Business Update October 29, 2024

2 Forward-looking statements This presentation and the accompanying oral presentation contain forward-looking statements. All statements other than statements of historical fact contained in this presentation and the accompanying oral presentation, including statements as to future performance, results of operations and financial position; statements related to the effectiveness of the Company’s cost reduction measures and the impacts on the Company's business; achievement of our strategic priorities and goals; our expectations regarding the impact of the anticipated sale of our credit card portfolio, including expected timelines; our expectations regarding the impact of the corporate debt refinancing; the Company’s preliminary financial results for the third quarter of 2024; the Company’s full year 2025 outlook; our profitability and future growth opportunities; business strategy; and plans and objectives of management for future operations of Oportun Financial Corporation (“Oportun,” "we," "us," "our," or the “Company”), are forward-looking statements. These statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the Company’s actual results and financial position, as well as our plans, objectives and expectations for our performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include those risks described in Oportun's filings with the Securities and Exchange Commission under the caption "Risk Factors", including the Company's most recent annual report on Form 10-K, and include, but are not limited to: our ability to retain existing members and attract new members; our ability to accurately predict demand for, and develop, our financial products and services; the effectiveness of our A.I. model; macroeconomic conditions, including rising inflation and market interest rates; Oportun’s future financial performance, including trends in revenue, net revenue, operating expenses, and net income; increases in loan non-payments, delinquencies and charge-offs; Oportun’s ability to operate successfully in a highly regulated industry; Oportun's ability to increase market share and enter into new markets; Oportun's ability to realize the benefits from acquisitions and integrate acquired technologies; the risk of security breaches or incidents affecting the Company's information technology systems or those of the Company's third-party vendors or service providers; Oportun's ability to successfully offer loans in additional states; Oportun’s ability to compete successfully with companies that are currently in, or may in the future enter, our industry; changes in Oportun's ability to obtain additional financing on acceptable terms or at all; and Oportun's potential need to seek additional strategic alternatives, including restructuring or refinancing its debt, seeking additional debt or equity capital, or reducing or delaying its business activities. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” or the negative of these terms or other similar words. These forward-looking statements are subject to the safe harbor provisions under the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are only predictions. Oportun has based these forward-looking statements on its current expectations and projections about future events, financial trends and risks and uncertainties that it believes may affect its business, financial condition and results of operations. Also, these forward-looking statements represent the Company’s estimates and assumptions only as of the date of this presentation. The Company assumes no obligation to update any forward-looking statements after the date of this presentation, except as required by law. This presentation also contains estimates and other statistical data made by independent parties and by the Company relating to market size and growth and other industry data. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. The Company has not independently verified the statistical and other industry data generated by independent parties and contained in this presentation and, accordingly, it cannot guarantee their accuracy or completeness. In addition, projections, assumptions and estimates of its future performance and the future performance of the industries in which it operates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by Oportun. You should view this presentation and the accompanying oral presentation with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. This presentation includes certain non-GAAP financial measures. Non-GAAP financial measures are presented in addition to, and not as a substitute for, and are not superior to, financial measures calculated in accordance with GAAP. The Company believes these Non-GAAP measures can be useful measures for period-to-period comparisons of our core business and provide useful information to investors and others in understanding and evaluating our operating results. Non-GAAP financial measures are provided in addition to, and not as a substitute for, and are not superior to, financial measures calculated in accordance with GAAP. In addition, the non-GAAP measures we use, as presented, may not be comparable to similar measures used by other companies. See the Appendix for a reconciliation of non-GAAP financial measures to the most comparable measure, calculated in accordance with GAAP. All financial information and other metrics used in this presentation are as of June 30, 2024, unless otherwise noted.

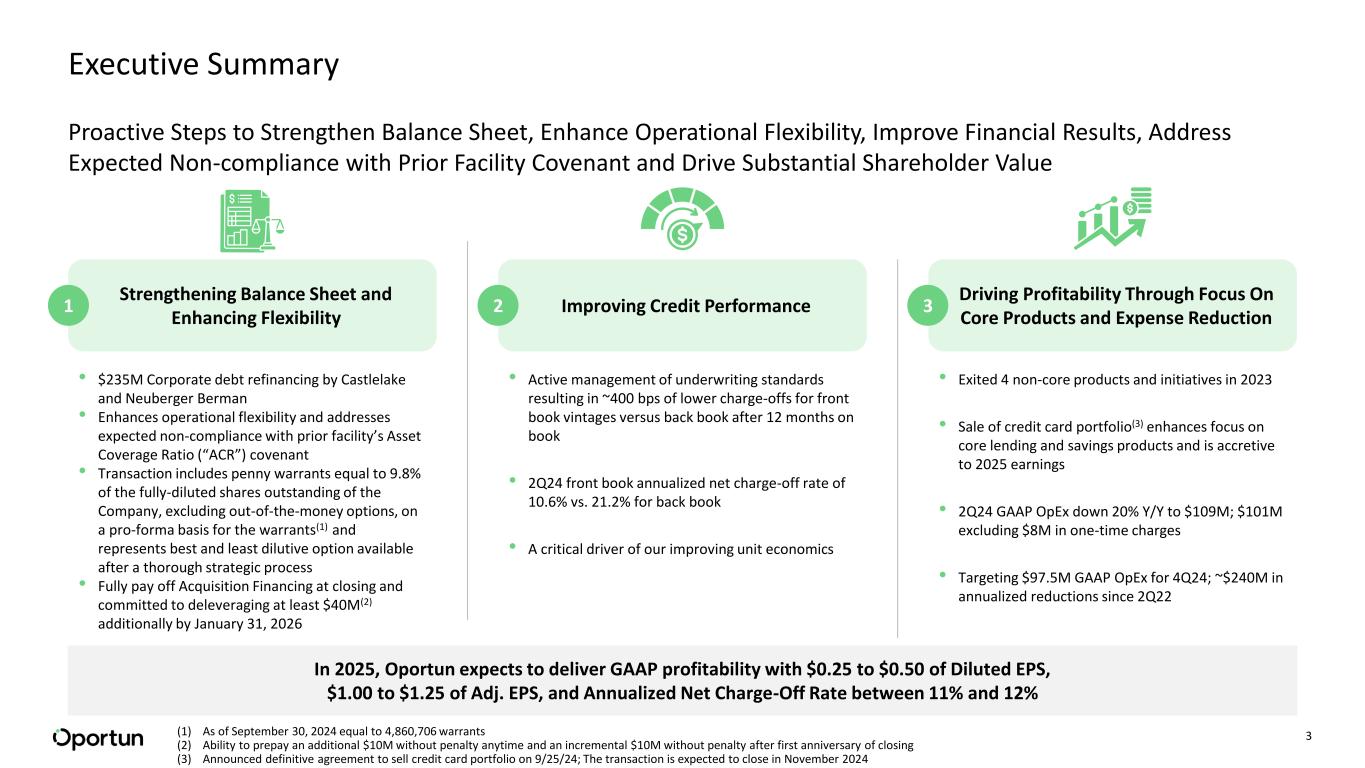

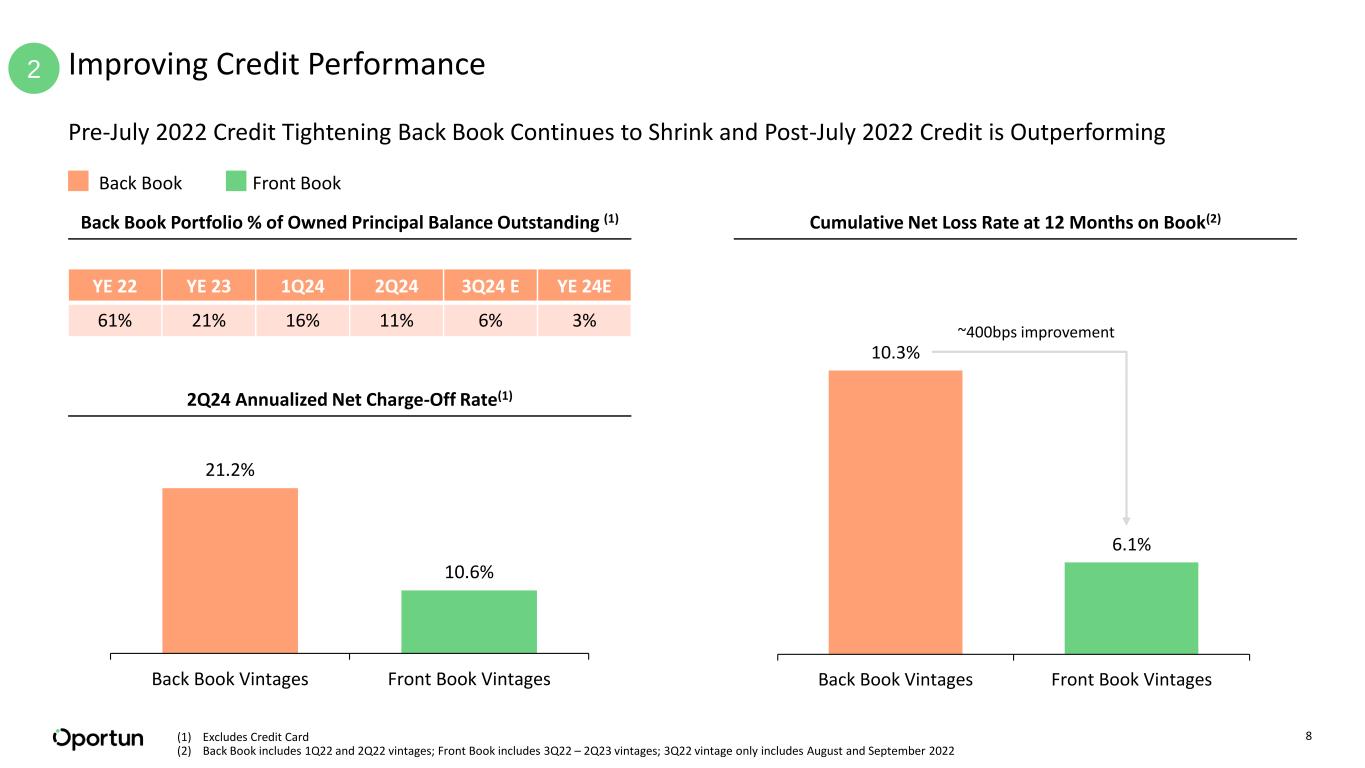

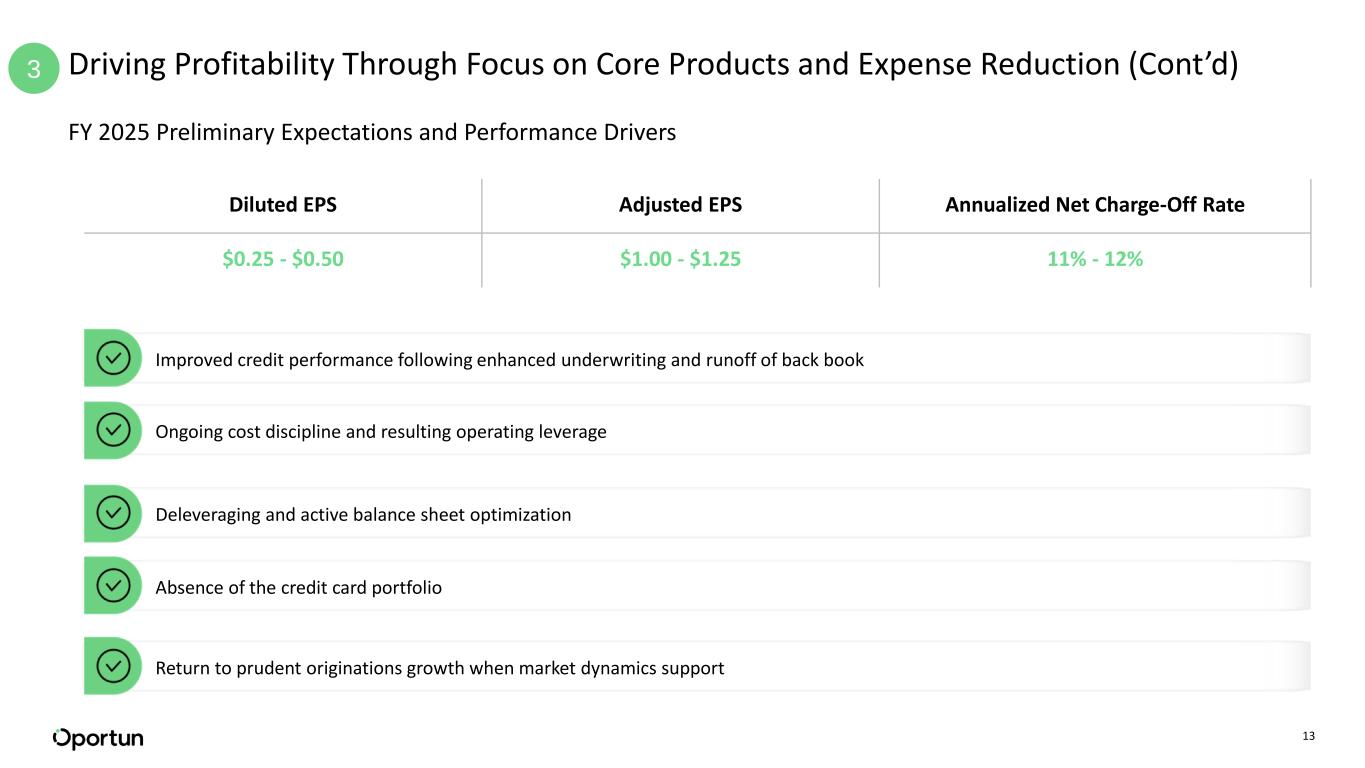

3 In 2025, Oportun expects to deliver GAAP profitability with $0.25 to $0.50 of Diluted EPS, $1.00 to $1.25 of Adj. EPS, and Annualized Net Charge-Off Rate between 11% and 12% Executive Summary Proactive Steps to Strengthen Balance Sheet, Enhance Operational Flexibility, Improve Financial Results, Address Expected Non-compliance with Prior Facility Covenant and Drive Substantial Shareholder Value • $235M Corporate debt refinancing by Castlelake and Neuberger Berman • Enhances operational flexibility and addresses expected non-compliance with prior facility’s Asset Coverage Ratio (“ACR”) covenant • Transaction includes penny warrants equal to 9.8% of the fully-diluted shares outstanding of the Company, excluding out-of-the-money options, on a pro-forma basis for the warrants(1) and represents best and least dilutive option available after a thorough strategic process • Fully pay off Acquisition Financing at closing and committed to deleveraging at least $40M(2) additionally by January 31, 2026 Strengthening Balance Sheet and Enhancing Flexibility 1 • Active management of underwriting standards resulting in ~400 bps of lower charge-offs for front book vintages versus back book after 12 months on book • 2Q24 front book annualized net charge-off rate of 10.6% vs. 21.2% for back book • A critical driver of our improving unit economics Improving Credit Performance 2 • Exited 4 non-core products and initiatives in 2023 • Sale of credit card portfolio(3) enhances focus on core lending and savings products and is accretive to 2025 earnings • 2Q24 GAAP OpEx down 20% Y/Y to $109M; $101M excluding $8M in one-time charges • Targeting $97.5M GAAP OpEx for 4Q24; ~$240M in annualized reductions since 2Q22 Driving Profitability Through Focus On Core Products and Expense Reduction 3 (1) As of September 30, 2024 equal to 4,860,706 warrants (2) Ability to prepay an additional $10M without penalty anytime and an incremental $10M without penalty after first anniversary of closing (3) Announced definitive agreement to sell credit card portfolio on 9/25/24; The transaction is expected to close in November 2024

4 • At the beginning of 2024, the Board of Directors of Oportun launched a process to explore strategic options, including a potential refinance of its senior secured corporate financing facility • After a thorough and competitive process, where multiple strategic options were considered, the Board of Directors of Oportun concluded that a refinance transaction with Castlelake and Neuberger Berman maximizes shareholder value ✓ Positions Company to deliver on its strategic objectives ✓ Improves operational flexibility ✓ Addresses expected non-compliance with prior facility’s ACR covenant ✓ Supports continued deleveraging ✓ Least dilutive option available • The Company has long standing relationships with the lenders, both of whom are familiar with and supportive of Company’s progress and strategy Strengthening Balance Sheet and Enhancing Flexibility1 Refinance Transaction is the Result of Thorough and Competitive Strategic Process Castlelake, L.P. is a global alternative investment manager focused on asset based investments. Founded in 2005, Castlelake manages approximately $24 billion of assets on behalf of a diversified global investor base Neuberger Berman is a private, independent, employee-owned, investment management firm. Founded in 1939, the firm manages $509 billion in assets as of September 30, 2024 across a broad set of strategies

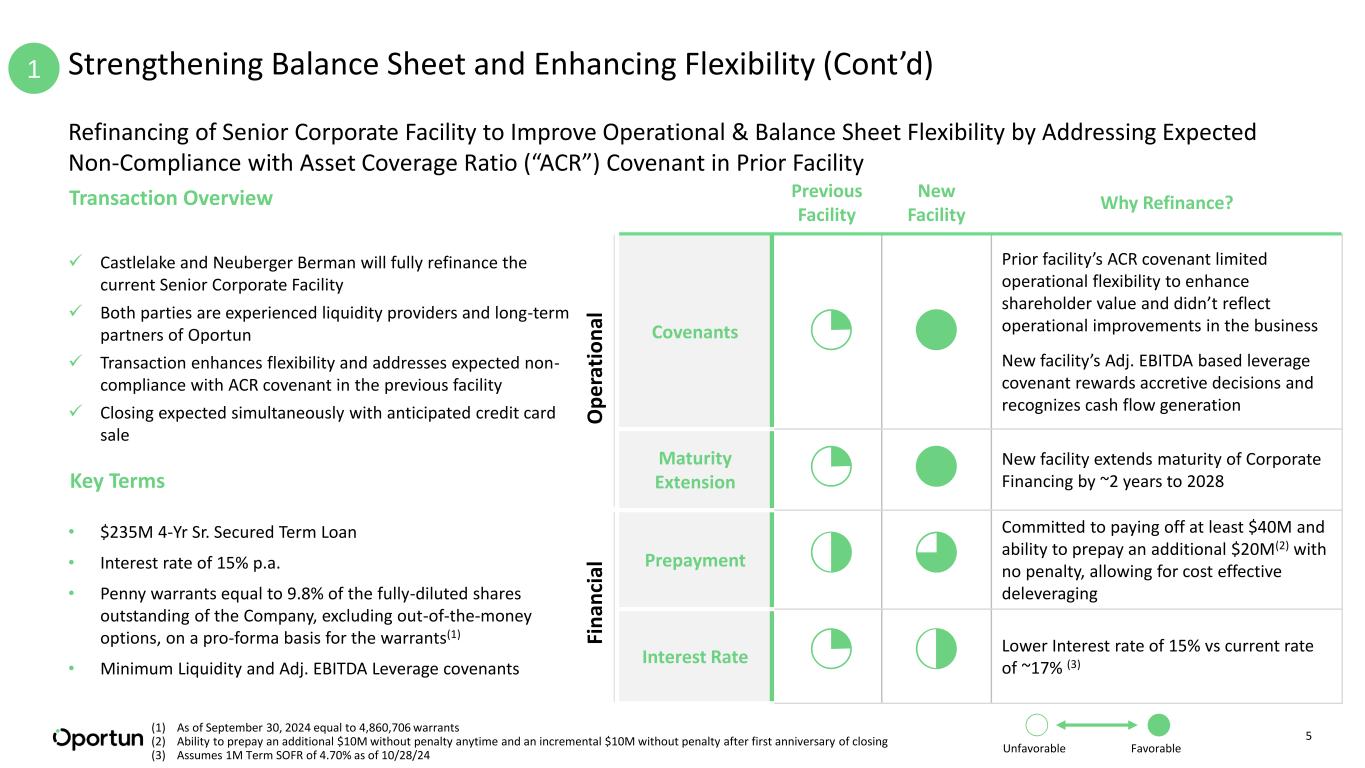

5 Previous Facility New Facility Why Refinance? Covenants Prior facility’s ACR covenant limited operational flexibility to enhance shareholder value and didn’t reflect operational improvements in the business New facility’s Adj. EBITDA based leverage covenant rewards accretive decisions and recognizes cash flow generation Maturity Extension New facility extends maturity of Corporate Financing by ~2 years to 2028 Prepayment Committed to paying off at least $40M and ability to prepay an additional $20M(2) with no penalty, allowing for cost effective deleveraging Interest Rate Lower Interest rate of 15% vs current rate of ~17% (3) O p e ra ti o n al Fi n an ci al (1) As of September 30, 2024 equal to 4,860,706 warrants (2) Ability to prepay an additional $10M without penalty anytime and an incremental $10M without penalty after first anniversary of closing (3) Assumes 1M Term SOFR of 4.70% as of 10/28/24 Strengthening Balance Sheet and Enhancing Flexibility (Cont’d)1 Refinancing of Senior Corporate Facility to Improve Operational & Balance Sheet Flexibility by Addressing Expected Non-Compliance with Asset Coverage Ratio (“ACR”) Covenant in Prior Facility Unfavorable Favorable • $235M 4-Yr Sr. Secured Term Loan • Interest rate of 15% p.a. • Penny warrants equal to 9.8% of the fully-diluted shares outstanding of the Company, excluding out-of-the-money options, on a pro-forma basis for the warrants(1) • Minimum Liquidity and Adj. EBITDA Leverage covenants Transaction Overview ✓ Castlelake and Neuberger Berman will fully refinance the current Senior Corporate Facility ✓ Both parties are experienced liquidity providers and long-term partners of Oportun ✓ Transaction enhances flexibility and addresses expected non- compliance with ACR covenant in the previous facility ✓ Closing expected simultaneously with anticipated credit card sale Key Terms

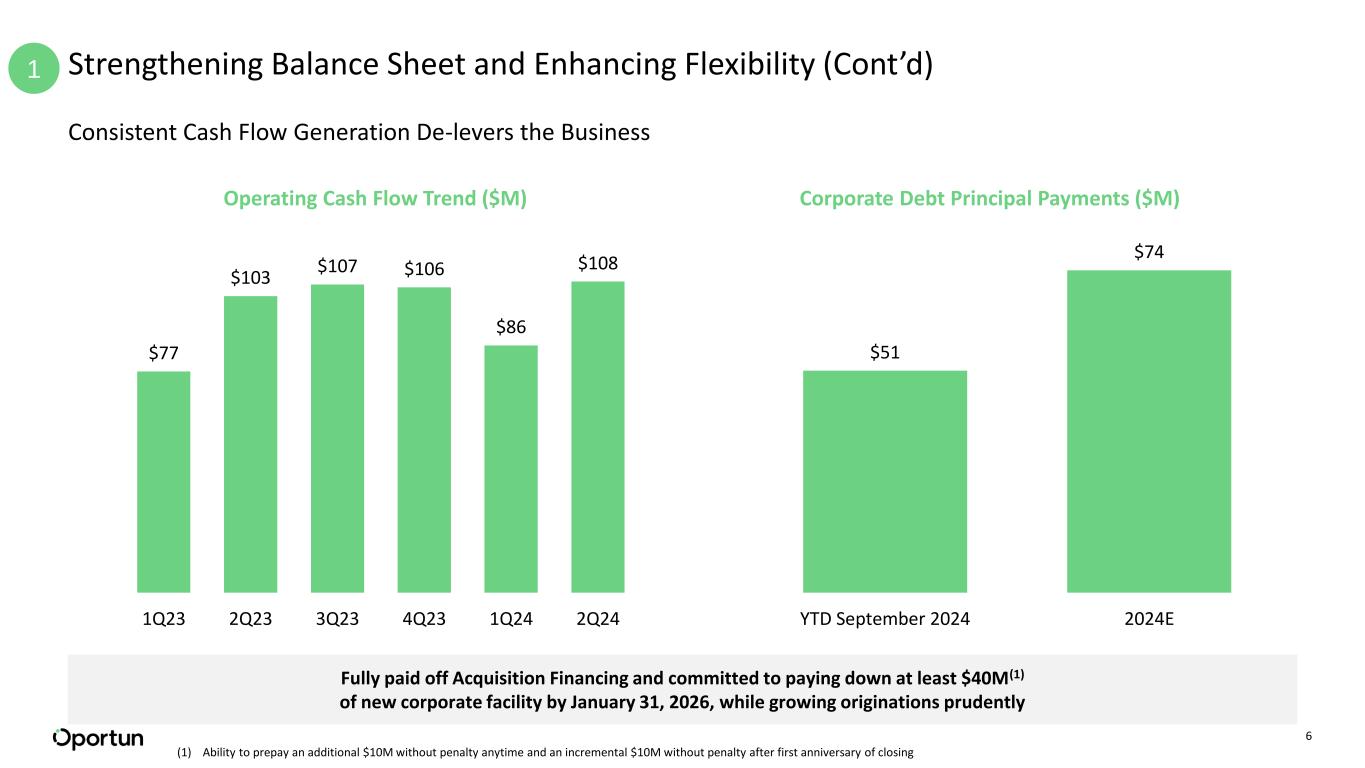

6 $77 $103 $107 $106 $86 $108 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 (1) Ability to prepay an additional $10M without penalty anytime and an incremental $10M without penalty after first anniversary of closing Strengthening Balance Sheet and Enhancing Flexibility (Cont’d)1 Consistent Cash Flow Generation De-levers the Business Operating Cash Flow Trend ($M) $51 $74 YTD September 2024 2024E Corporate Debt Principal Payments ($M) Fully paid off Acquisition Financing and committed to paying down at least $40M(1) of new corporate facility by January 31, 2026, while growing originations prudently

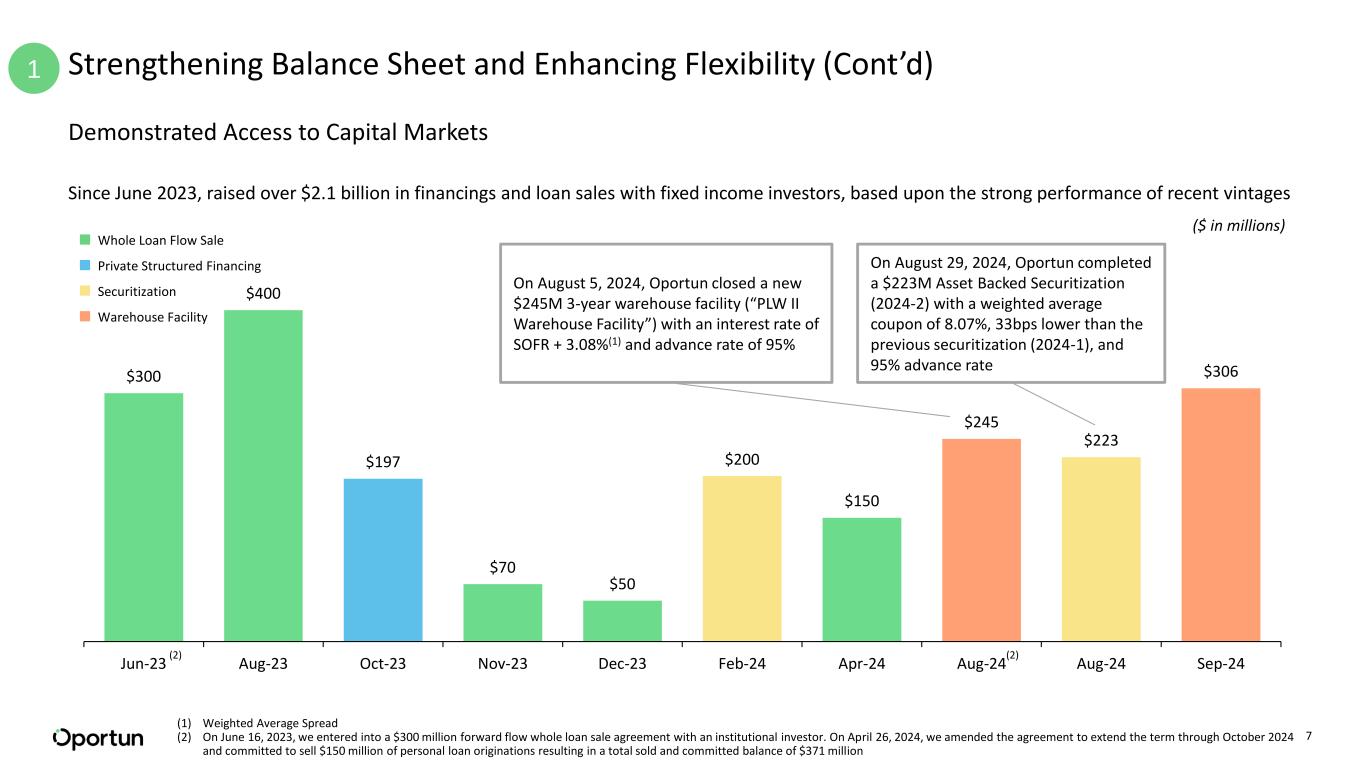

7 $300 $400 $197 $70 $50 $200 $150 $245 $223 $306 Jun-23 Aug-23 Oct-23 Nov-23 Dec-23 Feb-24 Apr-24 Aug-24 Aug-24 Sep-24 Strengthening Balance Sheet and Enhancing Flexibility (Cont’d)1 Demonstrated Access to Capital Markets Since June 2023, raised over $2.1 billion in financings and loan sales with fixed income investors, based upon the strong performance of recent vintages (1) Weighted Average Spread (2) On June 16, 2023, we entered into a $300 million forward flow whole loan sale agreement with an institutional investor. On April 26, 2024, we amended the agreement to extend the term through October 2024 and committed to sell $150 million of personal loan originations resulting in a total sold and committed balance of $371 million On August 5, 2024, Oportun closed a new $245M 3-year warehouse facility (“PLW II Warehouse Facility”) with an interest rate of SOFR + 3.08%(1) and advance rate of 95% Whole Loan Flow Sale Private Structured Financing Securitization Warehouse Facility (2) (2) ($ in millions) On August 29, 2024, Oportun completed a $223M Asset Backed Securitization (2024-2) with a weighted average coupon of 8.07%, 33bps lower than the previous securitization (2024-1), and 95% advance rate

8 Improving Credit Performance 2 Pre-July 2022 Credit Tightening Back Book Continues to Shrink and Post-July 2022 Credit is Outperforming (1) Excludes Credit Card (2) Back Book includes 1Q22 and 2Q22 vintages; Front Book includes 3Q22 – 2Q23 vintages; 3Q22 vintage only includes August and September 2022 Back Book Portfolio % of Owned Principal Balance Outstanding (1) Cumulative Net Loss Rate at 12 Months on Book(2) Front BookBack Book 10.3% 6.1% Back Book Vintages Front Book Vintages ~400bps improvement YE 22 YE 23 1Q24 2Q24 3Q24 E YE 24E 61% 21% 16% 11% 6% 3% 21.2% 10.6% Back Book Vintages Front Book Vintages 2Q24 Annualized Net Charge-Off Rate(1)

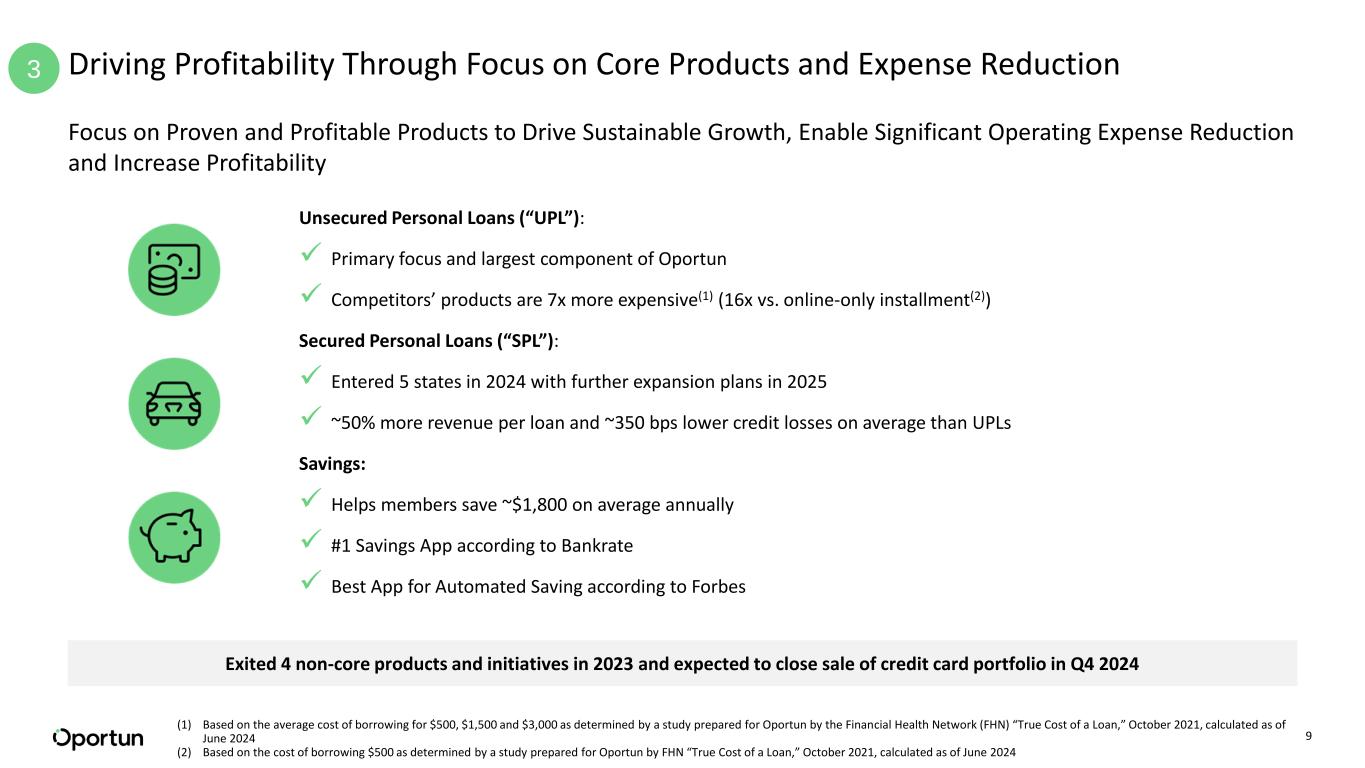

9 Driving Profitability Through Focus on Core Products and Expense Reduction Focus on Proven and Profitable Products to Drive Sustainable Growth, Enable Significant Operating Expense Reduction and Increase Profitability Unsecured Personal Loans (“UPL”): ✓ Primary focus and largest component of Oportun ✓ Competitors’ products are 7x more expensive(1) (16x vs. online-only installment(2)) Secured Personal Loans (“SPL”): ✓ Entered 5 states in 2024 with further expansion plans in 2025 ✓ ~50% more revenue per loan and ~350 bps lower credit losses on average than UPLs Savings: ✓ Helps members save ~$1,800 on average annually ✓ #1 Savings App according to Bankrate ✓ Best App for Automated Saving according to Forbes Exited 4 non-core products and initiatives in 2023 and expected to close sale of credit card portfolio in Q4 2024 (1) Based on the average cost of borrowing for $500, $1,500 and $3,000 as determined by a study prepared for Oportun by the Financial Health Network (FHN) “True Cost of a Loan,” October 2021, calculated as of June 2024 (2) Based on the cost of borrowing $500 as determined by a study prepared for Oportun by FHN “True Cost of a Loan,” October 2021, calculated as of June 2024 3

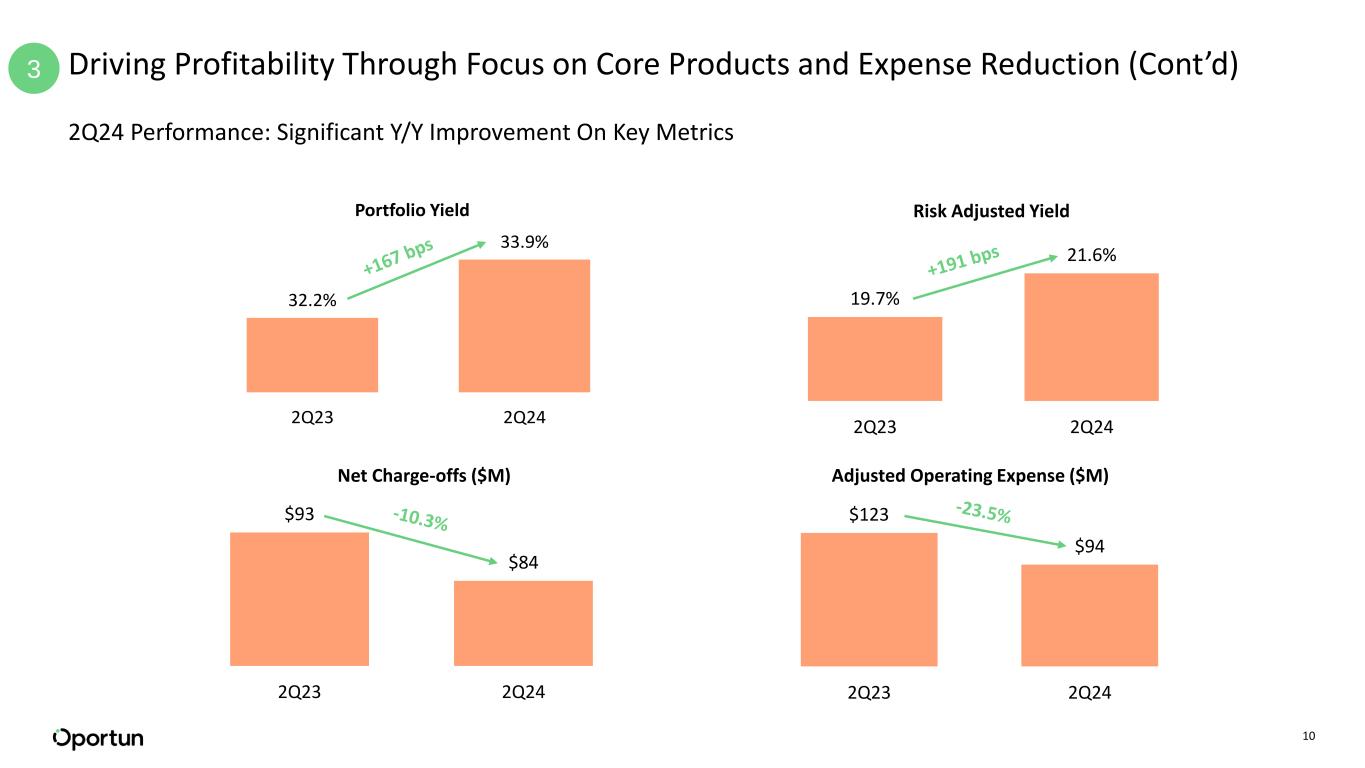

10 3 Driving Profitability Through Focus on Core Products and Expense Reduction (Cont’d) 32.2% 33.9% 2Q23 2Q24 Portfolio Yield 19.7% 21.6% 2Q23 2Q24 Risk Adjusted Yield $93 $84 2Q23 2Q24 Net Charge-offs ($M) $123 $94 2Q23 2Q24 Adjusted Operating Expense ($M) 2Q24 Performance: Significant Y/Y Improvement On Key Metrics

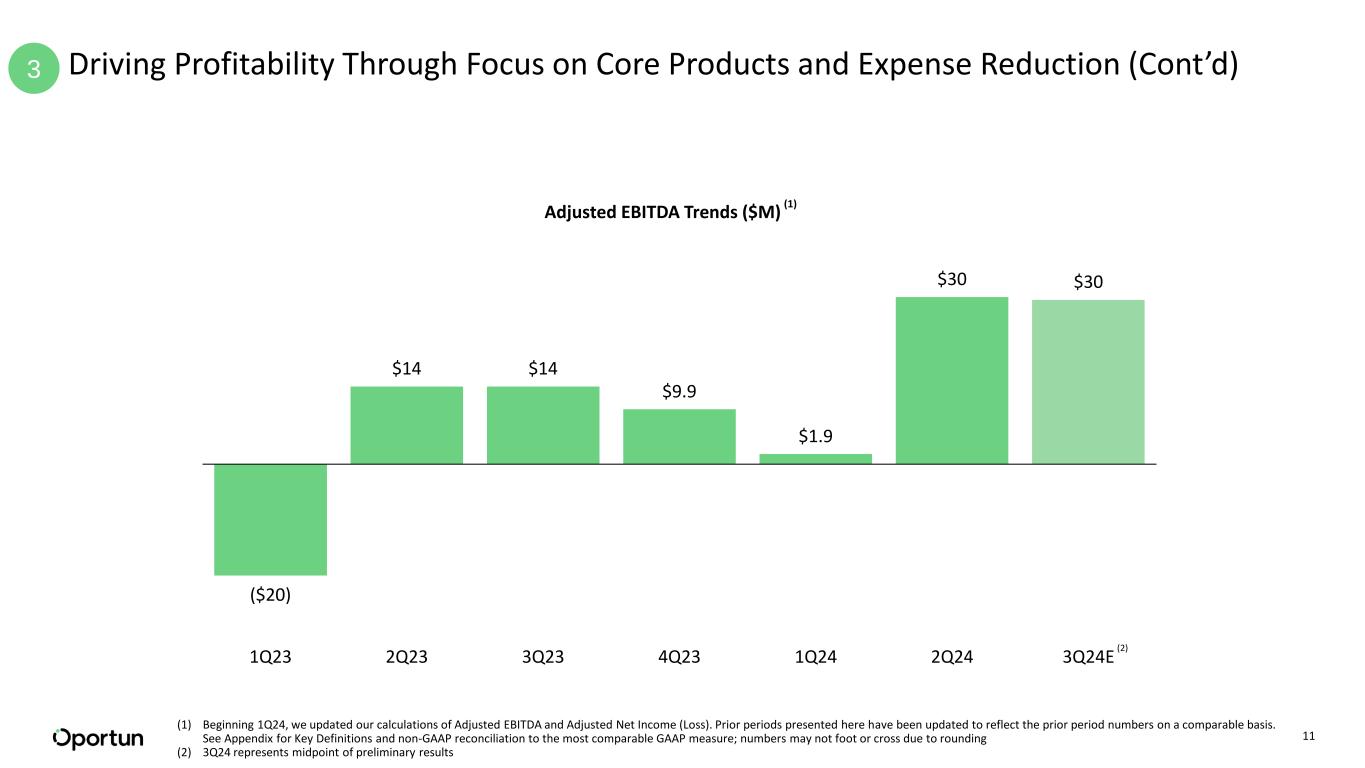

11 3 Driving Profitability Through Focus on Core Products and Expense Reduction (Cont’d) ($20) $14 $14 $9.9 $1.9 $30 $30 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24E Adjusted EBITDA Trends ($M) (1) Beginning 1Q24, we updated our calculations of Adjusted EBITDA and Adjusted Net Income (Loss). Prior periods presented here have been updated to reflect the prior period numbers on a comparable basis. See Appendix for Key Definitions and non-GAAP reconciliation to the most comparable GAAP measure; numbers may not foot or cross due to rounding (2) 3Q24 represents midpoint of preliminary results (1) (2)

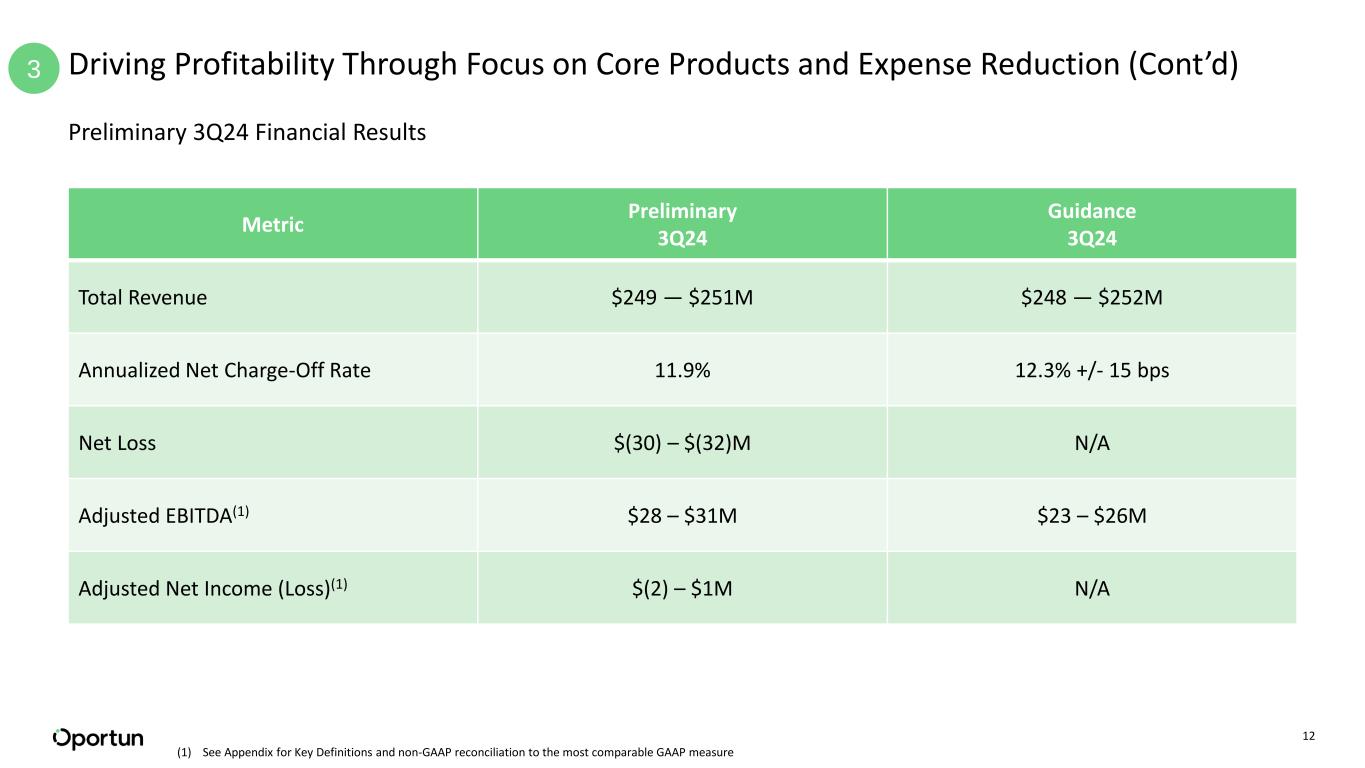

12 3 Driving Profitability Through Focus on Core Products and Expense Reduction (Cont’d) Metric Preliminary 3Q24 Guidance 3Q24 Total Revenue $249 — $251M $248 — $252M Annualized Net Charge-Off Rate 11.9% 12.3% +/- 15 bps Net Loss $(30) – $(32)M N/A Adjusted EBITDA(1) $28 – $31M $23 – $26M Adjusted Net Income (Loss)(1) $(2) – $1M N/A (1) See Appendix for Key Definitions and non-GAAP reconciliation to the most comparable GAAP measure Preliminary 3Q24 Financial Results

13 Driving Profitability Through Focus on Core Products and Expense Reduction (Cont’d)3 FY 2025 Preliminary Expectations and Performance Drivers Return to prudent originations growth when market dynamics support Improved credit performance following enhanced underwriting and runoff of back book Ongoing cost discipline and resulting operating leverage Deleveraging and active balance sheet optimization Absence of the credit card portfolio Diluted EPS Adjusted EPS Annualized Net Charge-Off Rate $0.25 - $0.50 $1.00 - $1.25 11% - 12%

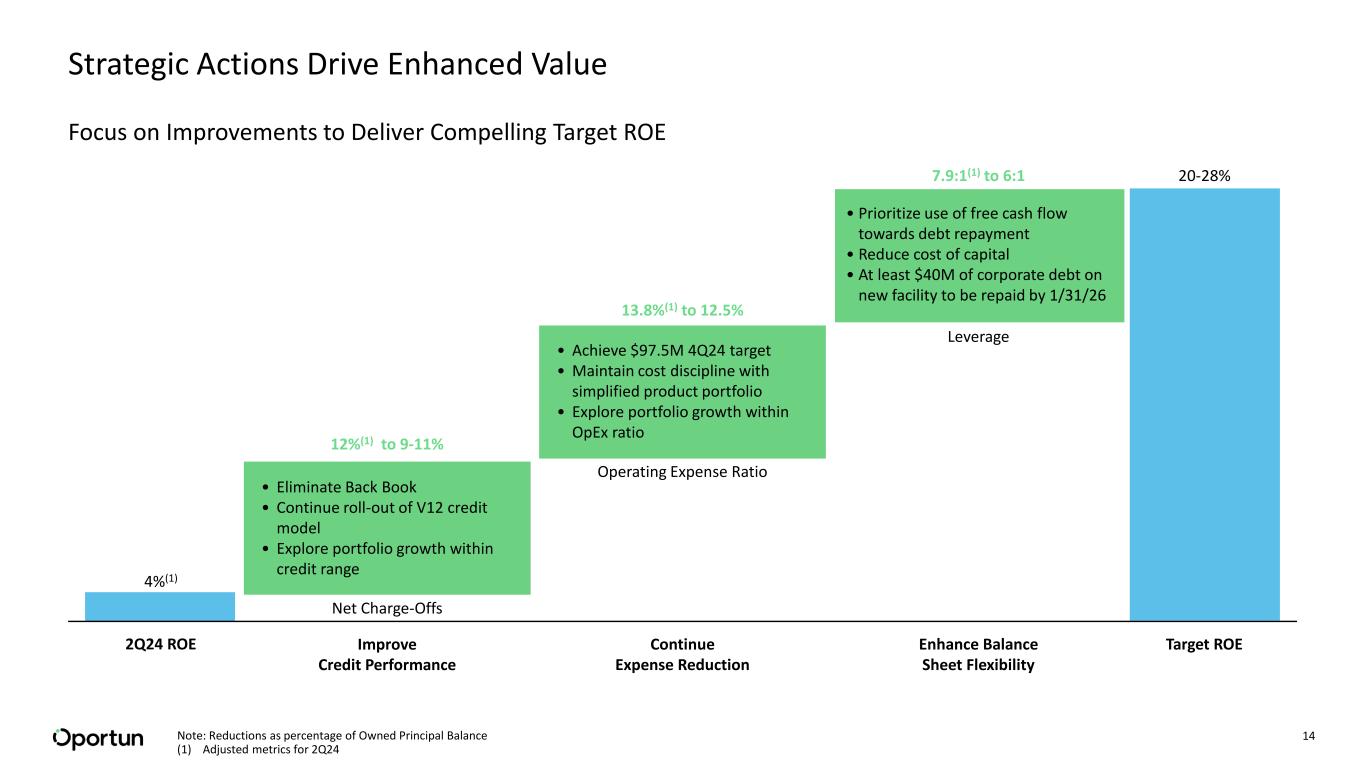

14 • Prioritize use of free cash flow towards debt repayment • Reduce cost of capital • At least $40M of corporate debt on new facility to be repaid by 1/31/26 20-28% 12%(1) to 9-11% 7.9:1(1) to 6:1 2Q24 ROE Target ROEImprove Credit Performance Continue Expense Reduction Enhance Balance Sheet Flexibility 4%(1) Net Charge-Offs Leverage Note: Reductions as percentage of Owned Principal Balance (1) Adjusted metrics for 2Q24 Strategic Actions Drive Enhanced Value Focus on Improvements to Deliver Compelling Target ROE • Achieve $97.5M 4Q24 target • Maintain cost discipline with simplified product portfolio • Explore portfolio growth within OpEx ratio 13.8%(1) to 12.5% Operating Expense Ratio • Eliminate Back Book • Continue roll-out of V12 credit model • Explore portfolio growth within credit range

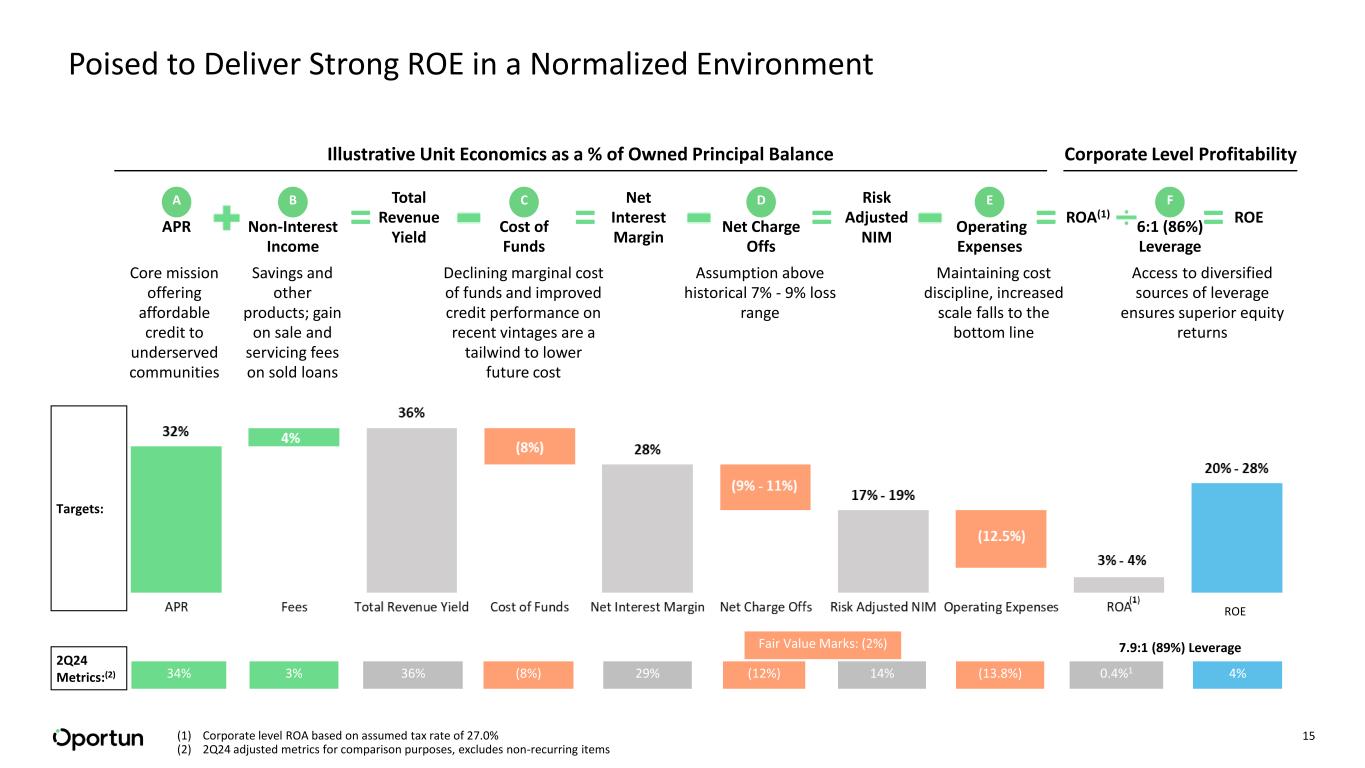

15 A APR = B Non-Interest Income C Cost of Funds D Net Charge Offs E Operating Expenses ROA(1) ROE== = F 6:1 (86%) Leverage = Total Revenue Yield Net Interest Margin Risk Adjusted NIM Core mission offering affordable credit to underserved communities Savings and other products; gain on sale and servicing fees on sold loans Declining marginal cost of funds and improved credit performance on recent vintages are a tailwind to lower future cost Assumption above historical 7% - 9% loss range Maintaining cost discipline, increased scale falls to the bottom line Access to diversified sources of leverage ensures superior equity returns 2Q24 Metrics:(2) ROE 34% 3% 36% (8%) 29% (12%) 14% (13.8%) 0.4%1 4% 7.9:1 (89%) Leverage Fair Value Marks: (2%) Targets: (1) (1) Corporate level ROA based on assumed tax rate of 27.0% (2) 2Q24 adjusted metrics for comparison purposes, excludes non-recurring items Illustrative Unit Economics as a % of Owned Principal Balance Corporate Level Profitability Poised to Deliver Strong ROE in a Normalized Environment

16 Strengthening Balance Sheet and Enhancing Flexibility1 Improving Credit Performance2 Driving Profitability Through Focus on Core Products and Expense Reduction 3 Oportun is Well Positioned to Deliver Enhanced Shareholder Value In 2025, Oportun expects to deliver GAAP profitability with $0.25 to $0.50 of Diluted EPS, $1.00 to $1.25 of Adj. EPS, and Annualized Net Charge-Off Rate between 11% and 12% 4

Appendix

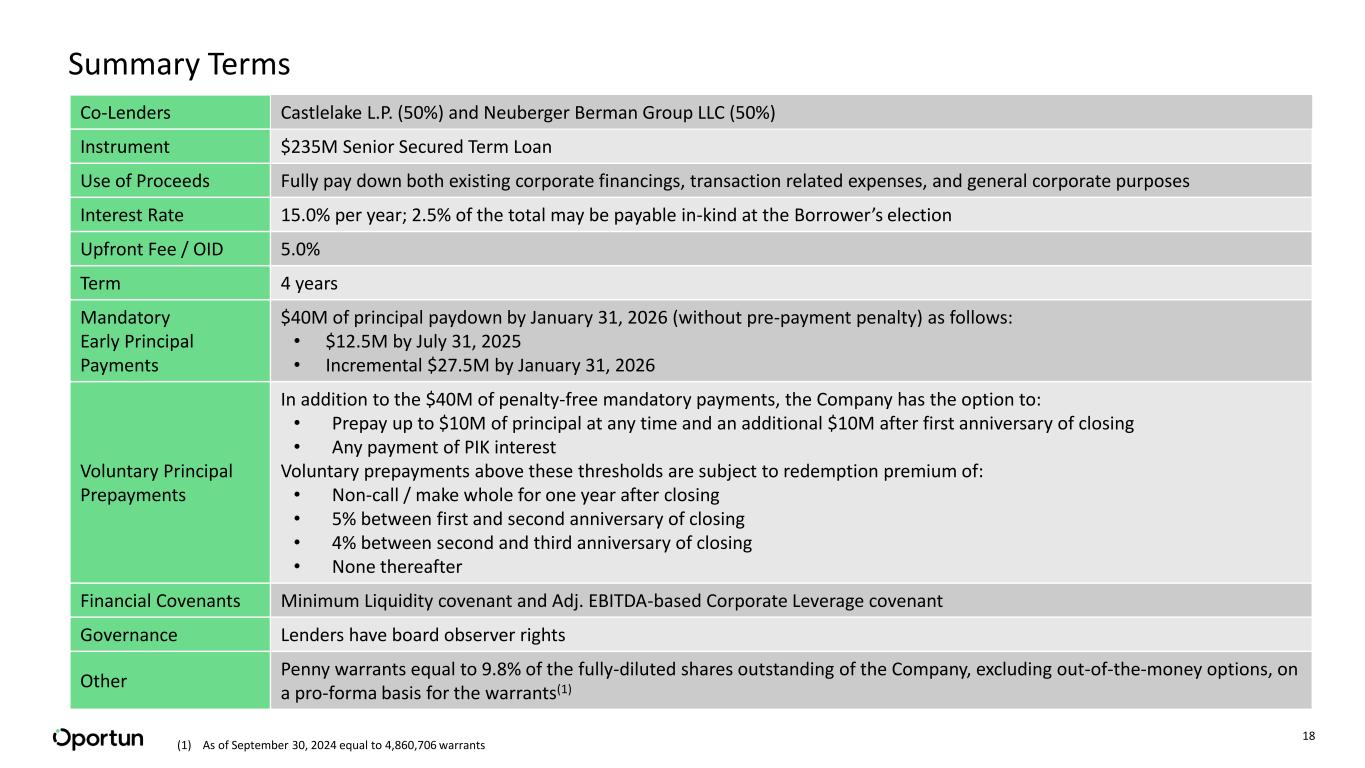

18 Co-Lenders Castlelake L.P. (50%) and Neuberger Berman Group LLC (50%) Instrument $235M Senior Secured Term Loan Use of Proceeds Fully pay down both existing corporate financings, transaction related expenses, and general corporate purposes Interest Rate 15.0% per year; 2.5% of the total may be payable in-kind at the Borrower’s election Upfront Fee / OID 5.0% Term 4 years Mandatory Early Principal Payments $40M of principal paydown by January 31, 2026 (without pre-payment penalty) as follows: • $12.5M by July 31, 2025 • Incremental $27.5M by January 31, 2026 Voluntary Principal Prepayments In addition to the $40M of penalty-free mandatory payments, the Company has the option to: • Prepay up to $10M of principal at any time and an additional $10M after first anniversary of closing • Any payment of PIK interest Voluntary prepayments above these thresholds are subject to redemption premium of: • Non-call / make whole for one year after closing • 5% between first and second anniversary of closing • 4% between second and third anniversary of closing • None thereafter Financial Covenants Minimum Liquidity covenant and Adj. EBITDA-based Corporate Leverage covenant Governance Lenders have board observer rights Other Penny warrants equal to 9.8% of the fully-diluted shares outstanding of the Company, excluding out-of-the-money options, on a pro-forma basis for the warrants(1) Summary Terms (1) As of September 30, 2024 equal to 4,860,706 warrants

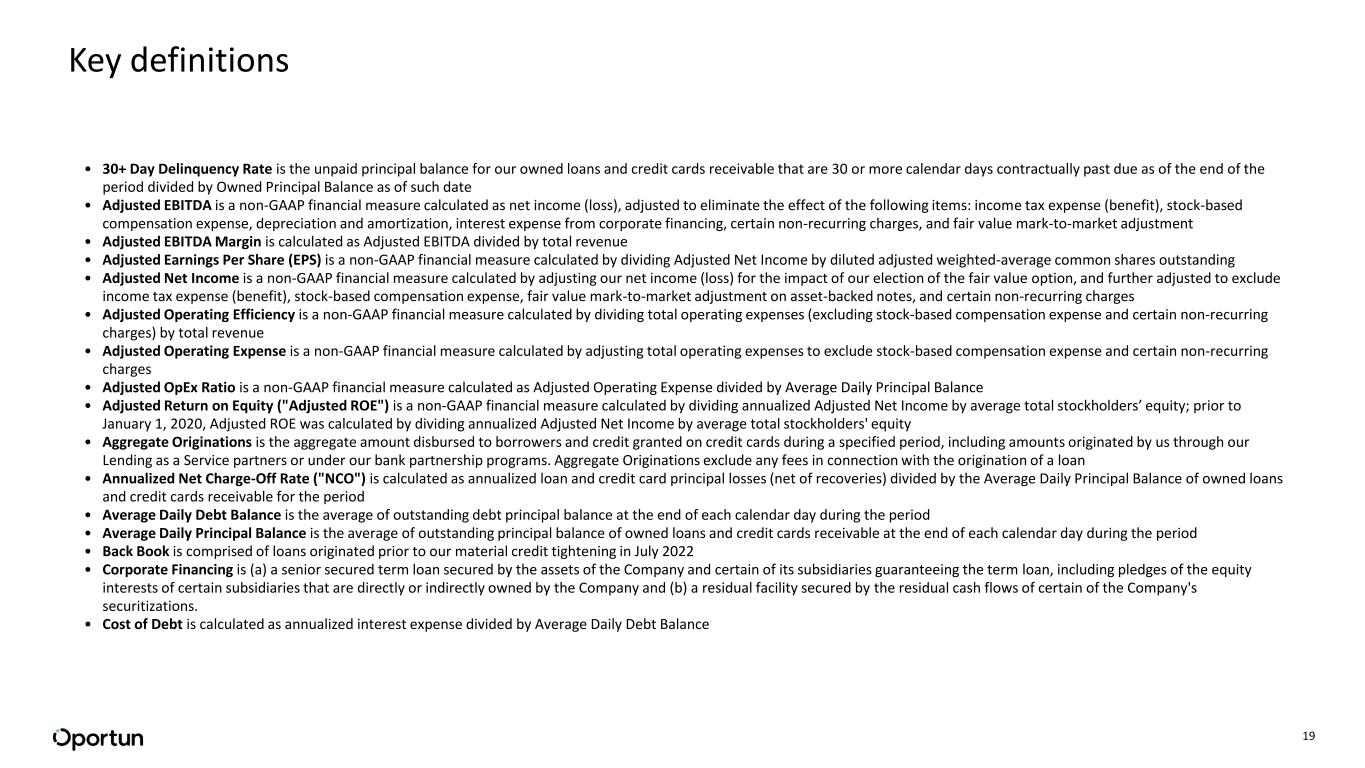

19 Key definitions • 30+ Day Delinquency Rate is the unpaid principal balance for our owned loans and credit cards receivable that are 30 or more calendar days contractually past due as of the end of the period divided by Owned Principal Balance as of such date • Adjusted EBITDA is a non-GAAP financial measure calculated as net income (loss), adjusted to eliminate the effect of the following items: income tax expense (benefit), stock-based compensation expense, depreciation and amortization, interest expense from corporate financing, certain non-recurring charges, and fair value mark-to-market adjustment • Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by total revenue • Adjusted Earnings Per Share (EPS) is a non-GAAP financial measure calculated by dividing Adjusted Net Income by diluted adjusted weighted-average common shares outstanding • Adjusted Net Income is a non-GAAP financial measure calculated by adjusting our net income (loss) for the impact of our election of the fair value option, and further adjusted to exclude income tax expense (benefit), stock-based compensation expense, fair value mark-to-market adjustment on asset-backed notes, and certain non-recurring charges • Adjusted Operating Efficiency is a non-GAAP financial measure calculated by dividing total operating expenses (excluding stock-based compensation expense and certain non-recurring charges) by total revenue • Adjusted Operating Expense is a non-GAAP financial measure calculated by adjusting total operating expenses to exclude stock-based compensation expense and certain non-recurring charges • Adjusted OpEx Ratio is a non-GAAP financial measure calculated as Adjusted Operating Expense divided by Average Daily Principal Balance • Adjusted Return on Equity ("Adjusted ROE") is a non-GAAP financial measure calculated by dividing annualized Adjusted Net Income by average total stockholders’ equity; prior to January 1, 2020, Adjusted ROE was calculated by dividing annualized Adjusted Net Income by average total stockholders' equity • Aggregate Originations is the aggregate amount disbursed to borrowers and credit granted on credit cards during a specified period, including amounts originated by us through our Lending as a Service partners or under our bank partnership programs. Aggregate Originations exclude any fees in connection with the origination of a loan • Annualized Net Charge-Off Rate ("NCO") is calculated as annualized loan and credit card principal losses (net of recoveries) divided by the Average Daily Principal Balance of owned loans and credit cards receivable for the period • Average Daily Debt Balance is the average of outstanding debt principal balance at the end of each calendar day during the period • Average Daily Principal Balance is the average of outstanding principal balance of owned loans and credit cards receivable at the end of each calendar day during the period • Back Book is comprised of loans originated prior to our material credit tightening in July 2022 • Corporate Financing is (a) a senior secured term loan secured by the assets of the Company and certain of its subsidiaries guaranteeing the term loan, including pledges of the equity interests of certain subsidiaries that are directly or indirectly owned by the Company and (b) a residual facility secured by the residual cash flows of certain of the Company's securitizations. • Cost of Debt is calculated as annualized interest expense divided by Average Daily Debt Balance

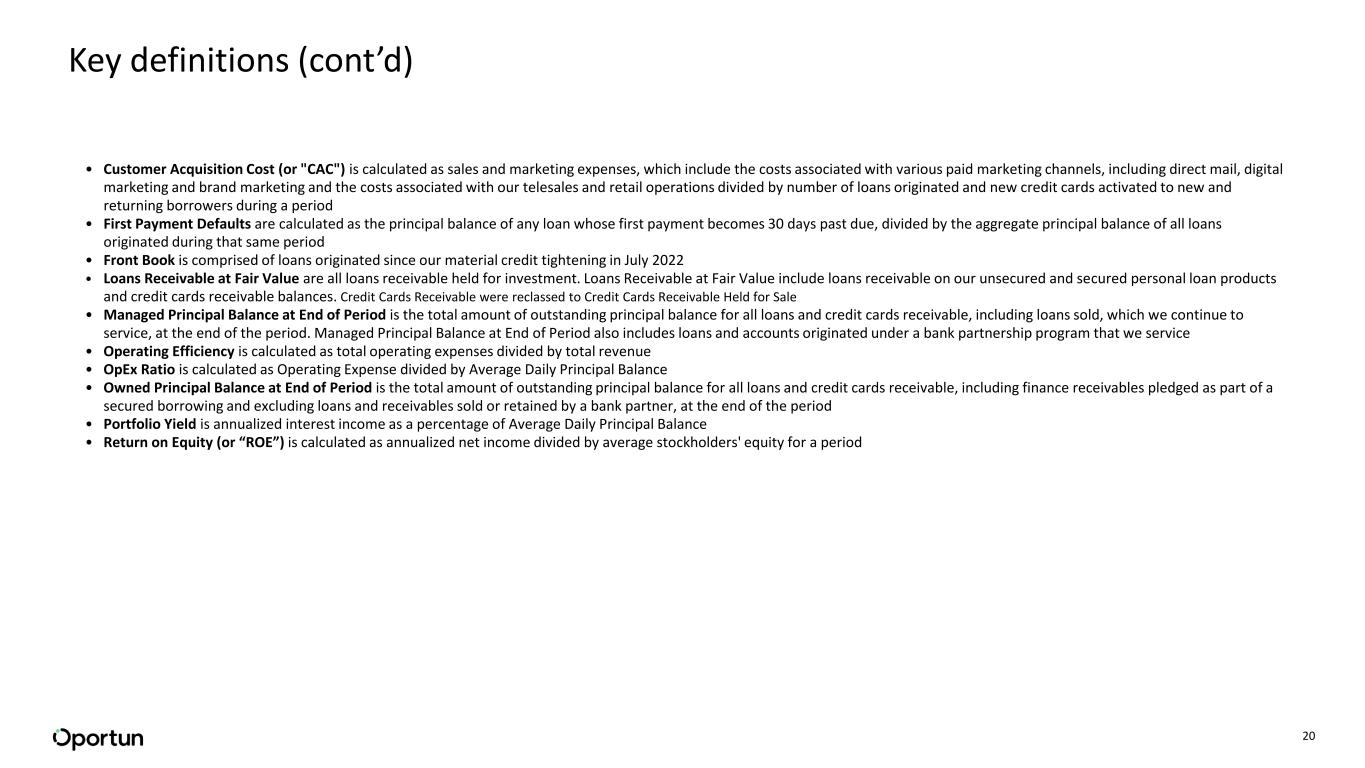

20 Key definitions (cont’d) • Customer Acquisition Cost (or "CAC") is calculated as sales and marketing expenses, which include the costs associated with various paid marketing channels, including direct mail, digital marketing and brand marketing and the costs associated with our telesales and retail operations divided by number of loans originated and new credit cards activated to new and returning borrowers during a period • First Payment Defaults are calculated as the principal balance of any loan whose first payment becomes 30 days past due, divided by the aggregate principal balance of all loans originated during that same period • Front Book is comprised of loans originated since our material credit tightening in July 2022 • Loans Receivable at Fair Value are all loans receivable held for investment. Loans Receivable at Fair Value include loans receivable on our unsecured and secured personal loan products and credit cards receivable balances. Credit Cards Receivable were reclassed to Credit Cards Receivable Held for Sale • Managed Principal Balance at End of Period is the total amount of outstanding principal balance for all loans and credit cards receivable, including loans sold, which we continue to service, at the end of the period. Managed Principal Balance at End of Period also includes loans and accounts originated under a bank partnership program that we service • Operating Efficiency is calculated as total operating expenses divided by total revenue • OpEx Ratio is calculated as Operating Expense divided by Average Daily Principal Balance • Owned Principal Balance at End of Period is the total amount of outstanding principal balance for all loans and credit cards receivable, including finance receivables pledged as part of a secured borrowing and excluding loans and receivables sold or retained by a bank partner, at the end of the period • Portfolio Yield is annualized interest income as a percentage of Average Daily Principal Balance • Return on Equity (or “ROE”) is calculated as annualized net income divided by average stockholders' equity for a period

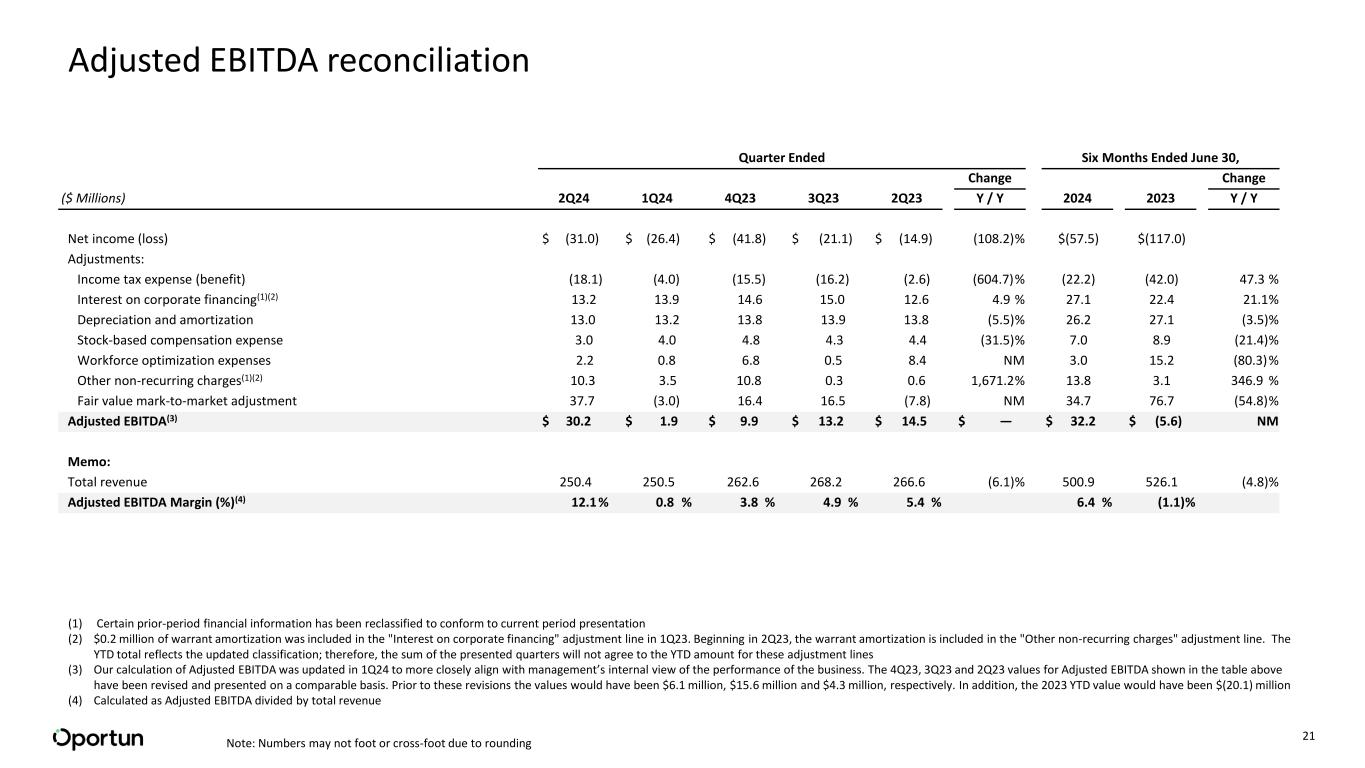

21 Adjusted EBITDA reconciliation Quarter Ended Six Months Ended June 30, Change Change ($ Millions) 2Q24 1Q24 4Q23 3Q23 2Q23 Y / Y 2024 2023 Y / Y Net income (loss) $ (31.0) $ (26.4) $ (41.8) $ (21.1) $ (14.9) (108.2)% $(57.5) $(117.0) Adjustments: Income tax expense (benefit) (18.1) (4.0) (15.5) (16.2) (2.6) (604.7)% (22.2) (42.0) 47.3 % Interest on corporate financing(1)(2) 13.2 13.9 14.6 15.0 12.6 4.9 % 27.1 22.4 21.1% Depreciation and amortization 13.0 13.2 13.8 13.9 13.8 (5.5)% 26.2 27.1 (3.5)% Stock-based compensation expense 3.0 4.0 4.8 4.3 4.4 (31.5)% 7.0 8.9 (21.4)% Workforce optimization expenses 2.2 0.8 6.8 0.5 8.4 NM 3.0 15.2 (80.3)% Other non-recurring charges(1)(2) 10.3 3.5 10.8 0.3 0.6 1,671.2% 13.8 3.1 346.9 % Fair value mark-to-market adjustment 37.7 (3.0) 16.4 16.5 (7.8) NM 34.7 76.7 (54.8)% Adjusted EBITDA(3) $ 30.2 $ 1.9 $ 9.9 $ 13.2 $ 14.5 $ — $ 32.2 $ (5.6) NM Memo: Total revenue 250.4 250.5 262.6 268.2 266.6 (6.1)% 500.9 526.1 (4.8)% Adjusted EBITDA Margin (%)(4) 12.1 % 0.8 % 3.8 % 4.9 % 5.4 % 6.4 % (1.1)% Note: Numbers may not foot or cross-foot due to rounding (1) Certain prior-period financial information has been reclassified to conform to current period presentation (2) $0.2 million of warrant amortization was included in the "Interest on corporate financing" adjustment line in 1Q23. Beginning in 2Q23, the warrant amortization is included in the "Other non-recurring charges" adjustment line. The YTD total reflects the updated classification; therefore, the sum of the presented quarters will not agree to the YTD amount for these adjustment lines (3) Our calculation of Adjusted EBITDA was updated in 1Q24 to more closely align with management’s internal view of the performance of the business. The 4Q23, 3Q23 and 2Q23 values for Adjusted EBITDA shown in the table above have been revised and presented on a comparable basis. Prior to these revisions the values would have been $6.1 million, $15.6 million and $4.3 million, respectively. In addition, the 2023 YTD value would have been $(20.1) million (4) Calculated as Adjusted EBITDA divided by total revenue

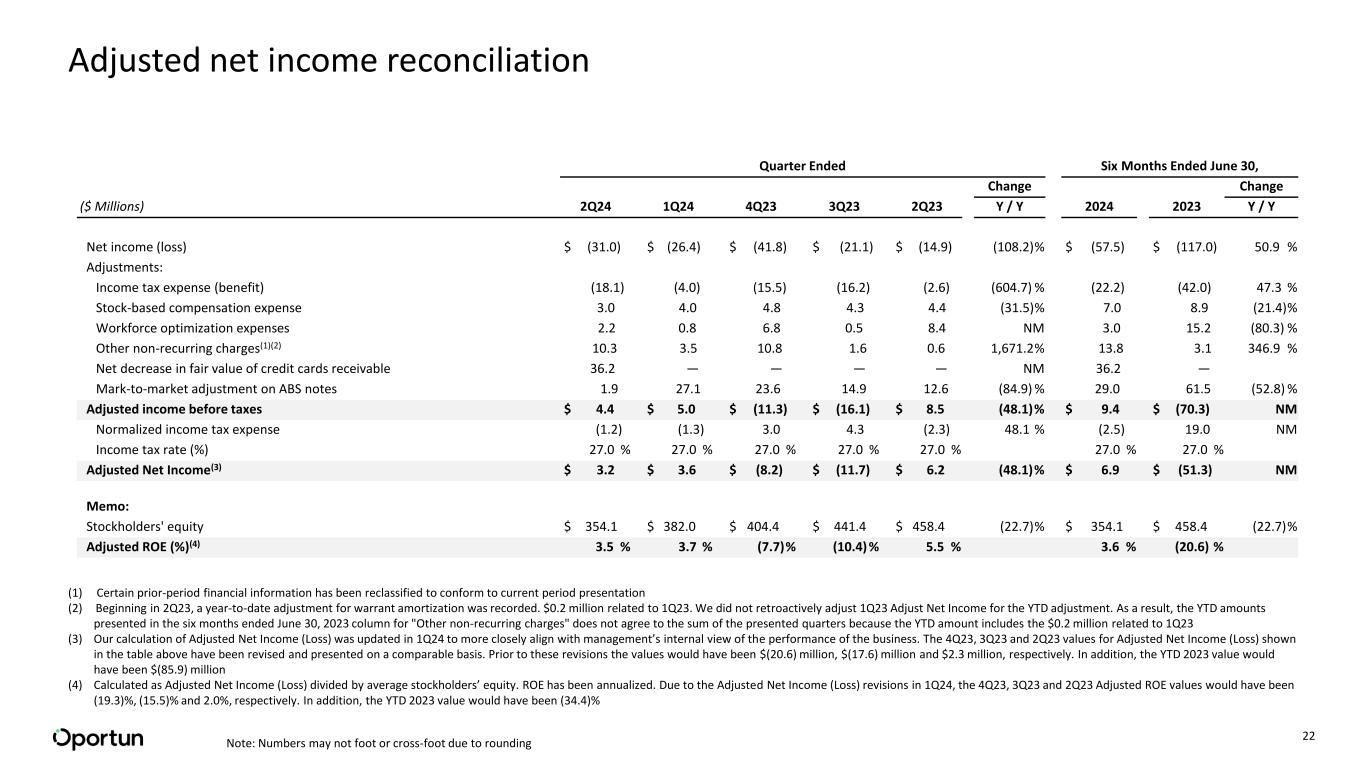

22 Quarter Ended Six Months Ended June 30, Change Change ($ Millions) 2Q24 1Q24 4Q23 3Q23 2Q23 Y / Y 2024 2023 Y / Y Net income (loss) $ (31.0) $ (26.4) $ (41.8) $ (21.1) $ (14.9) (108.2)% $ (57.5) $ (117.0) 50.9 % Adjustments: Income tax expense (benefit) (18.1) (4.0) (15.5) (16.2) (2.6) (604.7) % (22.2) (42.0) 47.3 % Stock-based compensation expense 3.0 4.0 4.8 4.3 4.4 (31.5)% 7.0 8.9 (21.4)% Workforce optimization expenses 2.2 0.8 6.8 0.5 8.4 NM 3.0 15.2 (80.3) % Other non-recurring charges(1)(2) 10.3 3.5 10.8 1.6 0.6 1,671.2% 13.8 3.1 346.9 % Net decrease in fair value of credit cards receivable 36.2 — — — — NM 36.2 — Mark-to-market adjustment on ABS notes 1.9 27.1 23.6 14.9 12.6 (84.9) % 29.0 61.5 (52.8) % Adjusted income before taxes $ 4.4 $ 5.0 $ (11.3) $ (16.1) $ 8.5 (48.1)% $ 9.4 $ (70.3) NM Normalized income tax expense (1.2) (1.3) 3.0 4.3 (2.3) 48.1 % (2.5) 19.0 NM Income tax rate (%) 27.0 % 27.0 % 27.0 % 27.0 % 27.0 % 27.0 % 27.0 % Adjusted Net Income(3) $ 3.2 $ 3.6 $ (8.2) $ (11.7) $ 6.2 (48.1)% $ 6.9 $ (51.3) NM Memo: Stockholders' equity $ 354.1 $ 382.0 $ 404.4 $ 441.4 $ 458.4 (22.7)% $ 354.1 $ 458.4 (22.7)% Adjusted ROE (%)(4) 3.5 % 3.7 % (7.7)% (10.4) % 5.5 % 3.6 % (20.6) % Adjusted net income reconciliation Note: Numbers may not foot or cross-foot due to rounding (1) Certain prior-period financial information has been reclassified to conform to current period presentation (2) Beginning in 2Q23, a year-to-date adjustment for warrant amortization was recorded. $0.2 million related to 1Q23. We did not retroactively adjust 1Q23 Adjust Net Income for the YTD adjustment. As a result, the YTD amounts presented in the six months ended June 30, 2023 column for "Other non-recurring charges" does not agree to the sum of the presented quarters because the YTD amount includes the $0.2 million related to 1Q23 (3) Our calculation of Adjusted Net Income (Loss) was updated in 1Q24 to more closely align with management’s internal view of the performance of the business. The 4Q23, 3Q23 and 2Q23 values for Adjusted Net Income (Loss) shown in the table above have been revised and presented on a comparable basis. Prior to these revisions the values would have been $(20.6) million, $(17.6) million and $2.3 million, respectively. In addition, the YTD 2023 value would have been $(85.9) million (4) Calculated as Adjusted Net Income (Loss) divided by average stockholders’ equity. ROE has been annualized. Due to the Adjusted Net Income (Loss) revisions in 1Q24, the 4Q23, 3Q23 and 2Q23 Adjusted ROE values would have been (19.3)%, (15.5)% and 2.0%, respectively. In addition, the YTD 2023 value would have been (34.4)%

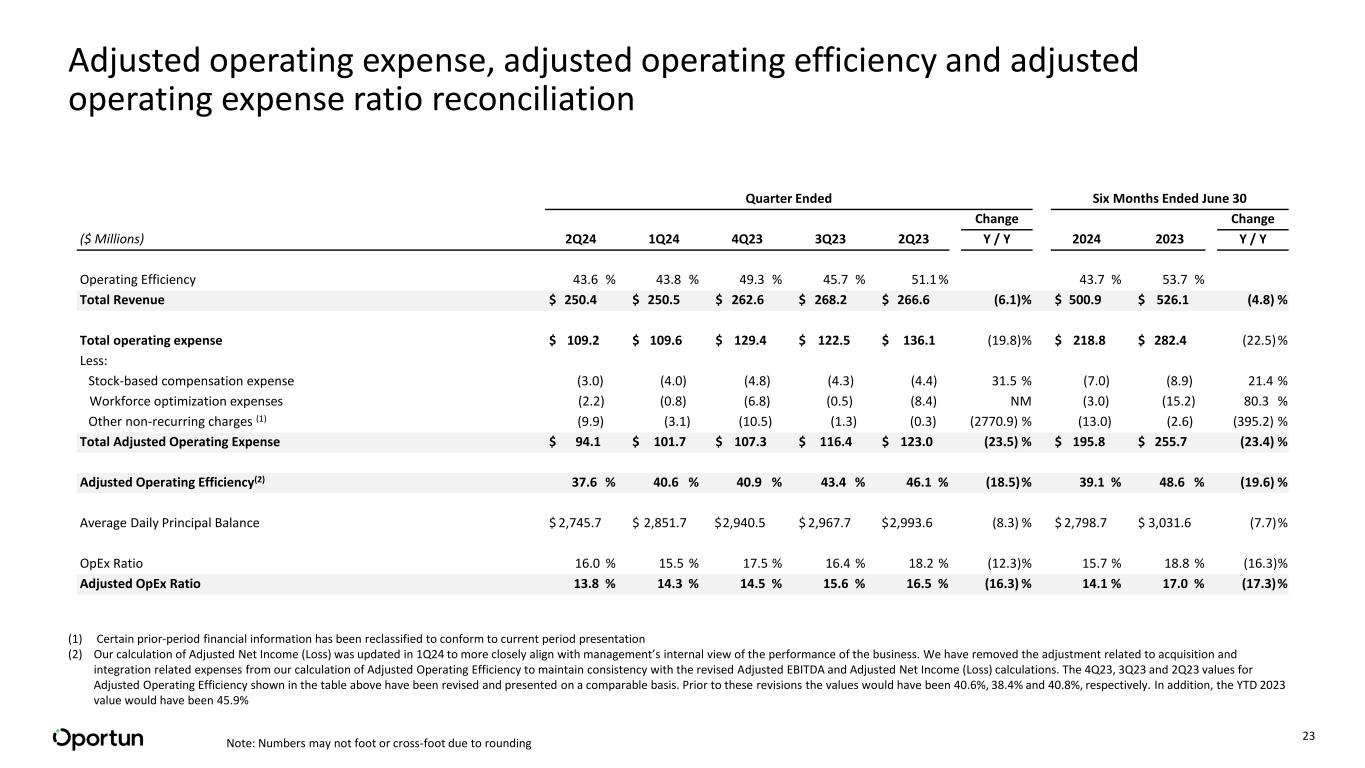

23 Quarter Ended Six Months Ended June 30 Change Change ($ Millions) 2Q24 1Q24 4Q23 3Q23 2Q23 Y / Y 2024 2023 Y / Y Operating Efficiency 43.6 % 43.8 % 49.3 % 45.7 % 51.1 % 43.7 % 53.7 % Total Revenue $ 250.4 $ 250.5 $ 262.6 $ 268.2 $ 266.6 (6.1)% $ 500.9 $ 526.1 (4.8) % Total operating expense $ 109.2 $ 109.6 $ 129.4 $ 122.5 $ 136.1 (19.8)% $ 218.8 $ 282.4 (22.5) % Less: Stock-based compensation expense (3.0) (4.0) (4.8) (4.3) (4.4) 31.5 % (7.0) (8.9) 21.4 % Workforce optimization expenses (2.2) (0.8) (6.8) (0.5) (8.4) NM (3.0) (15.2) 80.3 % Other non-recurring charges (1) (9.9) (3.1) (10.5) (1.3) (0.3) (2770.9) % (13.0) (2.6) (395.2) % Total Adjusted Operating Expense $ 94.1 $ 101.7 $ 107.3 $ 116.4 $ 123.0 (23.5) % $ 195.8 $ 255.7 (23.4) % Adjusted Operating Efficiency(2) 37.6 % 40.6 % 40.9 % 43.4 % 46.1 % (18.5)% 39.1 % 48.6 % (19.6) % Average Daily Principal Balance $ 2,745.7 $ 2,851.7 $2,940.5 $ 2,967.7 $2,993.6 (8.3) % $ 2,798.7 $ 3,031.6 (7.7)% OpEx Ratio 16.0 % 15.5 % 17.5 % 16.4 % 18.2 % (12.3)% 15.7 % 18.8 % (16.3)% Adjusted OpEx Ratio 13.8 % 14.3 % 14.5 % 15.6 % 16.5 % (16.3) % 14.1 % 17.0 % (17.3)% Adjusted operating expense, adjusted operating efficiency and adjusted operating expense ratio reconciliation Note: Numbers may not foot or cross-foot due to rounding (1) Certain prior-period financial information has been reclassified to conform to current period presentation (2) Our calculation of Adjusted Net Income (Loss) was updated in 1Q24 to more closely align with management’s internal view of the performance of the business. We have removed the adjustment related to acquisition and integration related expenses from our calculation of Adjusted Operating Efficiency to maintain consistency with the revised Adjusted EBITDA and Adjusted Net Income (Loss) calculations. The 4Q23, 3Q23 and 2Q23 values for Adjusted Operating Efficiency shown in the table above have been revised and presented on a comparable basis. Prior to these revisions the values would have been 40.6%, 38.4% and 40.8%, respectively. In addition, the YTD 2023 value would have been 45.9%

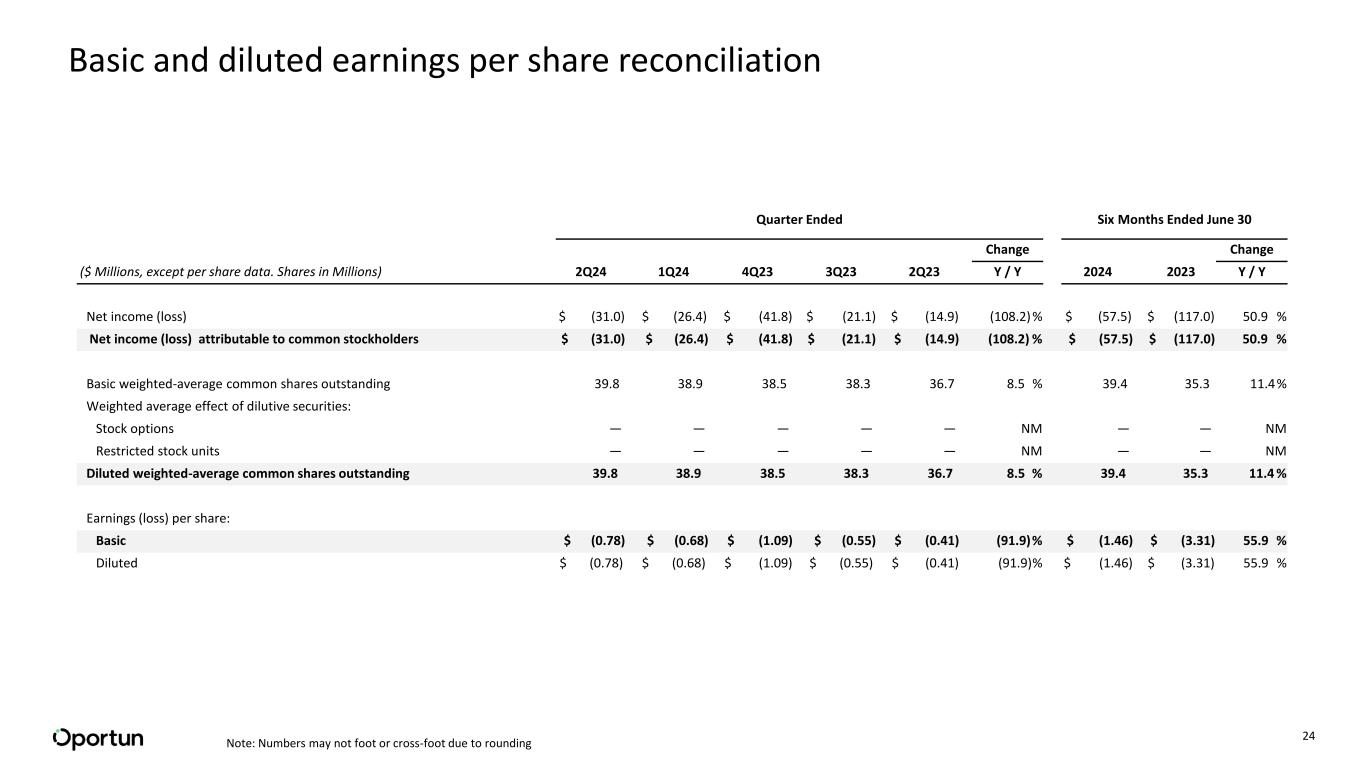

24 Quarter Ended Six Months Ended June 30 Change Change ($ Millions, except per share data. Shares in Millions) 2Q24 1Q24 4Q23 3Q23 2Q23 Y / Y 2024 2023 Y / Y Net income (loss) $ (31.0) $ (26.4) $ (41.8) $ (21.1) $ (14.9) (108.2) % $ (57.5) $ (117.0) 50.9 % Net income (loss) attributable to common stockholders $ (31.0) $ (26.4) $ (41.8) $ (21.1) $ (14.9) (108.2) % $ (57.5) $ (117.0) 50.9 % Basic weighted-average common shares outstanding 39.8 38.9 38.5 38.3 36.7 8.5 % 39.4 35.3 11.4% Weighted average effect of dilutive securities: Stock options — — — — — NM — — NM Restricted stock units — — — — — NM — — NM Diluted weighted-average common shares outstanding 39.8 38.9 38.5 38.3 36.7 8.5 % 39.4 35.3 11.4 % Earnings (loss) per share: Basic $ (0.78) $ (0.68) $ (1.09) $ (0.55) $ (0.41) (91.9)% $ (1.46) $ (3.31) 55.9 % Diluted $ (0.78) $ (0.68) $ (1.09) $ (0.55) $ (0.41) (91.9)% $ (1.46) $ (3.31) 55.9 % Basic and diluted earnings per share reconciliation Note: Numbers may not foot or cross-foot due to rounding

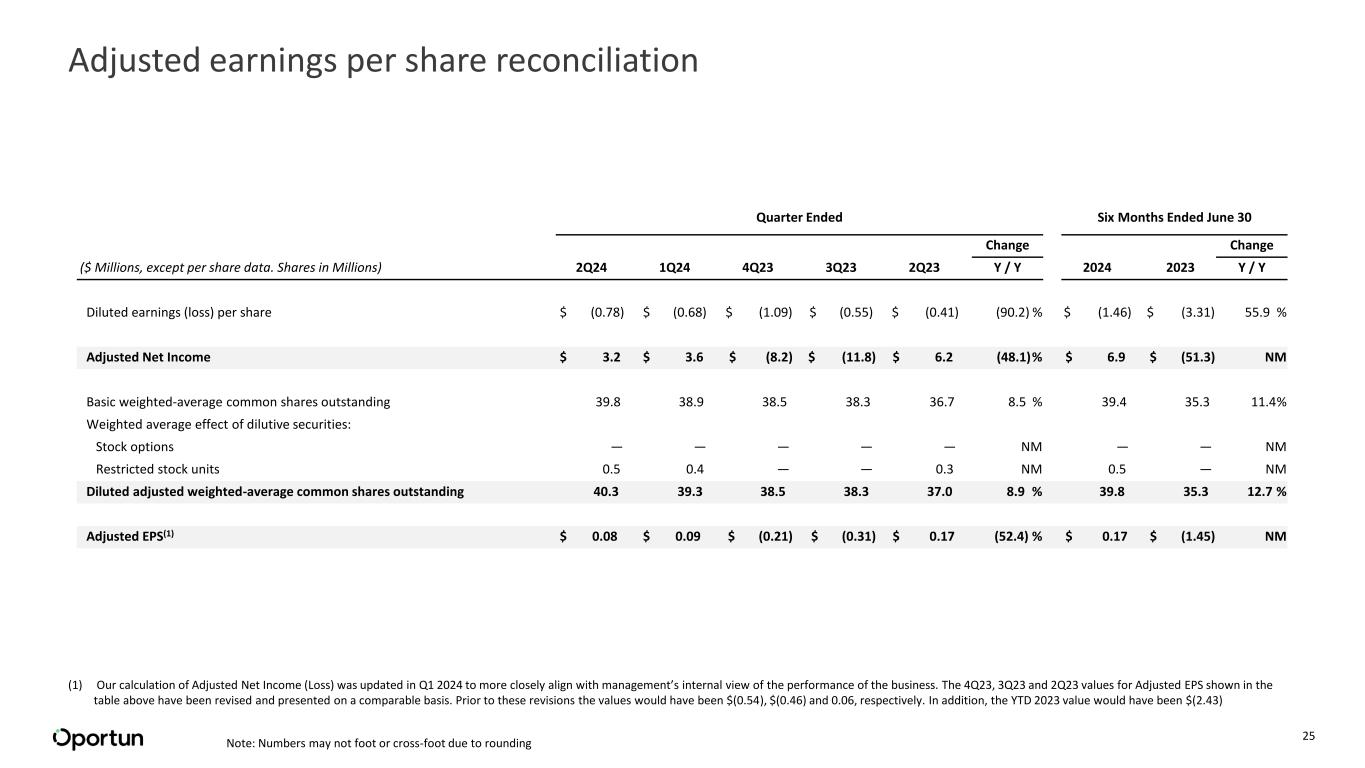

25 Quarter Ended Six Months Ended June 30 Change Change ($ Millions, except per share data. Shares in Millions) 2Q24 1Q24 4Q23 3Q23 2Q23 Y / Y 2024 2023 Y / Y Diluted earnings (loss) per share $ (0.78) $ (0.68) $ (1.09) $ (0.55) $ (0.41) (90.2) % $ (1.46) $ (3.31) 55.9 % Adjusted Net Income $ 3.2 $ 3.6 $ (8.2) $ (11.8) $ 6.2 (48.1)% $ 6.9 $ (51.3) NM Basic weighted-average common shares outstanding 39.8 38.9 38.5 38.3 36.7 8.5 % 39.4 35.3 11.4% Weighted average effect of dilutive securities: Stock options — — — — — NM — — NM Restricted stock units 0.5 0.4 — — 0.3 NM 0.5 — NM Diluted adjusted weighted-average common shares outstanding 40.3 39.3 38.5 38.3 37.0 8.9 % 39.8 35.3 12.7 % Adjusted EPS(1) $ 0.08 $ 0.09 $ (0.21) $ (0.31) $ 0.17 (52.4) % $ 0.17 $ (1.45) NM Adjusted earnings per share reconciliation Note: Numbers may not foot or cross-foot due to rounding (1) Our calculation of Adjusted Net Income (Loss) was updated in Q1 2024 to more closely align with management’s internal view of the performance of the business. The 4Q23, 3Q23 and 2Q23 values for Adjusted EPS shown in the table above have been revised and presented on a comparable basis. Prior to these revisions the values would have been $(0.54), $(0.46) and 0.06, respectively. In addition, the YTD 2023 value would have been $(2.43)

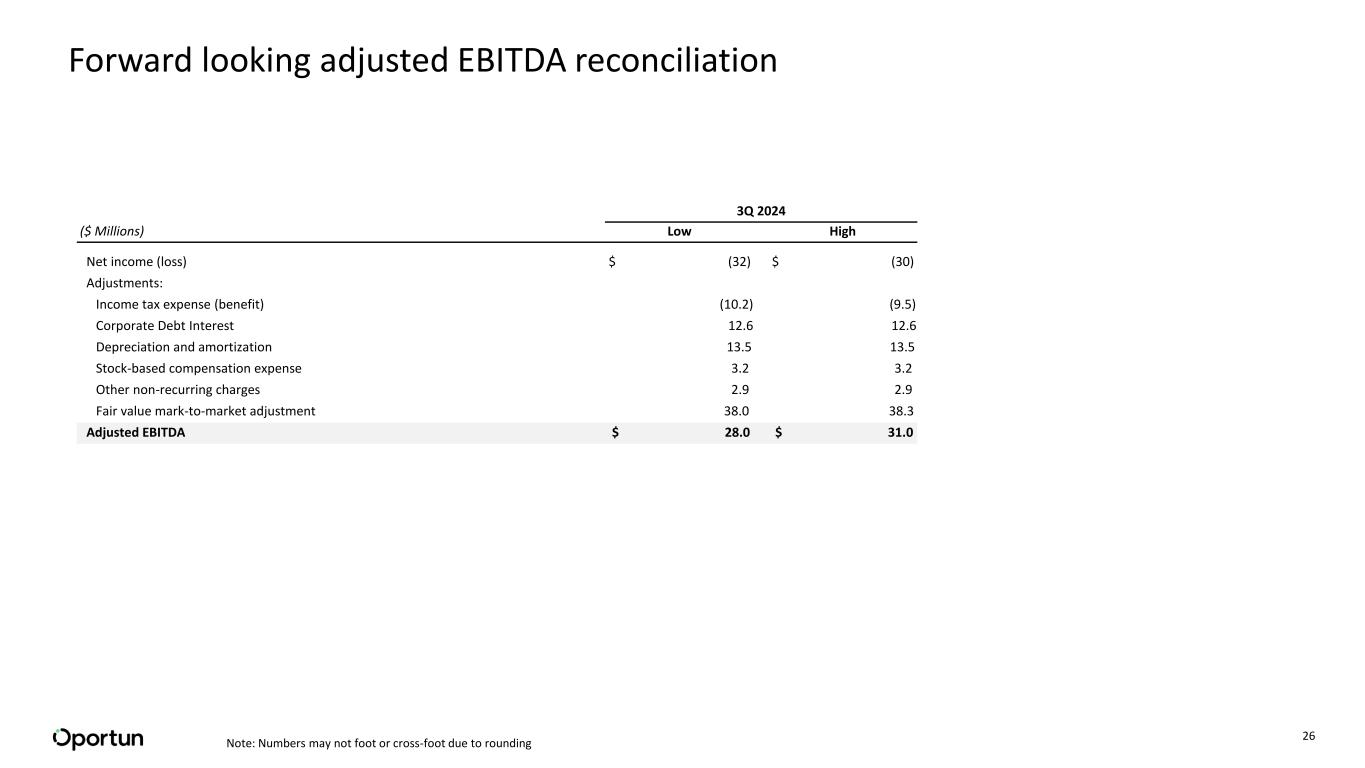

26 Forward looking adjusted EBITDA reconciliation 3Q 2024 ($ Millions) Low High Net income (loss) $ (32) $ (30) Adjustments: Income tax expense (benefit) (10.2) (9.5) Corporate Debt Interest 12.6 12.6 Depreciation and amortization 13.5 13.5 Stock-based compensation expense 3.2 3.2 Other non-recurring charges 2.9 2.9 Fair value mark-to-market adjustment 38.0 38.3 Adjusted EBITDA $ 28.0 $ 31.0 Note: Numbers may not foot or cross-foot due to rounding

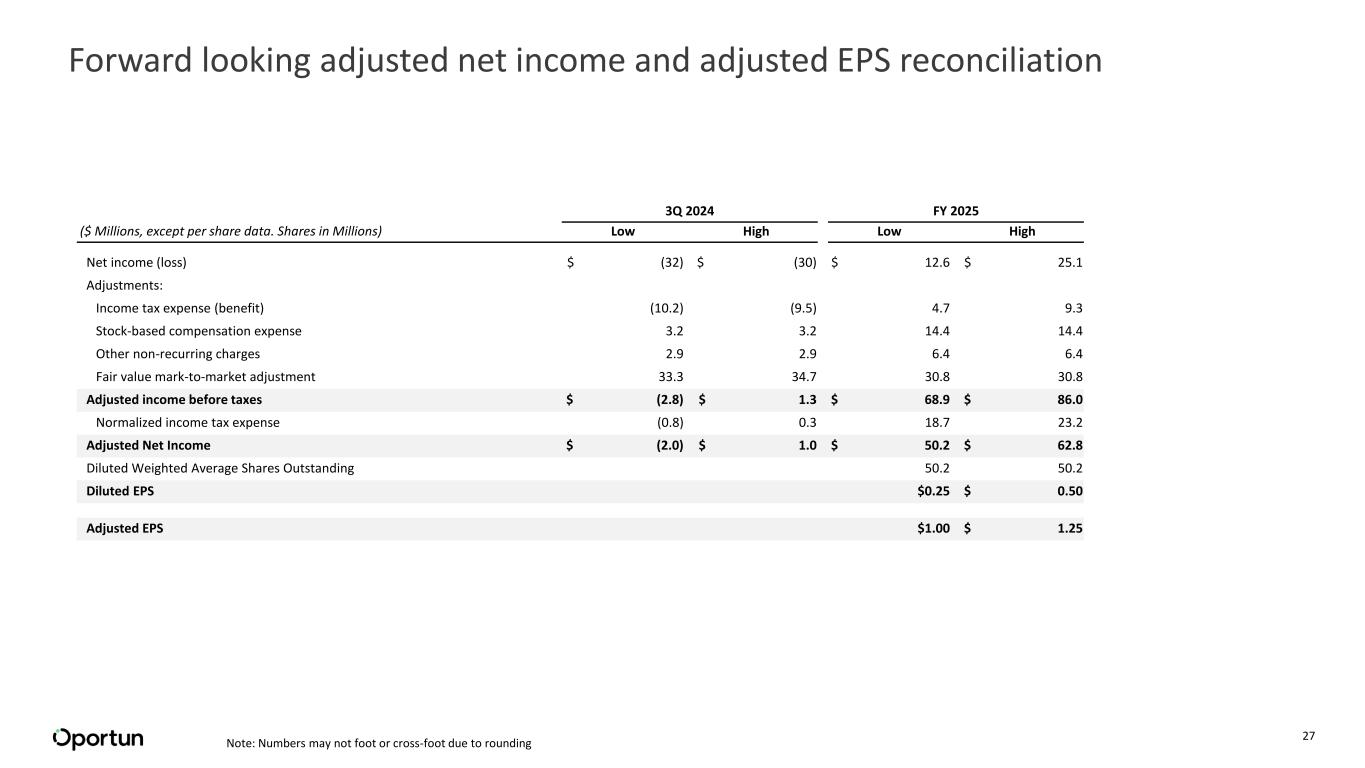

27 Forward looking adjusted net income and adjusted EPS reconciliation 3Q 2024 FY 2025 ($ Millions, except per share data. Shares in Millions) Low High Low High Net income (loss) $ (32) $ (30) $ 12.6 $ 25.1 Adjustments: Income tax expense (benefit) (10.2) (9.5) 4.7 9.3 Stock-based compensation expense 3.2 3.2 14.4 14.4 Other non-recurring charges 2.9 2.9 6.4 6.4 Fair value mark-to-market adjustment 33.3 34.7 30.8 30.8 Adjusted income before taxes $ (2.8) $ 1.3 $ 68.9 $ 86.0 Normalized income tax expense (0.8) 0.3 18.7 23.2 Adjusted Net Income $ (2.0) $ 1.0 $ 50.2 $ 62.8 Diluted Weighted Average Shares Outstanding 50.2 50.2 Diluted EPS $0.25 $ 0.50 Adjusted EPS $1.00 $ 1.25 Note: Numbers may not foot or cross-foot due to rounding