Oportun Announces Preliminary Q1 2024 Financial Information

Schedules First Quarter 2024 Earnings Release and Conference Call for Thursday, May 9, 2024

SAN CARLOS, Calif., April 22, 2024 — Oportun Financial Corporation (“Oportun” or the “Company”) (Nasdaq: OPRT), a mission-driven fintech, today announced certain preliminary unaudited financial and operating metrics for the first quarter ended March 31, 2024.

Preliminary Financial Results - First Quarter 2024

Based upon management's current expectations, the Company will report Total Revenue, Annualized Net Charge-Off Rate, 30+ Day Delinquency Rate, Net Loss, Adjusted EBITDA and Adjusted Net Income, for the first quarter as follows:

| | | | | | | | | | | | | | | | | | |

| Metric | Preliminary | Guidance | | | | |

| 1Q24 | 1Q24 | | | | 1Q23 | | |

| Total Revenue | $248 - $250 million | $233 - $238 million | | | | $259.5 million | | |

Annualized Net Charge-Off Rate | 12.0% | 12.1% +/- 15 bps | | | | 12.1% | | |

| 30+ Day Delinquency Rate | 5.2% | 5.1% - 5.3% 2 | | | | 5.5% | | |

Net Income (Loss) | $(30) - $(26) million | N/A | | | | $(102.1) million | | |

Adjusted EBITDA 1 | $0 - $4 million | $(14) - $(12) million | | | | $(20.2) million | | |

Adjusted Net Income (Loss) 1 | $0 - $4 million | N/A | | | | $(57.7) million | | |

1 Our calculations of Adjusted EBITDA and Adjusted Net Income were updated in Q1 2024 to more closely align with management’s internal view of the performance of the business. The Q1 2023 values for Adjusted EBITDA and Adjusted Net Income shown in the table above have been revised and presented on a comparable basis. Prior to these revisions the Q1 2023 values would have been $(24.5) million and $(88.3) million, respectively. See About Non-GAAP Financial Measures — Adjusted EBITDA and — Adjusted Net Income (Loss) for more detail. | | |

2 As indicated on page 11 of the Company's 4Q 2023 Earnings Presentation. | | |

“We are pleased to report preliminary indications of a strong first quarter,” said Raul Vazquez, CEO of Oportun. “We expect to deliver a resilient top-line performance with Total Revenue exceeding the top end of our guidance range by $10 to $12 million. Our tightened credit posture contributed to delivering annualized net charge-offs in the bottom half of our guidance range and below the net charge-off rate from last year. Additionally, our 30+ Day Delinquency Rate is 21 basis points lower than last year. On a GAAP basis, we expect Net Loss for the quarter to have improved by $72 to $76 million compared to last year. Given strong Total Revenue, improved credit performance and continued expense discipline, we also expect to be break-even to profitable on an Adjusted Net Income basis, an increase of $58 to $62 million over last year. We expect Adjusted EBITDA to be positive and $12 to $16 million above the top end of our guidance range, a $20 to $24 million increase compared to last year. As these results demonstrate, we continue to make significant progress towards driving sustainable, profitable earnings growth, and shareholder value.”

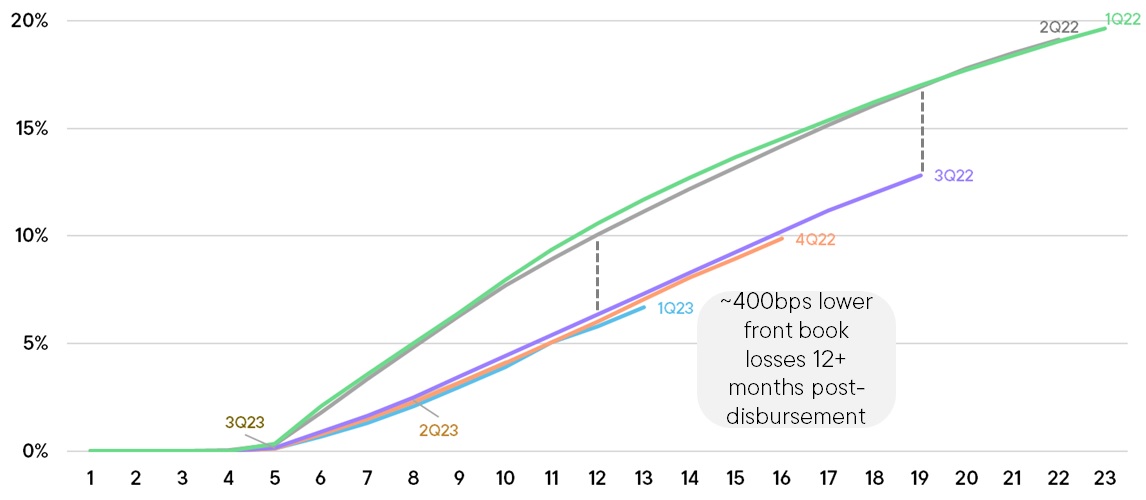

Improving Credit Trends

In addition, following the Company's July 2022 credit tightening, quarterly vintages continue to outperform prior vintages in net lifetime loss rate by month on book as set forth below.

Post-July 2022 credit tightening quarterly vintages are outperforming prior vintages in net lifetime loss rate by month on book.

Note: 3Q22 vintage only includes August and September 2022.

Earnings Release and Conference Call

Oportun will report earnings for the first quarter 2024 on Thursday, May 9, 2024 after market close. Management will host a conference call to discuss first quarter 2024 results at 5:00 p.m. ET (2:00 p.m. PT) on the same today. A live webcast of the call will be accessible from Oportun’s investor relations website at investor.oportun.com, and a webcast replay of the call will be available for one year. The dial-in number for the conference call is 1-866-604-1698 (toll-free) or 1-201-389-0844 (international). Participants should call in 10 minutes prior to the scheduled start time.

Preliminary Information

Numbers are as of March 31, 2024, and are unaudited, preliminary and subject to change upon completion of the Company’s closing process. As a result, the Company's final results may vary materially from the preliminary results included in this press release. Oportun undertakes no obligation to update or supplement the information provided in this press release until the Company releases its financial statements for the three months ended March 31, 2024. The preliminary financial information included in this press release reflects the Company's current estimates based on information available as of the date of this press release. This preliminary financial and operational information should not be viewed as a substitute for full financial statements prepared in accordance with GAAP and is not necessarily indicative of the results to be achieved for any future periods. This preliminary financial information could be impacted by the effects of financial closing procedures, final adjustments, and other developments.

About Oportun

Oportun (Nasdaq: OPRT) is a mission-driven fintech that puts its 2.2 million members' financial goals within reach. With intelligent borrowing, savings, and budgeting capabilities, Oportun empowers members with the confidence to build a better financial future. Since inception, Oportun has provided more than $17.8 billion in responsible and affordable credit, saved its members more than $2.4 billion in interest and fees, and helped its members save an average of more than $1,800 annually. For more information, visit Oportun.com.

Forward-Looking Statements

This press release contains forward-looking statements. These forward-looking statements are subject to the safe harbor provisions under the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact contained in this press release, including statements as to future performance, results of operations and financial position; the Company's preliminary financial results for the first quarter of 2024; the Company's expectations related to sustainable and profitable earnings growth and the creation of shareholder value are forward-looking statements. These statements can be generally identified by terms such as “expect,” “plan,” “goal,” “target,” “anticipate,” “assume,” “predict,” “project,” “outlook,” “continue,” “due,” “may,” “believe,” “seek,” or “estimate” and similar expressions or the negative versions of these words or comparable words, as well as future or conditional verbs such as “will,” “should,” “would,” “likely” and “could.” These statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause Oportun’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Oportun has based these forward-looking statements on its current expectations and projections about future events, financial trends and risks and uncertainties that it believes may affect its business, financial condition and results of operations. These risks and uncertainties include those risks described in Oportun's filings with the Securities and Exchange Commission, including Oportun's most recent annual report on Form 10-K. These forward-looking statements speak only as of the date on which they are made and, except to the extent required by federal securities laws, Oportun disclaims any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In light of these risks and uncertainties, there is no assurance that the events or results suggested by the forward-looking statements will in fact occur, and you should not place undue reliance on these forward-looking statements.

Investor Contact

Dorian Hare

(650) 590-4323

ir@oportun.com

Media Contact

Usher Lieberman

(720) 987-9538

usher.lieberman@oportun.com

About Non-GAAP Financial Measures

This press release presents information about the Company’s Adjusted EBITDA and Adjusted Net Income, which are non-GAAP financial measures provided as a supplement to the results provided in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Company believes non-GAAP measures can be useful measures for period-to-period comparisons of its core business and provide useful information to investors and others in understanding and evaluating its operating results. Non-GAAP financial measures are provided in addition to, and not as a substitute for, and are not superior to, financial measures calculated in accordance with GAAP. In addition, the non-GAAP measures the Company uses, as presented, may not be comparable to similar measures used by other companies. Reconciliations of non-GAAP to GAAP measures can be found below.

As previously announced on March 12, 2024, beginning with the quarter ended March 31, 2024 the Company has updated it's calculation of Adjusted EBITDA and Adjusted Net Income for all periods. Comparable prior period Non-GAAP financial measures are included in addition to the previously reported metrics.

Adjusted EBITDA

The Company defines Adjusted EBITDA as net income, adjusted to eliminate the effect of certain items as described below. The Company believes that Adjusted EBITDA is an important measure because it allows management, investors and its board of directors to evaluate and compare operating results, including return on capital and operating efficiencies, from period to period by making the adjustments described below. In addition, it provides a useful measure for period-to-period comparisons of Oportun's business, as it removes the effect of income taxes, certain non-cash items, variable charges and timing differences.

•The Company believes it is useful to exclude the impact of income tax expense, as reported, because historically it has included irregular income tax items that do not reflect ongoing business operations.

•The Company believes it is useful to exclude depreciation and amortization and stock-based compensation expense because they are non-cash charges.

•The Company believes it is useful to exclude the impact of interest expense associated with the Company's corporate financing facilities, including the senior secured term loan and the residual financing facility, as it views this expense as related to its capital structure rather than its funding.

•The Company excludes the impact of certain non-recurring charges, such as expenses associated with our workforce optimization, and other non-recurring charges because it does not believe that these items reflect ongoing business operations. Other non-recurring charges include litigation reserve, impairment charges, debt amendment and warrant amortization costs related to our corporate financing facilities.

•The Company also excludes fair value mark-to-market adjustments on its loans receivable portfolio and asset-backed notes carried at fair value because these adjustments do not impact cash.

Adjusted Net Income

The Company defines Adjusted Net Income as net income adjusted to eliminate the effect of certain items as described below. The Company believes that Adjusted Net Income is an important measure of operating performance because it allows management, investors, and the Company's board of directors to evaluate and compare its operating results, including return on capital and operating efficiencies, from period to period, excluding the after-tax impact of non-cash, stock-based compensation expense and certain non-recurring charges.

•The Company believes it is useful to exclude the impact of income tax expense (benefit), as reported, because historically it has included irregular income tax items that do not reflect ongoing business operations. The Company also includes the impact of normalized income tax expense by applying a normalized statutory tax rate.

•The Company believes it is useful to exclude the impact of certain non-recurring charges, such as expenses associated with our workforce optimization, and other non-recurring charges because it does not believe that these items reflect its ongoing business operations. Other non-recurring charges include litigation reserve, impairment charges, debt amendment and warrant amortization costs related to our corporate financing facilities.

•The Company believes it is useful to exclude stock-based compensation expense because it is a non-cash charge.

•The Company also excludes the fair value mark-to-market adjustment on its asset-backed notes carried at fair value to align with the 2023 accounting policy decision to account for new debt financings at amortized cost.

Reconciliation of Non-GAAP Financial Measures

Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, | | |

| (dollars in millions) | | | | 2024 | | | 2023* | | | | |

| | | | | | | | | | | |

| Net income (loss) | | | | $ (30) - (26) | | | $ | (102.1) | | | | | |

| Adjustments: | | | | | | | | | | | |

| | | | | | | | | | | |

| Income tax expense (benefit) | | | | (5.1) - (4.0) | | | (39.4) | | | | | |

| | | | | | | | | | | |

Interest on corporate financing (1) | | | | 13.9 | | | | 9.8 | | | | | |

| Depreciation and amortization | | | | 13.2 | | | | 13.4 | | | | | |

| | | | | | | | | | | |

| Stock-based compensation expense | | | | 4.0 | | | | 4.5 | | | | | |

| | | | | | | | | | | |

Workforce optimization expenses | | | | 0.8 | | | | 6.8 | | | | | |

| | | | | | | | | | | |

Other non-recurring charges (1) | | | | 3.5 | | | | 2.3 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Fair value mark-to-market adjustment | | | | (0.3)- (1.4) | | | 84.5 | | | | | |

| Adjusted EBITDA | | | | $ 0.0 - 4.0 | | | $ | (20.2) | | | | | |

| | | | | | | | | | | |

(1) Certain prior-period financial information has been reclassified to conform to current period presentation. | | | | | | | | | | | |

* Our calculation of Adjusted EBITDA was updated in Q1 2024 to more closely align with management’s internal view of the performance of the business. The Q1 2023 value for Adjusted EBITDA shown in the table above has been revised and presented on a comparable basis. Prior to these revisions the Q1 2023 value would have been $(24.5) million. |

Adjusted Net Income (Loss)

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| (dollars in millions) | | | 2024 | | 2023* |

| Net income (loss) | | | $ (30) - (26) | | $ | (102.1) | |

| Adjustments: | | | | | |

| | | | | |

| Income tax expense (benefit) | | | (5.1) - (4.0) | | (39.4) | |

| | | | | |

| | | | | |

| Stock-based compensation expense | | | 4.0 | | | 4.5 | |

| | | | | |

Workforce optimization expenses | | | 0.8 | | | 6.8 | |

| | | | | |

| | | | | |

Other non-recurring charges (1) | | | 3.5 | | | 2.3 | |

Mark-to-market adjustment on ABS notes | | | 26.8 - 27.2 | | 48.9 | |

| Adjusted income before taxes | | | $0.0 - 5.5 | | (79.0) | |

| Normalized income tax expense | | | 0.0 - 1.5 | | (21.3) | |

Adjusted Net Income (Loss) | | | $ 0.0 - 4.0 | | $ | (57.7) | |

| | | | | |

(1) Certain prior-period financial information has been reclassified to conform to current period presentation. | | | | | |

* Our calculation of Adjusted Net Income (Loss) was updated in Q1 2024 to more closely align with management’s internal view of the performance of the business. The Q1 2023 value for Adjusted Net Income (Loss) shown in the table above has been revised and presented on a comparable basis. Prior to these revisions the Q1 2023 value would have been $(88.3) million. |

Note: Numbers may not foot or cross-foot due to rounding.