section 5.12(a).

“Class A Note Rate” means, with respect to any Interest Period, a variable rate per annum equal to the sum of (i) the Benchmark applicable to such Interest Period (or if the Alternative Rate applies pursuant to Section 5.13, the Alternative Rate) plus (ii) the Applicable Margin.

“Class A Noteholder” means a Holder of a Class A Note.

“Class A Notes” has the meaning specified in paragraph (a) of the Designation.

“Clearing Agency” means an organization registered as a “clearing agency” pursuant to Section 17A of the Exchange Act or any successor provision thereto.

“Clearing Agency Participant” means a broker, dealer, bank, other financial institution or other Person for whom from time to time a Clearing Agency effects book-entry transfers and pledges of securities deposited with the Clearing Agency.

“Closing Date” means December 20, 2021.

“Code” means the Internal Revenue Code of 1986, as amended, and the rules and Treasury Regulations promulgated thereunder.

“Commission” means the U.S. Securities and Exchange Commission, and its successors. “Conforming Changes” means, with respect to any Benchmark Replacement, any

technical, administrative or operational changes (including changes to the definition of “Business Day,” the definition of “U.S. Government Securities Business Day,” the definition of “Interest Period,” timing and frequency of determining rates and making payments of interest, timing of borrowing requests or prepayment, conversion or continuation notices, length of lookback periods, the applicability of breakage provisions, and other technical, administrative or operational matters) that the Required Noteholders, in consultation with the Issuer, decide may be appropriate to reflect the adoption and implementation of such Benchmark Replacement and to permit the administration thereof in a manner substantially consistent with market practice (or, if the Required Noteholders decide that adoption of any portion of such market practice is not administratively feasible or if the Required Noteholders determine that no market practice for the administration of such Benchmark Replacement exists, in such other manner of administration as the Required Noteholders, in consultation with the Issuer, decide is reasonably necessary in connection with the administration of this Indenture and the other Transaction Documents).

“Consolidated Parent” means initially, Oportun Financial Corporation, a Delaware corporation, and any successor to Oportun Financial Corporation as the indirect or direct parent of Oportun, the financial statements of which are for financial reporting purposes consolidated with Oportun in accordance with GAAP, or if there is none, then Oportun.

“Contingent Liability” means any agreement, undertaking or arrangement by which any Person guarantees, endorses or otherwise becomes or is contingently liable upon (by direct or

indirect agreement, contingent or otherwise, to provide funds for payment, to supply funds to, or otherwise to invest in, a debtor, or otherwise to assure a creditor against loss) the indebtedness, obligation or any other liability of any other Person (other than by endorsements of instruments in the course of collection), or guarantees the payment of dividends or other distributions upon the shares of any other Person. The amount of any Person’s obligation under any Contingent Liability shall (subject to any limitation set forth therein) be deemed to be the outstanding principal amount (or maximum outstanding principal amount, if larger) of the debt, obligation or other liability guaranteed thereby.

“Contractual Obligation” means, with respect to any Person, any provision of any security issued by that Person or of any indenture, mortgage, deed of trust, contract, undertaking, agreement or other instrument to which that Person is a party or by which it or any of its properties is bound or to which it or any of its properties is subject.

“Corporate Trust Office” means the principal office of the Indenture Trustee at which at any particular time its corporate trust business shall be administered, which office at the date of the execution of this Indenture is located at 1100 N. Market Street, Wilmington, DE 19890, Attention: Corporate Trust Administration.

“Corresponding Tenor” with respect to any Available Tenor means, as applicable, either a tenor (including overnight) or an interest payment period having approximately the same length (disregarding business day adjustment) as such Available Tenor.

“Credit Risk Retention Rules” means Regulation RR (17 C.F.R. Part 246), as such rule may be amended from time to time, and subject to such clarification and interpretation as have been provided by the Department of Treasury, the Federal Reserve System, the Federal Deposit Insurance Corporation, the Federal Housing Finance Agency, the Securities and Exchange Commission and the Department of Housing and Urban Development in the adopting release (79 F.R. 77601 et seq.) or by the staff of any such agency, or as may be provided by any such agency or its staff from time to time, in each case, as effective from time to time.

“Custody Account” means each of the First Priority Custody Account and the Second Priority Custody Account.

“Custody Agreement” means the Custody Agreement, dated as of December 20, 2021, between the Issuer and Wilmington Trust, National Association, as custodian, as amended, supplemented or otherwise modified from time to time.

“Daily Simple SOFR” means, for any day, SOFR, with the conventions for this rate (which may include a lookback) being established by the Required Noteholders in accordance with the conventions for this rate selected or recommended by the Relevant Governmental Body for determining “Daily Simple SOFR” for business loans; provided, that if the Required Noteholders decide that any such convention is not administratively feasible, then the Required Noteholders may establish another convention in their reasonable discretion.

“Default” means any occurrence that is, or with notice or lapse of time or both would become, an Event of Default, an Administrator Default or a Rapid Amortization Event.

“Definitive Notes” has the meaning specified in Section 2.16(i). “Depository” means the Clearing Agency.

“Depository Agreement” means the agreement among the Issuer and the Clearing Agency.

“Determination Date” means the third Business Day prior to each Underlying Payment

Date.

“Dollars” and the symbol “$” mean the lawful currency of the United States. “DTC” means The Depository Trust Company.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the rules and regulations promulgated thereunder.

“ERISA Affiliate” means, with respect to any Person, (i) any corporation which is a member of the same controlled group of corporations (within the meaning of Section 414(b) of the Code) as such Person; (ii) any trade or business (whether or not incorporated) under common control (within the meaning of Section 414(c) of the Code) with such Person; or (iii) any member of the same affiliated service group (within the meaning of Section 414(m) of the Code) as such Person.

“ERISA Event” means any of the following: (i) the failure to satisfy the minimum funding standard under Section 302 of ERISA or Section 412 of the Code with respect to any Pension Plan;

(ii) the filing by the Pension Benefit Guaranty Corporation or a plan administrator of any notice relating to an intention to terminate any Pension Plan or Pension Plans or an event or condition which constitutes grounds under Section 4042 of ERISA for the termination of, or grounds to appoint a trustee to administer any Pension Plan; (iii) the complete withdrawal or partial withdrawal by any Person or any of its ERISA Affiliates from any Multiemployer Plan; (iv) any “reportable event” as defined in Section 4043 of ERISA or the regulations issued thereunder with respect to a Pension Plan (other than an event for which the 30-day notice period is waived), (v) the commencement of proceedings by the Pension Benefit Guaranty Corporation to terminate a Pension Plan or the treatment of a Pension Plan amendment as a termination under Section 4041 or 4041A of ERISA, or the termination of any Pension Plan (vi) the receipt by the Issuer, the Seller or any ERISA Affiliate of any notice concerning a determination that a Multiemployer Plan is, or is expected to be insolvent within the meaning of Title IV of ERISA; or (vii) the imposition of any liability under Title IV of ERISA, other than for Pension Benefit Guaranty Corporation premiums due but not delinquent under Section 4007 of ERISA, upon any Person or any of its ERISA Affiliates with respect to a Pension Plan.

“Event of Bankruptcy” shall be deemed to have occurred with respect to a Person if: